Friday’s record $19 billion crypto market liquidation occasion has actually left traders divided, with some implicating market makers of a collaborated sell-off while experts indicated a more natural deleveraging cycle.

Friday’s flash crash saw open interest for continuous futures on decentralized exchanges (DEXs) fall from $26 billion to listed below $14 billion, according to DefiLlama.

Crypto providing procedure charges rose previous $20 million on Friday, the greatest everyday overall on record, while weekly DEX volumes reached more than $177 billion. The overall obtained throughout providing platforms likewise dropped listed below $60 billion for the very first time because August.

Related: BitMine includes over 200K ETH in ‘aggressive’ post-crash weekend purchasing

Some experts see natural market reset

Regardless of numerous traders indicating a collaborated correction triggered by platform problems and big market individuals, blockchain information recommended that the majority of the record liquidation was natural.

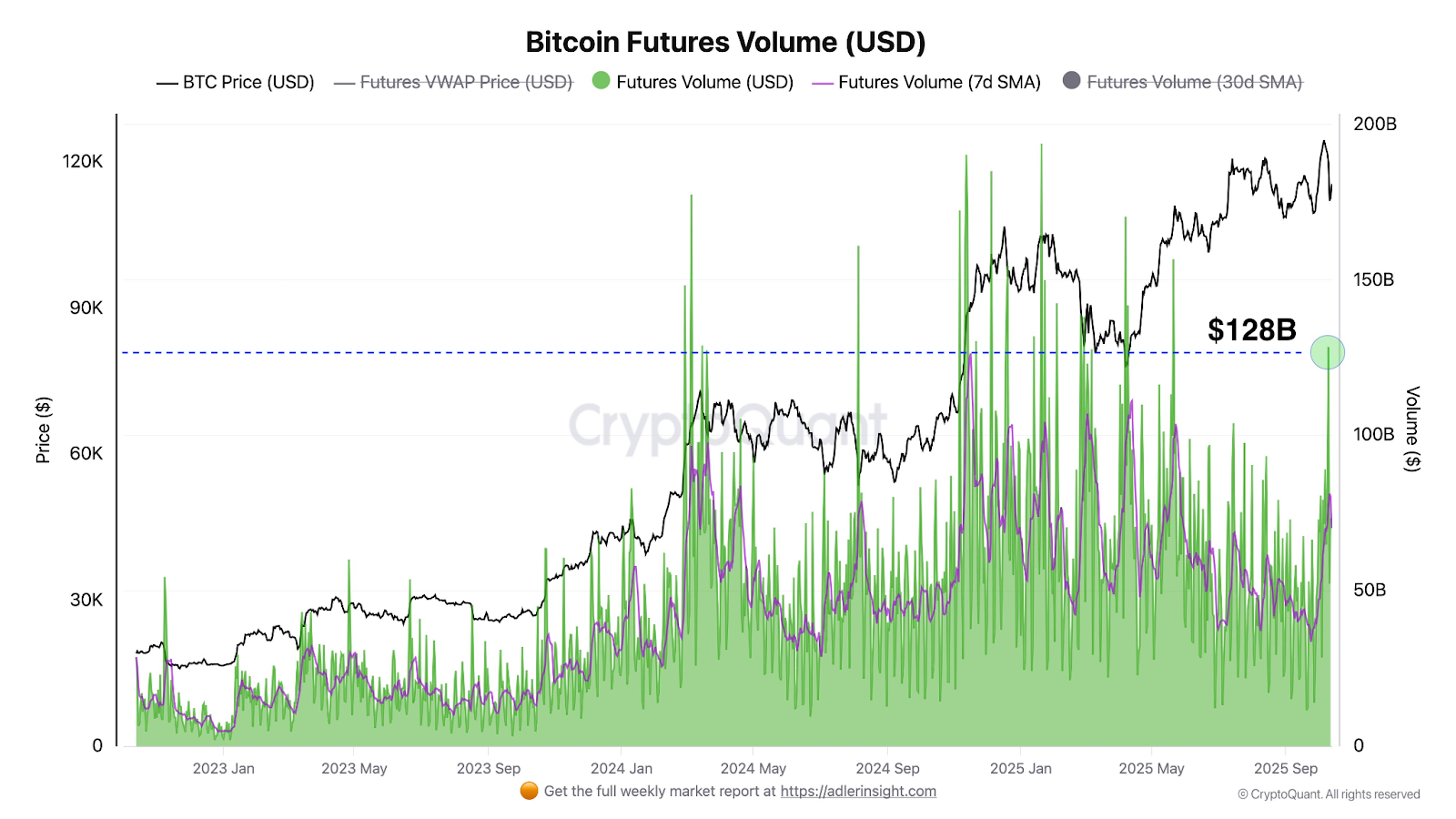

Throughout Friday’s crash, open interest saw a $14 billion decrease, however a minimum of 93% of this decrease was a “regulated deleveraging, not a waterfall,” according to Axel Adler Jr, expert at blockchain information platform CryptoQuant.

Out of the $14 billion, just $1 billion worth of long Bitcoin (BTC) positions were liquidated, which marked a “extremely fully grown minute for Bitcoin,” Adler stated in a Tuesday X post.

Related: Ethereum layer twos surpass crypto relief rally after $19B crash

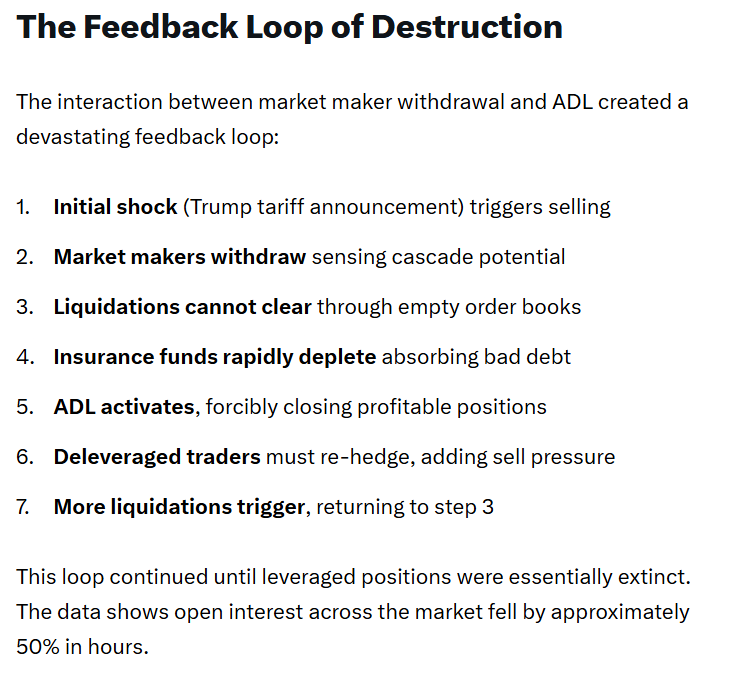

Still, not everybody is encouraged the occasion was simply mechanical. A number of market watchers have actually implicated significant market makers of adding to the collapse by pulling liquidity from exchanges at defining moments.

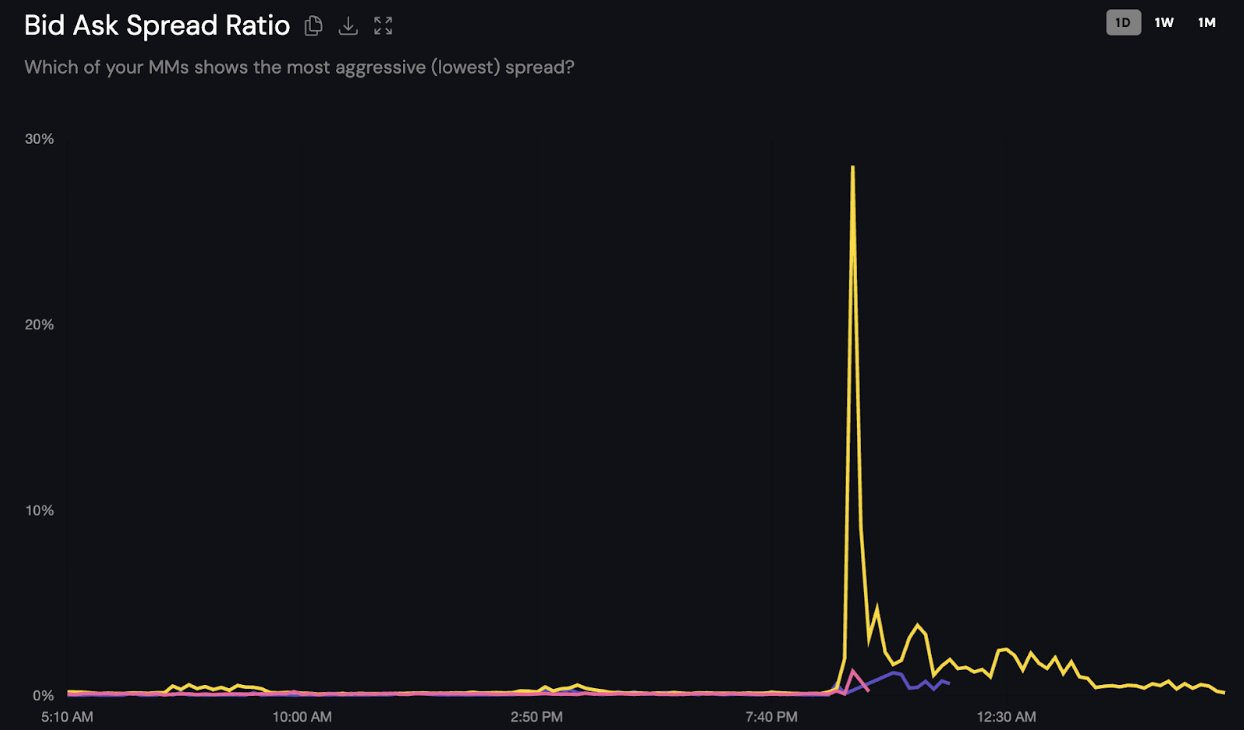

Taking a look at order book information, market makers presumably developed a “liquidity vacuum” that intensified the correction, according to blockchain sleuth YQ.

Market makers began withdrawing liquidity at 9:00 pm UTC on Friday, an hour after United States President Donald Trump’s tariff danger.

By 9:20 pm UTC, the majority of the tokens bottomed, while market depth on tracked tokens was up to simply $27,000, a 98% collapse, stated YQ in a Monday X post.

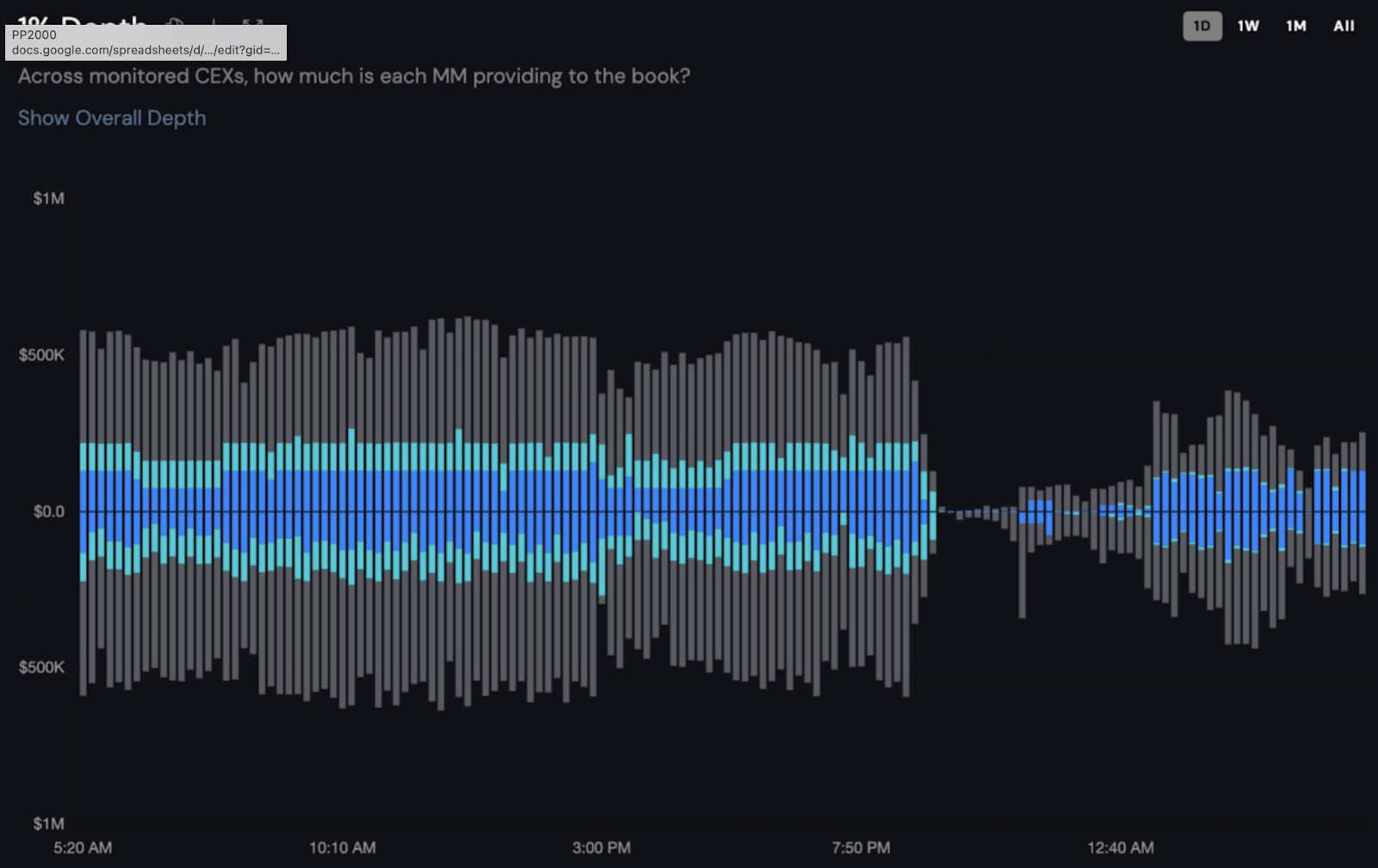

Blockchain information platform Coinwatch likewise highlighted the 98% market depth collapse on Binance, the world’s biggest cryptocurrency exchange.

” When the token cost crashed, both MMs pulled whatever from the books. 1.5 hours later on, Blue turned their bots back on and went back to offering comparable quantities of liquidity as previously. On the other hand, Blue-green remains in the books however hardly at all,” Coinwatch stated in a Sunday X post.

Taking a look at another unknown Binance-listed token worth over $5 billion, 2 out of 3 market makers “deserted their duty for 5 hours.”

Coinwatch likewise declared to be in conversation with the 2 market makers to “accelerate their return into the order books.”

Publication: Bitcoin to see ‘another huge thrust’ to $150K, ETH pressure constructs