Aave creator and CEO Stani Kulechov laid out a more comprehensive tactical vision for the procedure following a controversial governance vote that turned down a proposition to move control of Aave’s brand name properties and copyright to its decentralized self-governing company (DAO).

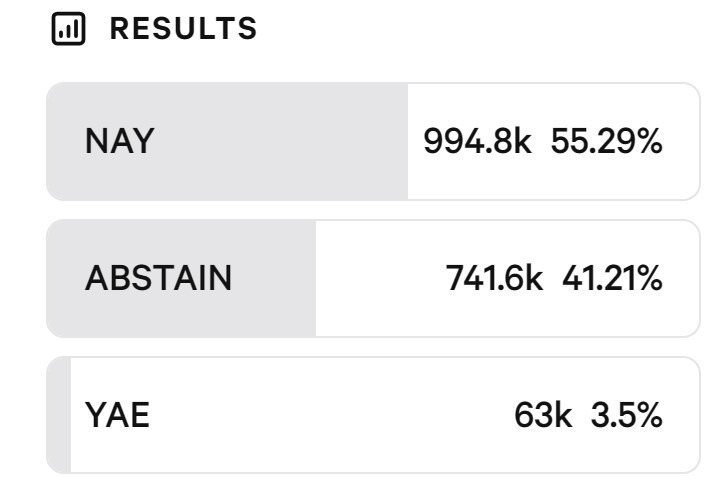

The unsuccessful vote triggered restored dispute within the Aave neighborhood over the procedure’s long-lasting instructions and governance structure, a problem Kulechov dealt with straight.

In a post released Friday on the Aave governance online forum, Kulechov argued that the procedure needs to progress beyond its core decentralized financing (DeFi) loaning service to pursue chances in real-world properties (RWAs), institutional loaning and consumer-facing monetary items.

He explained the neighborhood as being “at a crossroads,” keeping in mind that DeFi’s future development trajectory stays unsure without more comprehensive market growth.

Considerably, Kulechov stated Aave Labs prepares to disperse non-protocol earnings to Aave (AAVE) tokenholders, a relocation that might broaden how the token captures worth beyond governance involvement. He included that Aave Labs prepares to present a brand-new governance proposition to attend to copyright ownership and brand-related rights, following neighborhood pushback versus the earlier effort.

Kulechov’s post appears targeted at refocusing the neighborhood far from short-term governance disagreements and towards a more cohesive long-lasting method. He highlighted RWAs in specific, explaining the sector as a possible $500 trillion chance based upon the approximated worth of international monetary properties.

Aave is among the biggest DeFi procedures, with its overall worth locked surpassing $45 billion in October, according to market information.

Related: Crypto’s 2026 financial investment playbook: Bitcoin, stablecoin facilities, tokenized properties

The debate at the heart of Aave governance

As Cointelegraph reported, Aave’s current governance disagreement fixates who ought to manage and take advantage of costs created by cryptocurrency swaps within the environment.

A few of those swaps are routed through CoW Swap, a decentralized trading service that permits users to exchange tokens straight from Aave. The difference emerged over whether earnings connected to these swaps ought to come from the Aave DAO, which represents tokenholders, or stay under the control of designers at Aave Labs.

Some members of the Aave neighborhood likewise indicated Kulechov’s current purchase of approximately $15 million worth of AAVE tokens as an effort to affect the governance vote, a claim he highly rejected, stating the purchase showed his individual “conviction” in the procedure instead of an effort to sway the result.

Publication: How crypto laws altered in 2025– and how they’ll alter in 2026