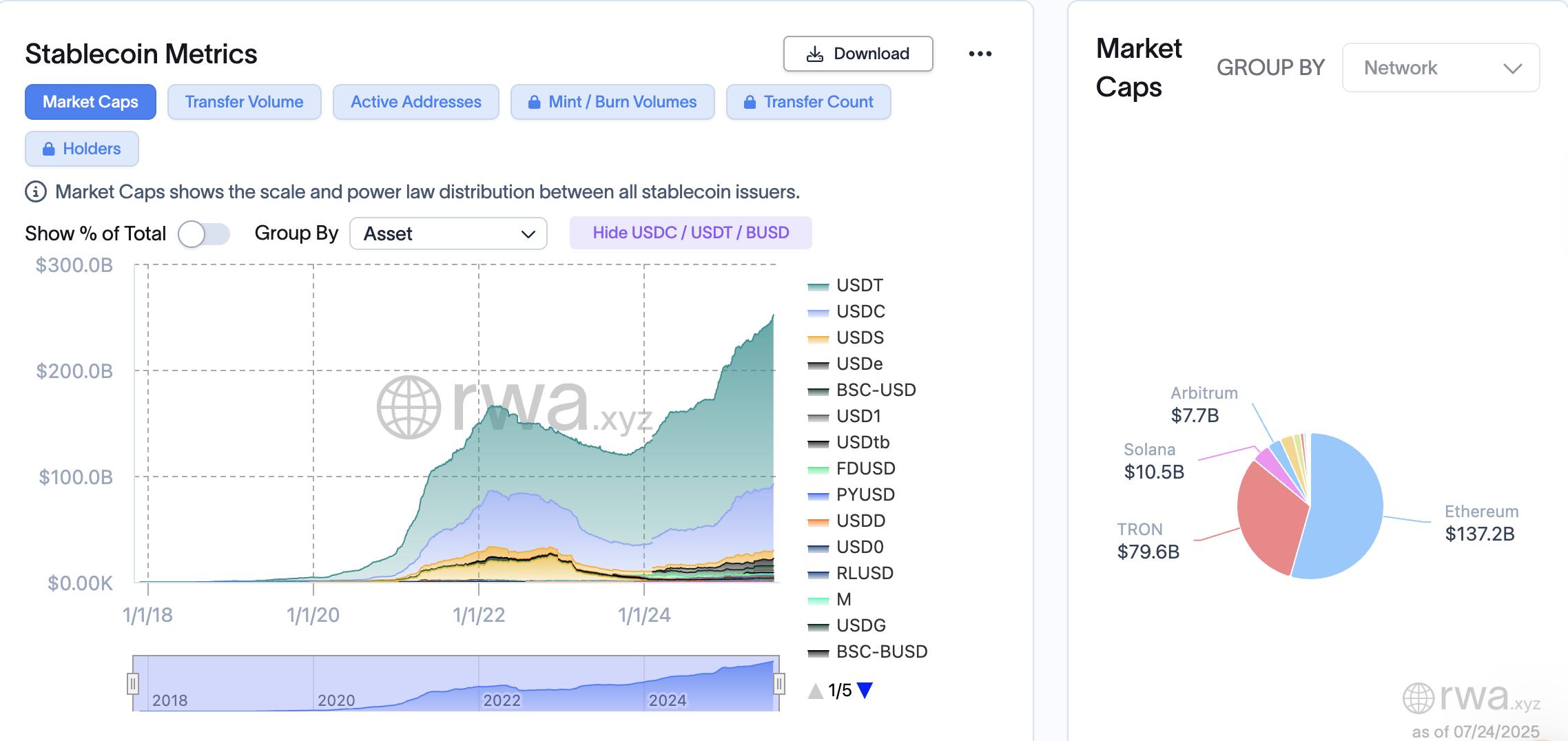

Anchorage Digital, an institutionally-focused digital possession provider, revealed the launch of a stablecoin issuance platform on Thursday, tapping artificial dollar and stablecoin company Ethena as its very first partner customer.

The business will introduce Ethena’s USDtb stablecoin in the United States, according to a statement made on Thursday. Presently, USDtb is released offshore.

Issuing USDtb in the United States will make the stablecoin completely certified under the GENIUS stablecoin policy, signed into law by United States President Donald Trump in July.

Teresa Cameron, group chief monetary officer at payments business Clear Junction, stated the GENIUS structure offers the regulative clearness to make banks comfy with utilizing digital fiat tokens. She included:

” Stablecoins provide what tradition systems can not: real-time settlement, 24/7 accessibility, and improved openness. What began as specific niche development is now ending up being important facilities as controlled gamers look for options to SWIFT and other tradition networks.”

The passage of the GENIUS Act is thought about a watershed minute for the crypto market, and it eliminated the regulative unpredictability stopping banks from providing, holding, and offering stablecoin services in the United States.

Related: Boom in RWA tokenization anticipated after passing of GENIUS Act– Aptos officer

Conventional banks stack into the stablecoin video game

The finalizing of the GENIUS Expense was participated in by crypto market executives, consisting of those from Anchorage Digital, and numerous conventional monetary companies have actually revealed stablecoin strategies considering that the costs was signed.

PNC Bank revealed a collaboration with Coinbase on Tuesday to provide crypto services to customers, consisting of custody and the capability to purchase and offer digital properties.

Cash transmission service Western Union is likewise checking out stablecoin combinations and collaborations with tokenization companies to update its service. Western Union is a significant gamer in the cross-border remittance market.

” We see stablecoins truly as a chance, not as a risk,” Western Union CEO Devin McGranahan informed Bloomberg on Monday.

Property supervisor WisdomTree revealed a rebrand of the USDW stablecoin on Monday following the passage of the GENIUS Act.

Publication: Crypto wished to topple banks, now it’s becoming them in the stablecoin battle