The cryptocurrency market continued its healing in the previous week as the overall crypto market capitalization breached the $3 trillion mark for the very first time because the start of March.

Bitcoin (BTC) increased to an over two-month high of $97,300 last seen at the end of February, before the “Freedom Day” tariffs statement in the United States, boosting expert forecasts for a rally driven by “structural” institutional and exchange-traded fund (ETF) inflows into the world’s very first cryptocurrency.

Danger cravings continued increasing amongst crypto financiers, as Chinese state-linked news outlets suggested that the Trump administration has actually silently called Beijing to talk about tariff decreases.

In the larger crypto area, Ethereum designers proposed a brand-new token requirement to enhance the interoperability of the world’s second-largest blockchain network.

Bitcoin to $1 million by 2029 sustained by ETF and gov’ t need– Bitwise officer

Bitcoin’s broadening institutional adoption might supply the “structural” inflows needed to exceed gold’s market capitalization and press its rate beyond $1 million by 2029, according to Bitwise’s head of European research study, André Dragosch.

” Our internal forecast is $1 million by 2029. So that Bitcoin will match gold’s market cap and overall addressable market by 2029,” he informed Cointelegraph throughout the Domino effect day-to-day X areas reveal on April 30.

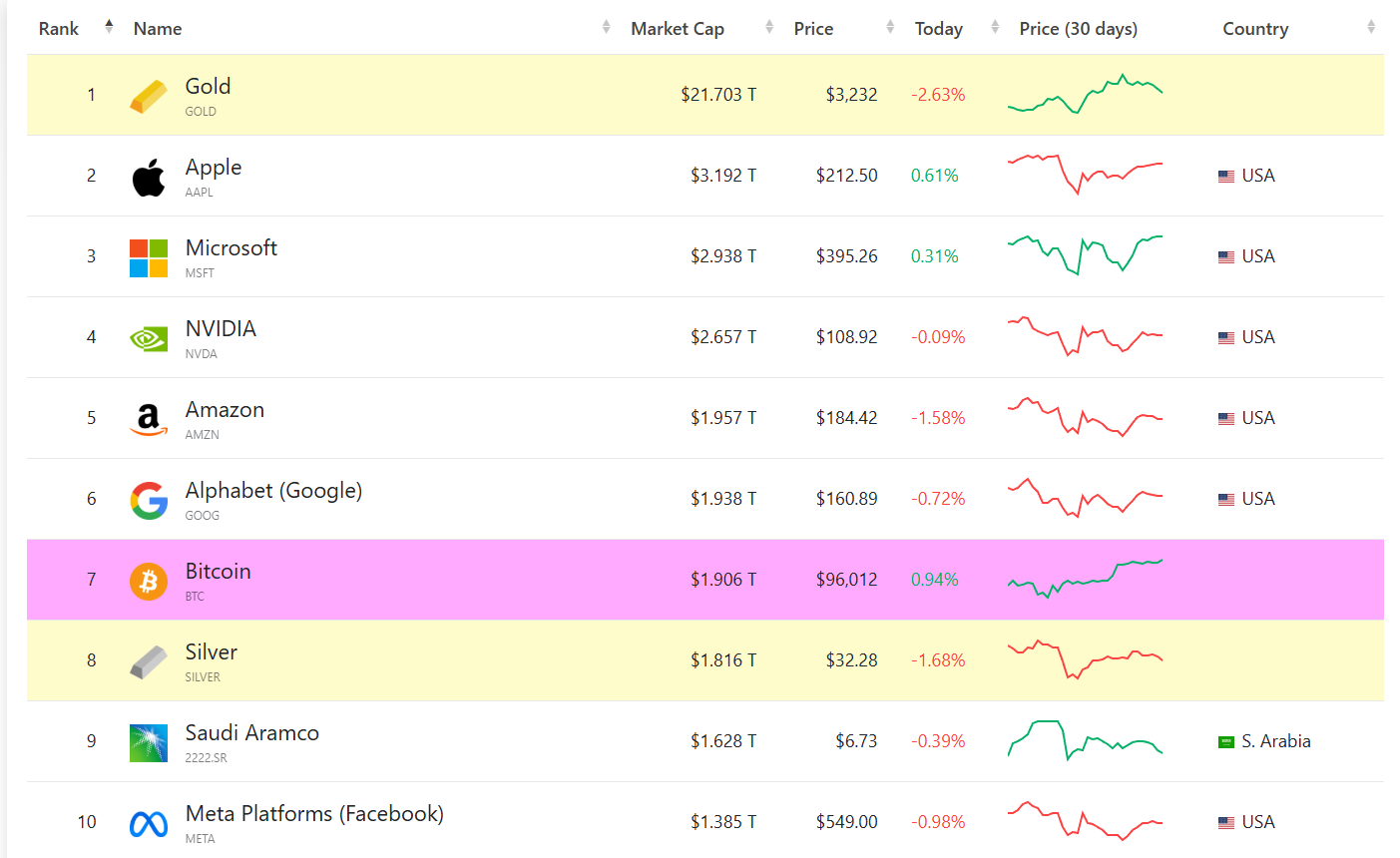

Gold is presently the world’s biggest property, valued at over $21.7 trillion. In contrast, Bitcoin’s market capitalization sits at $1.9 trillion, making it the seventh-largest property internationally, according to CompaniesMarketCap information.

For the 2025 market cycle, Bitcoin might exceed $200,000 in the “base case” and $500,000 with more governmental adoption, Dragosch stated.

Continue reading

Eric Trump: USD1 will be utilized for $2 billion MGX financial investment in Binance

Abu Dhabi-based financial investment company MGX will utilize a stablecoin connected to United States President Donald Trump’s household to settle a $2 billion financial investment in Binance, the world’s biggest cryptocurrency exchange.

The World Liberty Financial USD (USD1) United States dollar-pegged stablecoin was introduced by the Trump-associated crypto platform World Liberty Financial (WLFI) in March 2025.

MGX will utilize the USD1 stablecoin for its $2 billion financial investment in the Binance exchange, according to a statement by Eric Trump throughout a panel conversation at Token2049 in Dubai. Trump, the child of the president, works as executive vice president of the Trump Company.

MGX revealed its financial investment in Binance on March 12, marking the very first institutional financial investment in the exchange and among the greatest financing handle the whole Web3 market.

At the time, Binance decreased Cointelegraph’s demand to reveal what stablecoin was utilized in the deal.

This marks the Abu Dhabi-based financial investment company’s very first endeavor into the cryptocurrency area.

Continue reading

Ethereum to streamline crosschain deals with brand-new token requirements

Ethereum designers are working to enhance blockchain interoperability with 2 brand-new token requirements: ERC-7930 and ERC-7828.

” There’s no basic method for wallets, apps, or procedures to analyze or show this details,” decentralized financing (DeFi) community advancement company Wonderland composed in a Might 1 X post. Wallets, decentralized applications (DApps), block explorers and clever agreements follow various guidelines.

” The outcome? An unpleasant, irregular experience that breaks crosschain UX,” Wonderland specified.

Wonderland is a group of designers, scientists and information researchers concentrated on enhancing the Ethereum DeFi community. The company partnered with several DeFi procedures, consisting of Optimism, Aztec, Connext and Yearn.

In the post, the company shared what was gone over at a current Ethereum Structure interoperability working group call. Teddy from Wonderland described that the existing objective is to complete both token requirements within the next 2 weeks. He included:

” We terribly require feedback on the ETH-Magicians online forum.”

Continue reading

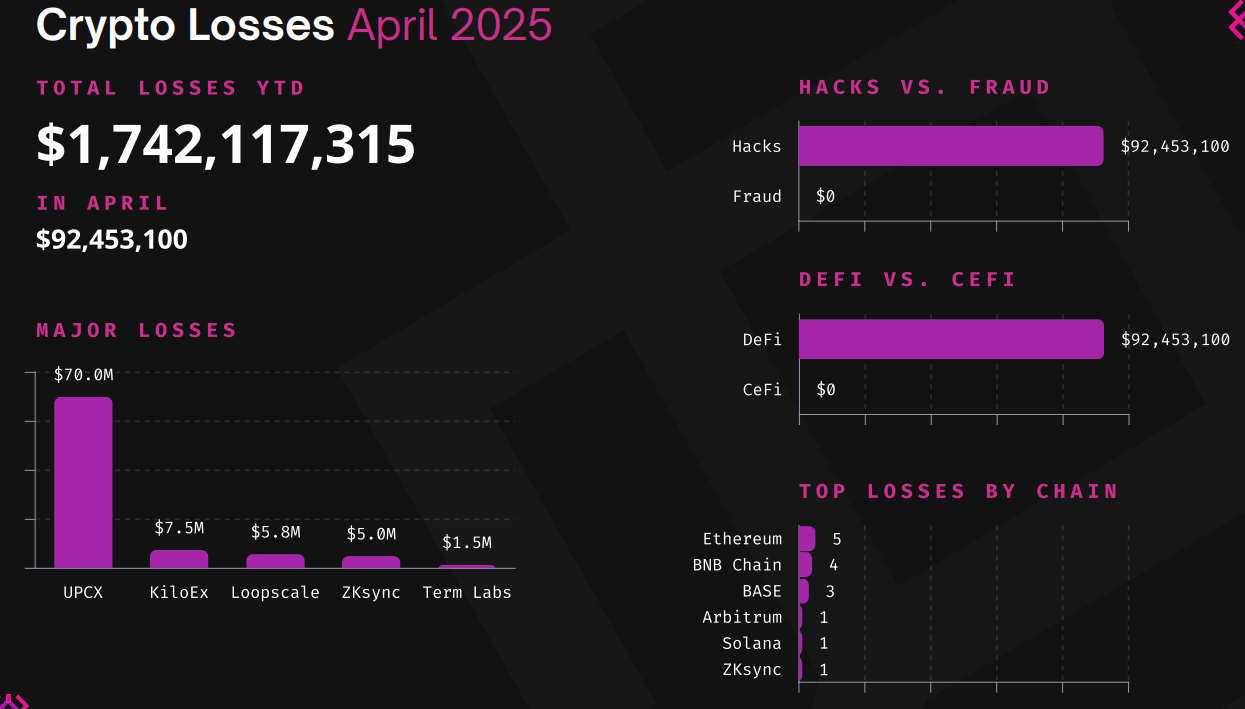

Crypto hackers struck DeFi for $92 million in April as attacks double from March

Cryptocurrency hackers took more than $90 million in April, dealing another blow to the market’s traditional track record regardless of continuous efforts to enhance cybersecurity.

Hackers stole $92 countless digital possessions throughout 15 occurrences in April, according to an April 30 research study report by blockchain cybersecurity company Immunefi.

The overall marks a 124% month-over-month boost from March, when hackers took $41 million.

The month’s biggest hack on open-source platform UPCX represented the majority of the damage in April, with over $70 million in losses, while KiloEx lost $7.5 million as April’s second-largest hack.

The KiloEx exploiter returned the taken funds simply days after the attack took place.

All of April’s reported attacks targeted decentralized financing (DeFi) platforms. Central exchanges reported no occurrences throughout the month, the report kept in mind.

Immunefi, which states it assists safeguard $190 billion in user funds, has actually paid more than $116 million in bounties to white hat hackers.

Continue reading

Crypto group asks Trump to end prosecution of crypto devs, Roman Storm

The crypto lobby group, the DeFi Education Fund, has actually petitioned the Trump administration to end what it declared was the “lawless prosecution” of open-source software application designers, consisting of Roman Storm, a developer of the crypto blending service Twister Money.

In an April 28 letter to White Home crypto czar David Sacks, the group advised President Donald Trump “to take instant action to stop the Biden-era Department of Justice’s lawless project to criminalize open-source software application advancement.”

The letter particularly pointed out the prosecution of Storm, who was charged in August 2023 with assisting wash over $1 billion in crypto through Twister Money. His trial is still set for July, and his fellow charged co-founder, Roman Semenov, is at big and thought to be in Russia.

The DeFi Education Fund stated that in Storm’s case, the Department of Justice is trying to hold software application designers criminally accountable for how others utilize their code, which is “not just unreasonable in concept, however it sets a precedent that possibly cools all crypto advancement in the United States.”

The group likewise required the acknowledgment that the prosecution opposes the Treasury Department’s Financial Crimes Enforcement Network (FinCEN) assistance from Trump’s very first term, which developed that designers of self-custodial, peer-to-peer procedures are not cash transmitters.

” This type of legal environment does not simply chill development– it freezes it,” they argued. The letter included that it likewise “empowers politically-motivated enforcement and puts every open-source designer at danger, despite market.”

In January, a federal court in Texas ruled that the Treasury violated its authority by approving Twister Money.

Continue reading

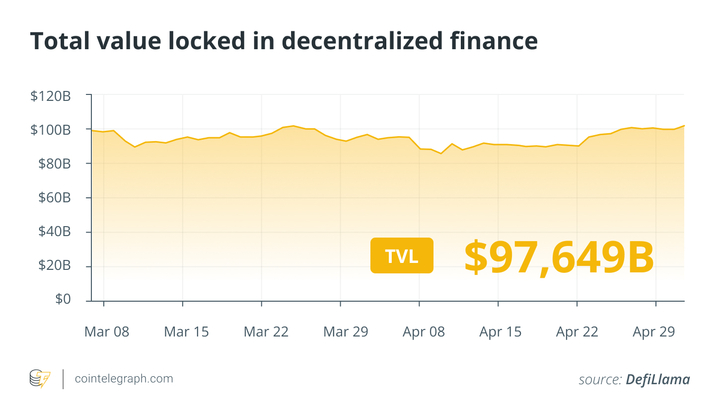

DeFi market introduction

According to information from Cointelegraph Markets Pro and TradingView, the majority of the 100 biggest cryptocurrencies by market capitalization ended the week in the green.

The Virtuals Procedure (VIRTUAL) token increased over 103% as the week’s greatest gainer, followed by the Solayer (LAYER) token, up over 29% throughout the previous week.

Thanks for reading our summary of this week’s most impactful DeFi advancements. Join us next Friday for more stories, insights and education concerning this dynamically advancing area.