BNB Chain derivatives decentralized exchange (DEX) Aster finished repayments to traders injured by a problem in its Plasma (XPL) continuous market that briefly drove costs above market levels.

According to Abhishek Pawa, the CEO of Web3 firm AP Collective, the problem originated from a misconfigured index hard-coded at $1. With the mark cost cap raised before the repair, XPL futures on Aster increased to almost $4 while other places stayed $1.30.

The abrupt Friday cost inconsistency set off unforeseen liquidations and irregular cost charges, triggering losses to users. Nevertheless, the platform moved rapidly, guaranteeing its users that all funds were safe and appealing to compensate them for any losses.

Simply hours later on, the DEX stated the repayments for the event had actually been totally dispersed to their accounts. Soon after, Aster released another round of payment, consisting of trading and liquidation charges.

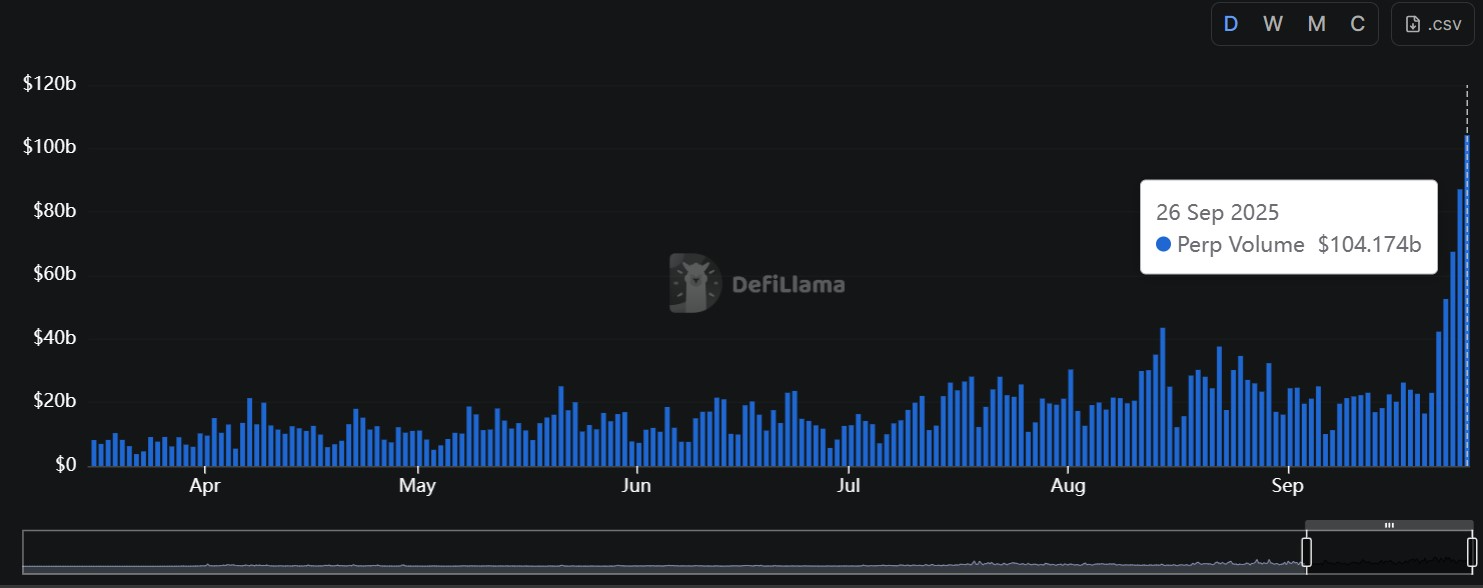

Aster sends out perps trading to a day-to-day record of $100 billion volume

On The Other Hand, Aster has actually sustained its fast development today, driving total continuous DEX volumes to $104 billion on Friday, marking a 4th straight day of record day-to-day highs.

DefiLlama revealed that Aster tape-recorded $46 billion in volume on Friday, overshadowing its rivals Lighter and Hyperliquid, which both had strong efficiencies of almost $19 billion and $17 billion, respectively.

Aster’s volume rise began on Wednesday, exceeding its greatest rival, Hyperliquid, with a trading volume of almost $25 billion. At the time of composing, CoinGlass revealed that Aster’s open interest was at $1.15 billion.

While Aster’s metrics kept increasing, neighborhood members voiced issues over possible dangers for traders.

One neighborhood member revealed hesitation over the trading volume on Aster, raising airdrop rewards for utilizing the platform. Another user prompted traders to squander on their trades, stating that it’s simple to lose cash at this phase.

Related: Crypto costs, stablecoins, brand-new ETPs to drive Q4 crypto returns: Experts

What is the XPL token?

XPL is the native token of Plasma, a layer-1 network enhanced for stablecoins. The network uses zero-fee Tether (USDT) transfers and EVM compatibility for clever agreements and is backed by investor Peter Thiel and Tether CEO Paolo Ardoino.

The network has actually just recently gotten traction within the DeFi environment. On Friday, Ethena’s USDe financing markets on Aave by means of Plasma reached their preliminary $1 billion supply caps within hours of introducing, signifying strong need for the artificial dollar stablecoin on Plasma.

Publication: ‘ Assist! My robotic vac is taking my Bitcoin’: When clever gadgets attack