Aave’s tokenholders authorized a governance proposition to begin redeeming the decentralized financing (DeFi) procedure’s governance token, AAVE, as part of a wider tokenomics overhaul, Aave stated on April 9.

The proposition– which was authorized by more than 99% of AAVE tokenholders– allows the procedure to acquire $4 million in AAVE (AAVE) tokens, enough for one month of buybacks.

The relocation is a “primary step” towards a wider strategy to buy $1 million AAVE tokens weekly for 6 months. It is likewise the current circumstances of DeFi procedures carrying out buyback systems in reaction to tokenholder needs.

” The objective is to sustainably increase AAVE acquisition from the free market and disperse it to the Environment Reserve,” the proposition stated.

The AAVE token’s cost rallied more than 13% on April 9, bringing the procedure’s market capitalization to more than $2.1 billion, according to information from CoinGecko.

The buyback proposition passed with frustrating assistance. Source: Aave

Related: Aave proposition to peg Ethena’s USDe to USDT stimulates neighborhood pushback

Buybacks get appeal

In March, the Aave Chan Effort (ACI), a governance advisory group, proposed a tokenomics revamp that would consist of brand-new earnings allowances for AAVE tokenholders, boosted security functions for users, and the production of an “Aave Financing Committee.”

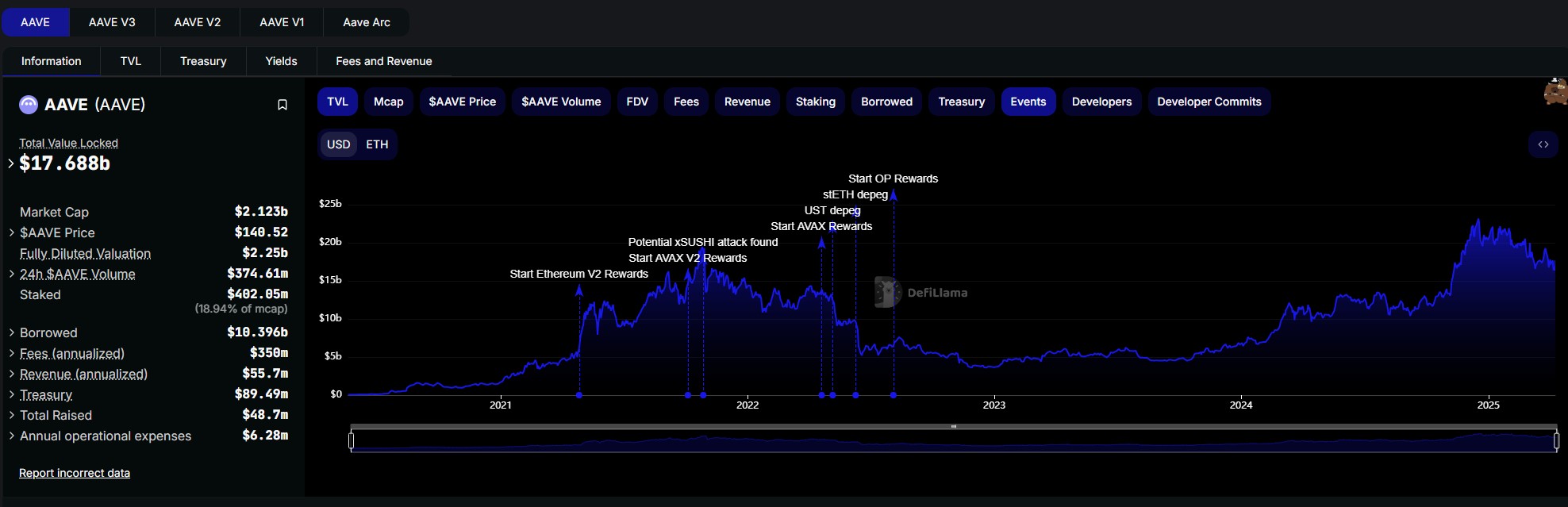

Aave is Web3’s most popular DeFi procedure, with overall worth locked going beyond $17.5 billion since April 9, according to DefiLlama.

It is likewise amongst DeFi’s most significant charge generators, with an approximated annualized charge earnings of $350 million, the information programs.

Aave is DeFi’s most popular procedure by TVL. Source: DeFILlama

DeFi procedures are under increasing pressure to supply tokenholders with a share of procedure incomes– partially since United States President Donald Trump has actually cultivated a friendlier regulative environment for DeFi procedures in the United States.

Projects consisting of Ethena, Ether.fi and Maple are piloting value-accrual systems for their native tokens.

In January, Maple Financing’s neighborhood drifted redeeming native SYRUP tokens and dispersing them as benefits to stakers.

In December, Ether.fi, a liquid restaking token provider, tipped strategies to direct 5% of procedure incomes towards redeeming native ETHFI tokens.

Likewise, Ethena, a yield-bearing stablecoin provider, consented to share a few of its around $200 million in procedure incomes with tokenholders in November.

Publication: DeFi will increase once again after memecoins wane: Sasha Ivanov, X Hall of Flame