Secret takeaways

-

Crypto detective ZachXBT slammed Token2049 for bad sponsor vetting, cautioning that platinum sponsorships do not correspond to authenticity. Numerous sponsors he flagged ended up to have dubious records.

-

JPEX and HyperVerse utilized occasion sponsorships to predict reliability. Both later on collapsed under scams examinations, triggering billions in financier losses and arrests.

-

Warnings consist of confidential groups, low liquidity, overhyped marketing, bad tokenomics and listings just on unknown exchanges.

-

What drives these coins isn’t development however speculation, influencer buzz and cult-like followings, highlighting how unpredictability fuels their survival.

In the unforeseeable cryptocurrency market, specific digital properties continue to exist regardless of dealing with debates, substantial rate drops or doing not have significant underlying worth. Though flagged as dubious coins, they continue drawing substantial interest from devoted fans. This continual engagement is typically driven by speculative enjoyment, strong neighborhood assistance and the attraction of fast earnings.

ZachXBT, a popular crypto sleuth, made some observations by means of his Telegram channel on a couple of sponsors of Token2049, a significant crypto occasion. He felt the organizers of such occasions do little bit due diligence on their sponsors which a job being a platinum sponsor does not increase reliability. He went on publishing on his channel about questionable Token2049 sponsors.

This short article checks out why some coins show an exceptional determination regardless of being questionable. It talks about 5 dubious coins that continue drawing crypto financiers and examines the factors for their durability. It will likewise discuss how beginner traders can secure themselves from such tasks.

Why dubious coins endure regardless of the chances

Regardless of weak basics, numerous doubtful cryptocurrencies continue the marketplace. While the majority of stop working rapidly, some endure or briefly prosper due to particular aspects. These consist of:

-

Speculative trading: Sharp rate variations bring in risk-tolerant traders looking for fast earnings.

-

Devoted neighborhoods: Faithful advocates, typically driven by memes or fond memories, keep these tasks alive.

-

Low market liquidity: Minimal trading activity permits big financiers or experts to affect costs, attracting speculators.

-

Routine buzz: Social network patterns, influencer recommendations or unforeseen news can momentarily increase interest in these coins.

Did you understand? From “1,000 x ensured returns” to “satellite-powered DeFi,” scammy tasks typically utilize fancy stories to hook traders. When the claims are strong without proof, coins are most likely to be questionable.

5 dubious coins declining to pass away

ZachXBT went over a couple of sponsors of TOKEN2049, which continue within the unforeseeable crypto market regardless of nontransparent operations. He discussed the following coins as questionable:

Spacecoin (AREA)

-

Origin: Released by Gluwa in 2024-2025 and the title sponsor of Token2049, Spacecoin intends to be the world’s very first decentralized physical facilities network (DePIN) powered by satellites. It declares its decentralized satellite network will offer international 5G web to the 2.9 billion individuals who presently do not have gain access to, to link the whole world.

-

Debates: Onchain detective ZachXBT identified Spacecoin as “botted” and undependable, questioning its authenticity. While botted can be analyzed in numerous methods, none of the significances is lovely.

-

Why doubtful: There are issues surrounding Spacecoin. For instance, in June 2022, it declared to have actually gone through numerous months of improvement and clever agreement auditing, without calling a particular audit company, and no public report was supplied. Additionally, there is no proven paperwork relating to the launch of satellites.

-

What sustains it: Strong marketing efforts, occasion sponsorships and speculative interest, together with a devoted neighborhood and limelights, keep minimal trading activity alive.

JuCoin

-

Origin: JuCoin, formerly Jubi, is a Singapore-based cryptocurrency exchange developed in 2013, with its JU token and CeDeFi services broadening its community by 2025.

-

Debates: ZachXBT flagged JuCoin as a “questionable” platinum sponsor of Token2049, pointing out a history of ownership modifications, rebrands and regulative pivots.

-

Why doubtful: JuCoin does not have guideline in significant markets, though it has actually gotten a license in Taiwan. The task is not controlled in the United States, EU or other significant markets having robust regulative requirements, apart from Singapore’s Monetary Authority.

-

What sustains it: Speculation around the token and an aggressive marketing drive for trading activity.

Weex

-

Origin: Weex is a Singapore-registered crypto futures platform operating given that 2018 and using confidential trading and perk rewards.

-

Debates: Weex is not controlled by any monetary authority with stringent requirements.

-

Why doubtful: There have actually been social networks posts suffering uncommon habits on the exchange, consisting of frozen accounts and unforeseen Know Your Client (KYC) concerns.

-

What sustains it: The appeal of futures trading, speculative interest in high-yield chances preserve trading volume and aggressive promos keep driving it.

DWF

-

Origin: Noted as a platinum sponsor at Token2049, DWF is a questionable market maker, according to ZachXBT, that performs trades on over 60 exchanges and is participated in prominent financial investments. It has little bit openly offered info about its background or group.

-

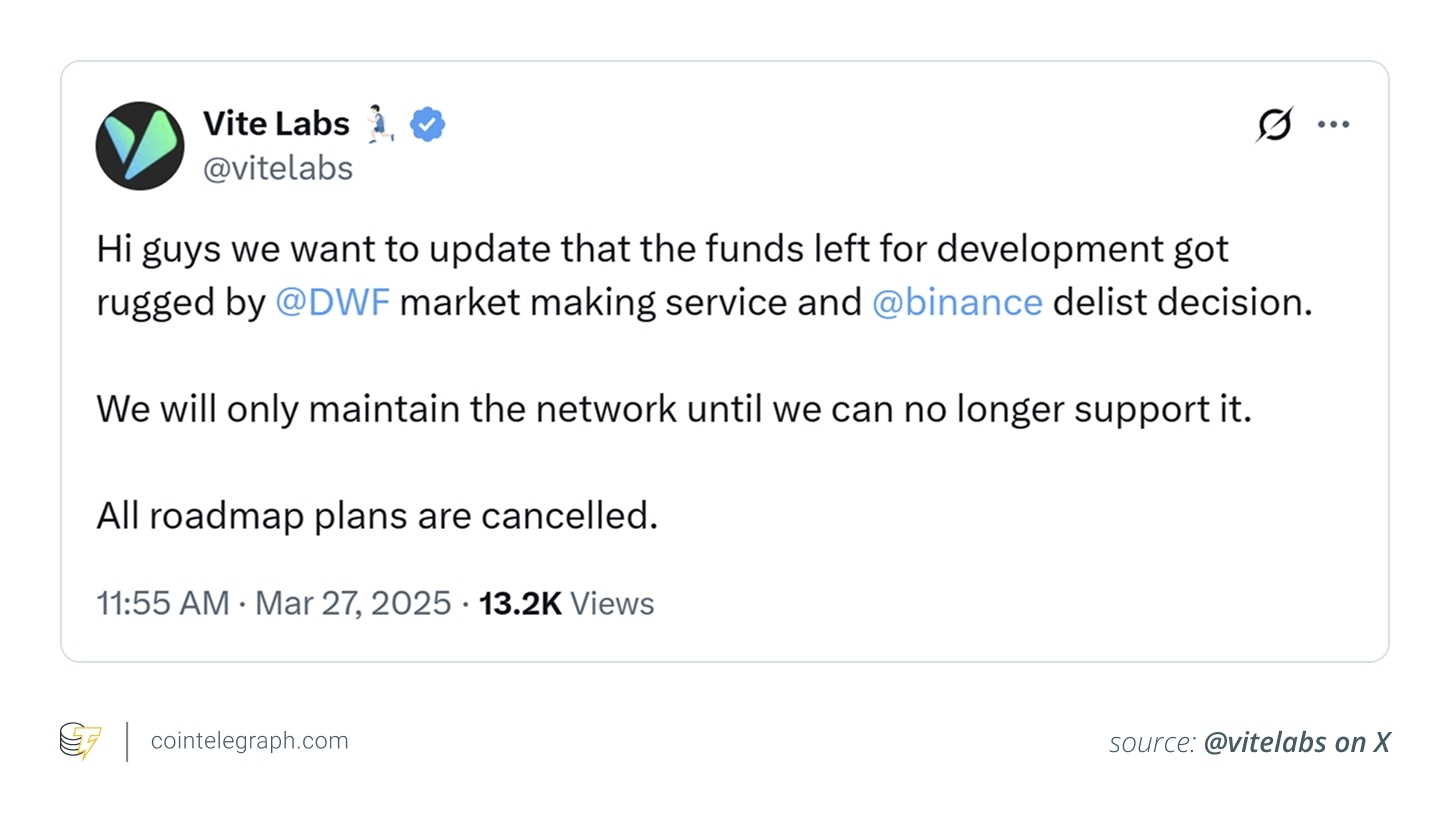

Debates: It might have been consisted of on ZachXBT’s list due to previous allegations of wash trading as a market maker and a more current accusation of a “carpet pull” from Vite Labs.

-

Why doubtful: On March 27, 2025, Vite Labs mentioned its advancement funds were “rugged” by DWF’s market-making services and Binance’s choice to delist the task.

-

What sustains it: Acknowledgment from conference sponsorships, marketing stories and speculative buzz around listings keeps very little trading interest alive.

Bitunix

-

Origin: Established around 2021, Butunix is a crypto exchange signed up in Saint Vincent and the Grenadines. It uses area and futures trading.

-

Debates: Identified “questionable” by ZachXBT most likely for drawing the examination of South Korea’s Financial Intelligence System (FIU), which becomes part of the Financial Providers Commission (FSC), for offering services to Korean clients without the needed registration.

-

Why doubtful: Minimal regulative oversight and an uncertain business structure weaken trust.

-

What sustains it: Trading volume is driven by listings of specific niche altcoins, perk rewards and speculative traders looking for fast earnings.

Did you understand? Companies like CertiK or Hacken audit genuine clever agreements. Numerous questionable coins declare “internal audits” or merely avoid them totally, exposing users to bugs or exploits.

Previous circumstances of questionable tasks impersonating sponsors

Here are 2 cases when dubious crypto tasks ended up being sponsors of popular occasions, just to utilize the reliability they had actually made to fool financiers:

JPEX

At Token2049 in Singapore, JPEX contributed $70,000 to end up being a platinum sponsor, utilizing it to appear genuine. Nevertheless, after Hong Kong regulators released cautions in mid-September 2023, JPEX deserted its cubicle and vanished from the occasion by the 2nd day.

Soon later, the exchange stopped withdrawals, charged extreme costs of 999 USDt (USDT) on 1,000-USDT deals and dealt with countless grievances implicating it of scams and operating without a license. Authorities jailed numerous people, froze properties and approximated financier losses at over 1 billion Hong Kong dollars.

HyperVerse

HyperVerse hosted luxurious marketing occasions, consisting of a $3,500-per-person celebration on a $40-million Seafair megayacht in Florida, including rap artist Rick Ross, to emerge as a distinguished crypto and metaverse platform. It declared to be establishing a “best virtual world” and assured day-to-day go back to bring in financiers worldwide.

Nevertheless, United States regulators later on exposed that HyperVerse was a Ponzi plan that defrauded financiers of around $1.89 billion. Secret promoters, consisting of Steven Lewis and Brenda Chunga, were charged by the United States Securities and Exchange Commission for running a deceptive pyramid plan.

Did you understand? Some dubious coins utilize bots to develop phony trading volume and technique platforms into ranking them greater. You require to research study well before investing.

What beginner traders ought to look out for

For those brand-new to cryptocurrency, recognizing suspicious coins early can avoid monetary loss and tension. Here are essential aspects to think about when examining a cryptocurrency:

-

Research study the group and task history: Search for indication such as confidential creators, regular rebrands or an absence of credible collaborations.

-

Examine marketing techniques: Beware of coins promoted through aggressive marketing, consisting of meme-driven social networks, paid influencer recommendations or impractical claims like “surefire 100x returns.”

-

Examine liquidity: Coins with low trading volume or focused ownership are susceptible to rate adjustment by experts.

-

Examine tokenomics: Look for warnings like exceedingly big token supply, uncertain token-burning procedures or allowances greatly preferring experts, which might show dangers of rate adjustment or frauds.

-

Confirm exchange listings: Coins noted just on lesser-known or badly controlled exchanges might do not have openness.

-

Examine previous concerns: Research study any history of issues, such as stopped withdrawals, frauds or regulative cautions.

-

Usage trusted tools and diversify: Prevent relying entirely on influencers or trending charts. Rather, utilize onchain analytics to keep an eye on wallet activity and diversify financial investments to restrict threat.

Shady coins typically function as cautions instead of authentic financial investment chances. They bring in financiers with pledges of huge earnings, however they usually conceal manipulative plans, uncertain group backgrounds and weak basics. Regardless of regular market crashes or debates, these coins continue due to the unforeseeable, community-driven nature of crypto markets.

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.