A proposition for the decentralized financing (DeFi) loaning procedure Aave to introduce a central variation of its service on the crypto exchange Kraken’s Ink blockchain has actually gotten extensive approval amongst the neighborhood.

An Aave ask for remark (ARFC) for the release of a whitelabel variation of Aave v3 for the Ink Structure, the company behind the Ink blockchain, was authorized with 99.8% of the votes cast in favor.

An ARFC serves as an initial offchain vote before continuing with a complete decentralized self-governing company (DAO) vote. The next stage includes preparing an Aave enhancement proposition (AIP) that will be voted onchain.

The ARFC mentions that “by approving a license to release a central variation of the Aave (AAVE) codebase, Aave can broaden its innovation adoption while producing brand-new earnings streams.”

Aave had actually not reacted to an ask for remark by publication time.

Kraken revealed its Ink blockchain in late 2024, following an October statement. The chain intends to function as a certified layer-2 platform for tokenized properties and institutional DeFi.

Related: TradFi might move onchain due to ‘awful banking experiences’

Aave eyes institutional loaning market

The proposition mentions that the collaboration might be “a chance for Aave to broaden its impact in the institutional loaning area,” producing extra earnings streams for the procedure.

The Aave DAO would get a share “higher than or equivalent to the equivalent of a Reserve Aspect of 5% based upon obtain volume in all swimming pools.” The Ink Structure likewise devoted funds to the advancement of the brand-new procedure:

” The Ink Structure has actually devoted substantial rewards to bootstrapping this circumstances. This consists of numerous liquidity mining programs that are anticipated to bring over $250m in early supply to the circumstances.”

Related: No more ETH discards? Ethereum Structure turns to DeFi for money

Aave’s favorable development trajectory

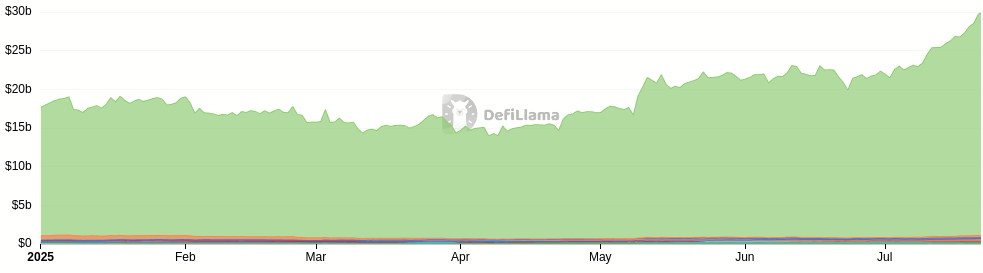

The statement follows Aave reaching an overall worth locked (TVL) of $40.3 billion in mid-May.

Nevertheless, information from DefiLlama reveals Aave’s existing TVL has actually dipped to about $33.5 billion, positioning it 2nd behind liquid staking platform Lido, which holds $34.3 billion in properties.

Publication: TradFi is constructing Ethereum L2s to tokenize trillions in RWAs: Information