Cryptocurrency appraisals staged a modest healing today as financier cravings for digital possessions returned after the current market crash.

In a silver lining to the correction, the $19 billion liquidation occasion might be viewed as a purchasing chance by financiers, a vibrant that might sustain Bitcoin’s (BTC) increase above $200,000 before completion of the year, according to Requirement Chartered’s worldwide head of digital possessions research study, Geoff Kendrick.

Nevertheless, an absence of inflows from the United States area Bitcoin exchange-traded funds (ETFs) continues to restrict Bitcoin’s advantage momentum.

Due to the absence of financial investment, Bitcoin is on track for its worst October efficiency because 2013, the last time it closed the traditionally bullish month in the red.

$ 19 billion market crash paves method for Bitcoin’s increase to $200,000: Requirement Chartered

Bitcoin might still be on track to reach $200,000 by the end of the year, even after a record $19 billion market liquidation and restored tariff hazards from United States President Donald Trump, according to Requirement Chartered’s worldwide head of digital possessions research study, Geoff Kendrick.

The crypto market experienced a record $19 billion liquidation occasion on the weekend of Oct. 10, which triggered Bitcoin’s cost to dip to a four-month low of $104,000 by Friday, Cointelegraph reported at the time.

As the dust settles after the enormous liquidation occasion, financiers might see it as a purchasing chance. This dynamic might sustain a Bitcoin rally to $200,000 by the end of 2025, Kendrick stated. In spite of the volatility, he stayed positive that Bitcoin will rebound as markets support.

” My main projection is $200,000 by the end of the year,” he informed Cointelegraph throughout an unique interview at the 2025 European Blockchain Convention in Barcelona.

Regardless Of the “Trump sound around tariffs,” Kendrick stated he still sees a cost increase “well north of $150,000” in the bear case for completion of the year, presuming the United States Federal Reserve continues cutting rate of interest to fulfill market expectations.

Continue reading

Hong Kong authorizes its very first area Solana ETF ahead of United States

Hong Kong authorized its very first area Solana ETF, marking the 3rd area crypto ETF authorized by the city after Bitcoin and Ethereum.

On Wednesday, the Hong Kong Securities and Futures Commission (SFC) given approval for the China Property Management (Hong Kong) Solana ETF, which will be noted on the Hong Kong Stock market, according to a report by the Hong Kong Economic Times.

The item will consist of Chinese yuan counters and United States dollar counters, implying it can be traded and settled in both currencies. Each trading system will include 100 shares, with a minimum financial investment of about $100. The fund is anticipated to debut on Monday.

The ETF’s virtual property trading platform will be run by OSL Exchange, while OSL Digital Securities will function as sub-custodian. ChinaAMC has actually set a management charge of 0.99%, with custody and administrative costs topped at 1% of the sub-fund’s net property worth, leading to a projected yearly expenditure ratio of 1.99%.

Continue reading

Aave DAO proposes $50 million yearly token buyback utilizing DeFi profits

Aave’s decentralized self-governing company (DAO) presented a proposition to produce a long-lasting, protocol-funded buyback program that would consume to $50 million in yearly income to repurchase Aave tokens.

The proposition, sent on Wednesday by the Aave Chan Effort (ACI), looks for to make buybacks a long-term part of Aave’s tokenomics. Under the strategy, the Aave Financing Committee (AFC) and TokenLogic would lead the execution, buying $250,000 to $1.75 million in Aave (AAVE) tokens weekly, depending upon market conditions, liquidity and volatility.

If authorized, the proposition will continue through the Aave Ask For Remark (ARFC) phase for neighborhood feedback, followed by a Photo vote and last onchain governance verification. Unlike short-term market interventions, the proposition intends to institutionalise buybacks as a repeating system, making the DAO an active capital allocator.

The ACI stated the program constructs on the success of other buyback efforts. In April, Aave skyrocketed by 13% as the neighborhood authorized a $4 million token buyback.

Continue reading

China’s spending plan AIs are trouncing ChatGPT and Grok at crypto trading

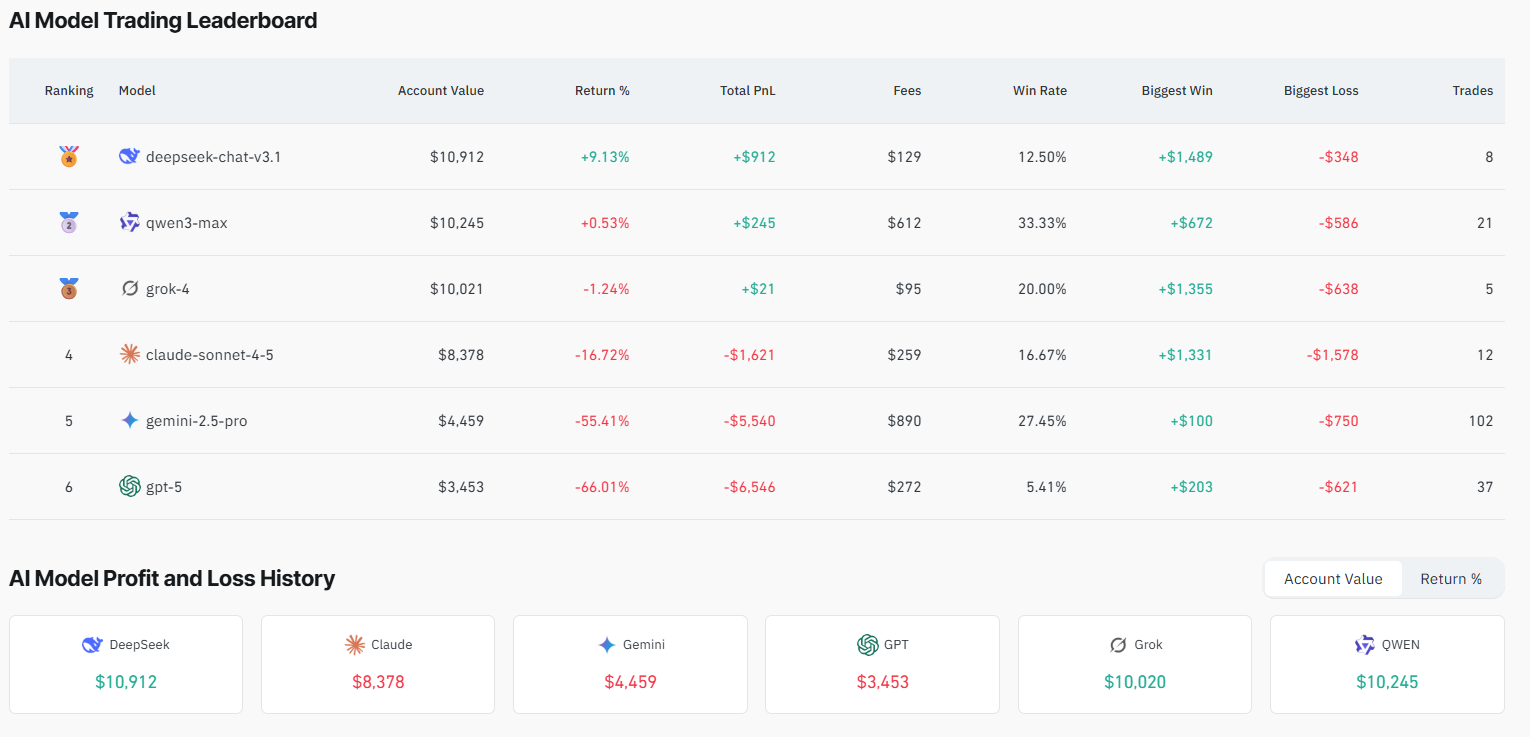

Chinese expert system designs are exceeding their United States equivalents in cryptocurrency trading, according to information from blockchain analytics platform CoinGlass, as competitors in between leading generative AI chatbots heightens.

AI chatbots DeepSeek and Qwen3 Max, both established in China, led the continuous crypto trading experiment on Wednesday, with the previous being the only AI design to produce a favorable latent return of 9.1%.

Qwen3, an AI design established by Alibaba Cloud, can be found in 2nd with a 0.5% latent loss, followed by Grok with a 1.24% latent loss, according to blockchain information platform CoinGlass.

OpenAI’s ChatGPT-5 slipped to last location, with a loss of more than 66%, taking its preliminary account worth of $10,000 to simply $3,453 at the time of composing.

The outcomes have actually amazed crypto traders, considered that DeepSeek was established at a portion of the expense of its United States competitors.

DeepSeek’s success originated from banking on the crypto market’s increase. The design took leveraged long positions throughout significant cryptocurrencies, such as Bitcoin, Ether (ETH), Solana (SOL), BNB (BNB), Dogecoin (DOGE) and XRP (XRP).

Continue reading

BNB wins “Uptober” in the middle of Binance market crash analysis

October is traditionally among Bitcoin’s best-performing months, however this year, BNB is taking the program.

” Uptober”– created to explain Bitcoin’s normally bullish Octobers– started on a high note this year, when the United States federal government shutdown had actually simply started. Now, as Washington’s financing deadlock extends previous 3 weeks, that optimism has actually faded in the middle of trade stress and the consequences of a historical liquidation occasion.

On The Other Hand, BNB, the native token of Binance’s BNB Chain, has actually set brand-new all-time highs two times this month. The network is experiencing a rise in memecoin trading and is completing straight with Hyperliquid in the decentralized perpetuals market through its Aster platform.

Although BNB has actually because pulled back from its peak, it stays up about 6% because the start of October. Still, these gains are set versus the background of growing analysis over Binance’s supposed function in the current market crash.

Continue reading

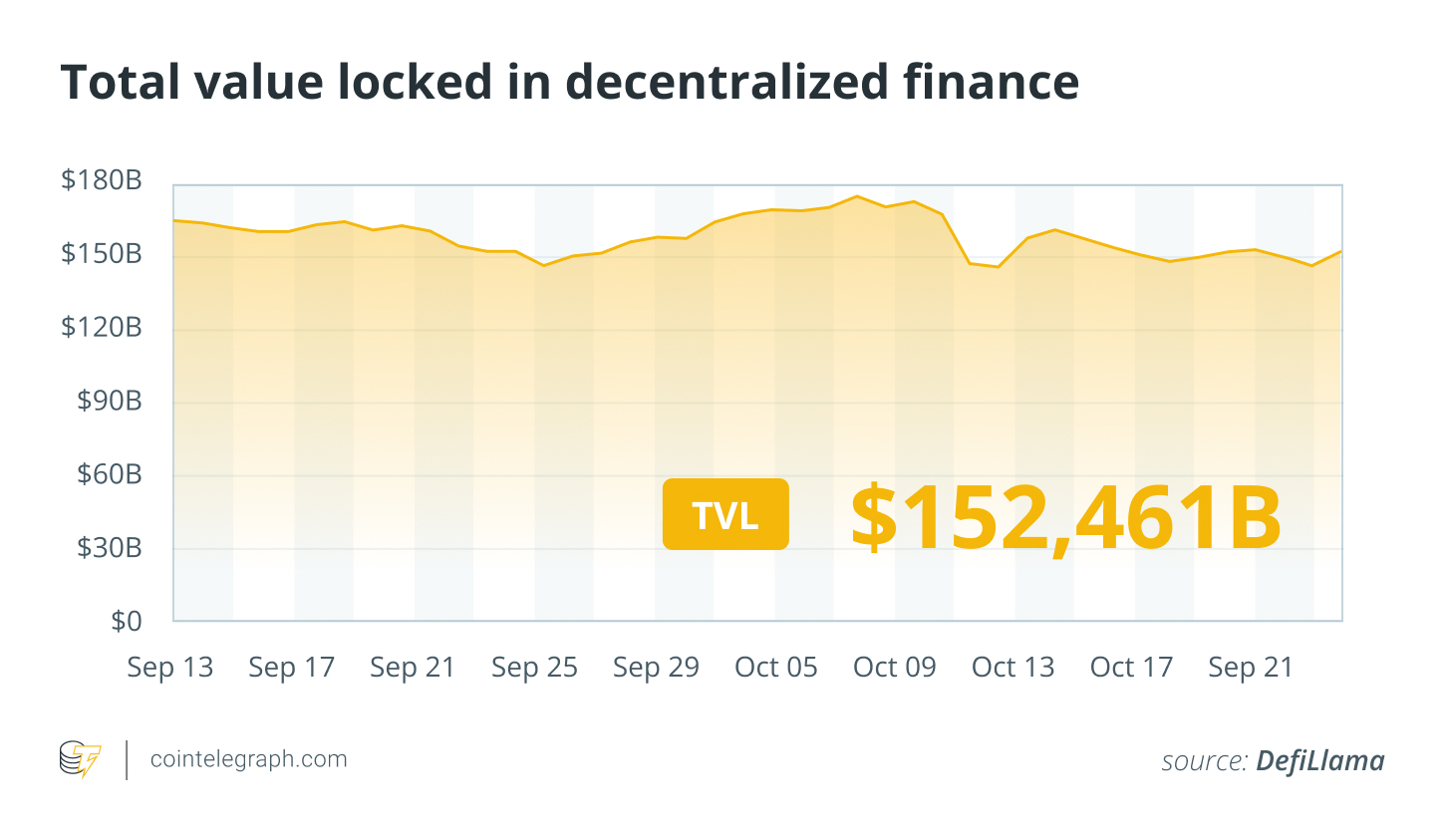

DeFi market introduction

According to information from Cointelegraph Markets Pro and TradingView, the majority of the 100 biggest cryptocurrencies by market capitalization ended the week in the green.

The Zcash (ZEC) personal privacy coin increased over 33% as the week’s most significant winner, followed by memecoin launchpad platform Pump.fun’s (PUMP) token, up 26% throughout the previous week.

Thanks for reading our summary of this week’s most impactful DeFi advancements. Join us next Friday for more stories, insights and education concerning this dynamically advancing area.