Ethereum layer-2 network Aztec released its mainnet Wednesday– albeit with partial performance– marking the launch of among the couple of totally decentralized networks in the environment.

According to an Aztec e-mail seen by Cointelegraph, Aztec has actually released its “Ignition” mainnet chain, a practical consensus-producing chain that produces blocks, however without the wise agreement execution layer.

According to L2Beat, just the trustless, positive rollup network Element v1 and Aztec’s old decentralized financing (DeFi) anonymization task, Zk.Money are classified as a phase 2 system with complete decentralization.

Together with Element, Aztec is amongst the couple of procedures without any centralized “training wheels,” as ownership of the rollup agreement was renounced, and Aztec is neither a rollup processor nor an operator. Users or 3rd parties should run the rollup system themselves to withdraw or negotiate.

In an e-mail sent out to the Aztec newsletter customers, the Aztec group highlighted that “neither the Aztec Structure, core group, nor financiers can run nodes, stake, or take part in governance for the next 12 months.” “This makes Aztec the very first community-launched L2 in Ethereum history,” the group informed customers.

Aztec had actually not reacted to Cointelegraph’s ask for remark by publication.

Related: You call that decentralized? Layer twos are ruining crypto

Aztec staking is now live

Aztec staking is now readily available to holders, enabling them to take part in network agreement, make block benefits and shape governance choices. The e-mail recommends that early stakeholders get greater benefits since “early individuals gain from dispersing block benefits among less stakers.”

The staking control panel shows that 107.2 million AZTEC tokens are presently staked. Both the financiers and the advancement group are presently disallowed from staking, so it is most likely that those funds are sourced from the 200 million AZTEC offered in the genesis sequencer sale, which targets whitelisted neighborhood members clearly to bootstrap the mainnet.

The minimum stake quantity (likewise relevant to delegated stakes) is 200,000 AZTEC, comparable to about $6,000 at the costs of the continuous community-only Constant Cleaning Auctions stage. Still, the tokens might be cost greater costs than the existing $0.03 per AZTEC if need boosts.

Related: Vitalik informs Ethereum L2s ‘Phase 1 or GTFO’– Who makes it?

The continuous token sale

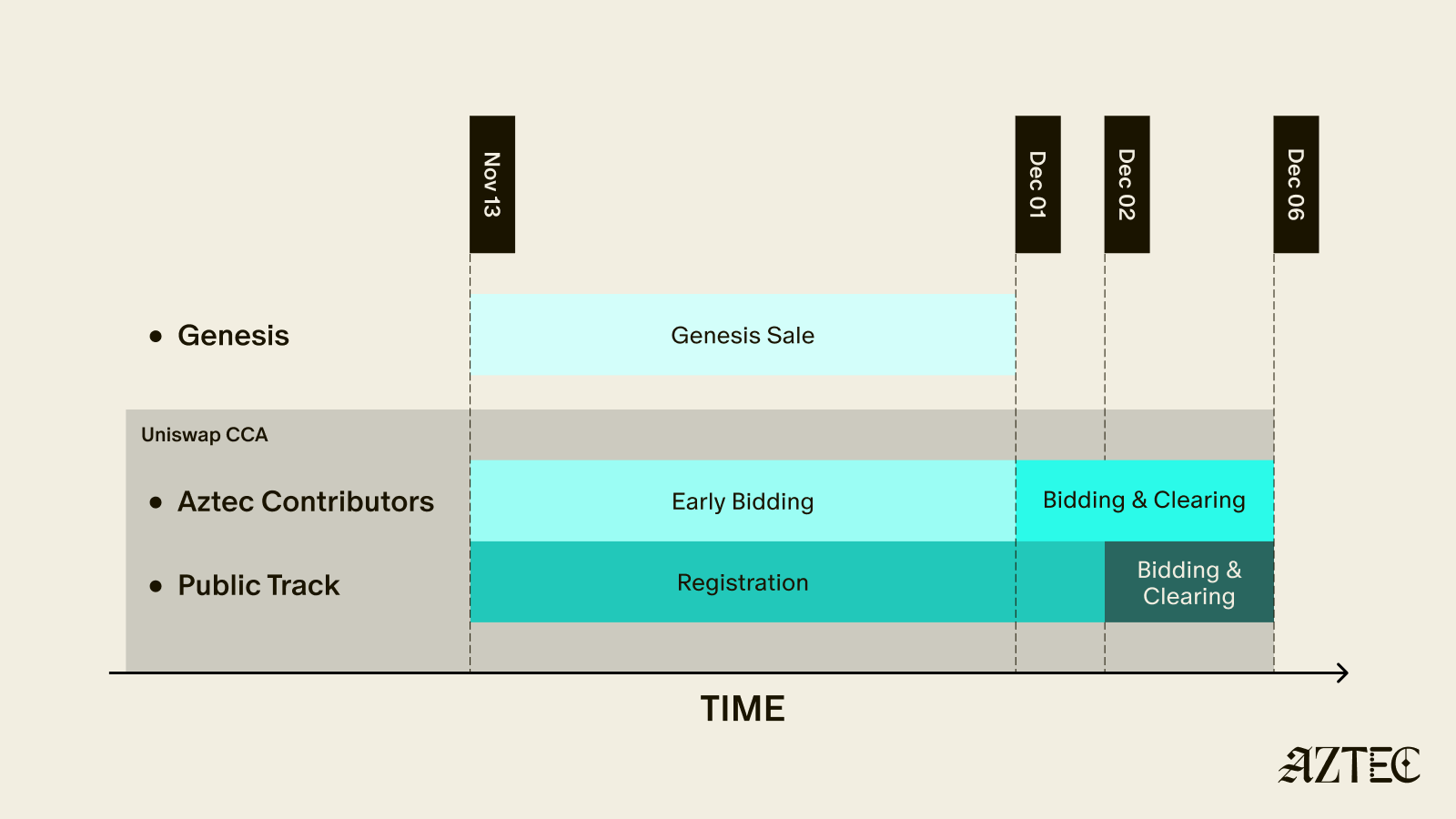

Aztec is presently in the whitelisted neighborhood members-only stage of its token sale, drawing in $2.77 million worth of possessions from 2,209 special bidders given that its opening on Nov. 13. This stage will close on Dec. 1, prior to the general public sale begins on Dec. 2 and closes on Dec. 6.

The tokens bought through the sale will be locked for a minimum of 90 days and approximately 12 months, depending upon whether the neighborhood votes to launch them early. The sale will disperse 1.547 billion tokens, representing 14.95% of the overall supply.

Aztec claims that the token sale is happening at a 75% discount rate relative to the implied network assessment from previous fundraising efforts. According to ICO Drops information, Aztec raised $2.1 million in its seed round, $17 million in its Series A, and $100 million in its Series B financing rounds. Backers consist of Ethereum co-founder Vitalik Buterin, Coinbase Ventures, Paradigm, Consensys, Andreessen Horowitz and HashKey Capital, to name a few.

Still, Aztec’s own token sale disclaimer cautions that “any recommendation to a previous assessment or portion discount rate is offered exclusively to notify prospective buyers of how the preliminary flooring cost for the token sale was computed.” The flooring cost presently stands at 0.000010 ETH, or about $0.03 per AZTEC– putting the task at a completely watered down assessment of $310 million. The disclaimer likewise keeps in mind that unsold tokens “might be declared back by the Structure.”

On Dec. 6, a Uniswap swimming pool consisting of 273 million AZTEC (2.64% of supply) will go live to bootstrap liquidity. Tokens purchased on the secondary market will not undergo lockups.

Publication: What are native rollups? Complete guide to Ethereum’s most current development