Positive regulative expectations ended up being the centerpiece for cryptocurrency financiers today, following an occasion called by the United States federal government as “Crypto Week,” throughout which legislators looked for to pass 3 crucial regulative expenses for the Web3 market.

Sustained by the positive outlook, Bitcoin (BTC) turned Amazon’s $2.3 trillion market capitalization and skyrocketed to end up being the world’s fifth-largest possession by overall worth.

Regulators passed the 3 crucial expenses amidst Republican worry about reserve bank digital currencies (CBDCs).

In a Thursday Home session, legislators voted 294-134 to pass the Digital Property Market Clearness (CLEARNESS) Act, an expense focused on developing a market structure for cryptocurrencies, 308-122 in favor of the Guiding and Developing National Development for United States Stablecoins (GENIUS) Act and 219-210 for the Anti-CBDC Security State Act.

Market watchers see the GENIUS Serve as the secret to legitimizing stablecoins for worldwide adoption amongst banks and banks.

Bitcoin turns Amazon’s $2.3 T market cap to end up being fifth worldwide possession

Bitcoin has actually ended up being the world’s fifth-largest possession, surpassing Amazon by market capitalization.

Bitcoin (BTC) rate increased to a brand-new all-time high of $122,600 on Monday and has actually skyrocketed almost 13% over the previous week, as Cointelegraph reported.

These gains permitted Bitcoin to exceed a $2.4 trillion market capitalization, surpassing Amazon’s $2.3 trillion, Silver’s $2.2 trillion and Alphabet’s (Google) $2.19 trillion, Cointelegraph information programs.

This suggested Bitcoin’s market cap was just $730 million shy of tech huge Apple at the time of composing.

The advancement signals Bitcoin’s growing existence in the worldwide monetary system, according to Enmanuel Cardozo, market expert at real-world possession tokenization platform Brickken. He informed Cointelegraph:

” With institutional giants like BlackRock and MicroStrategy’s treasury constantly increasing, the authenticity of Bitcoin as an investable possession class is no longer in concern, with regulative momentum likewise moving.”

Cardozo stated that continued institutional build-up and the “encouraging macro environment might assist Bitcoin exceed Apple’s evaluation, suggesting a Bitcoin rate of over $142,000.

Continue reading

Grayscale sends personal IPO filing with SEC

Cryptocurrency-focused possession supervisor and exchange-traded fund (ETF) provider Grayscale signed up with a growing list of crypto business looking for to release IPOs in the United States.

On Monday, Grayscale stated it had actually submitted to note its business show the Securities and Exchange Commission (SEC) under a brand-new provision that allows personal filings ahead of a last public offering.

Going into public markets would make it possible for Grayscale to look for more financing chances through techniques such as public stock offerings, which was leveraged by Michael Saylor’s Technique, or convertible note offerings, such as GameStop’s $2.25 billion offering from June 13.

Grayscale’s filing comes by a month after Circle, the provider of the world’s second-largest stablecoin USDC (USDC), upsized its IPO to more than $1.05 billion and debuted on the New York Stock Exchange on June 5.

The IPO prices provided Circle an appraisal of $6.9 billion based upon the more than 220 million exceptional shares noted in its June 2 filing.

Circle’s IPO success might influence more crypto-native companies to move into public markets with comparable offerings, stimulating a restored crypto IPO season in 2025.

Continue reading

Trump’s World Liberty crypto tokens are set to end up being tradable

Tokenholders of United States President Donald Trump-backed crypto task World Liberty Financial (WLFI) have actually voted to make them tradable, unlocking for the Trump-linked token to increase in worth.

The proposition sent by the WLFI group on July 9 closed on Wednesday, with an “frustrating” 99.94% in favor of the unlock. It will make the platform’s governance token tradable through peer-to-peer deals and secondary markets.

” Following the vote to make the token tradable, WLFI’s governance structure will make it possible for more tokenholders to take part straight in procedure choices,” the WLFI group stated in the proposition.

” This consists of ballot on emissions, environment rewards, and future treasury actions. This proposition is the initial step in handing higher impact to the neighborhood.”

Not all the governance tokens will be opened simultaneously, according to the WLFI group, and a complete launch strategy is coming quickly, according to WLFI’s post on X on Wednesday.

Continue reading

DEX-to-CEX ratio strikes brand-new high as crypto traders run away centralization

Cryptocurrency traders have actually been moving far from central exchanges (CEXs) in favor of decentralized exchanges (DEXs), pressing the CEX-to-DEX ratio to a brand-new all-time high.

Area trading volume on DEXs rose a minimum of 25% in the 2nd quarter of 2025 over the previous quarter, while CEXs volumes plunged practically 28%, according to the most recent quarterly market report by the crypto information aggregator CoinGecko.

This shift drove the DEX-to-CEX ratio to a record high in Q2, increasing from 0.13 in the previous quarter to 0.23, the report kept in mind.

Regardless of the increasing ratio, the area DEX market is still considerably smaller sized than CEX, with the leading 10 decentralized trading platforms publishing $877 billion in volume in Q2, compared to $3.9 trillion for CEXs.

Continue reading

BTCFi TVL leaps 22x to $7B, however trust stays a problem

Bitcoin-based decentralized financing (DeFi), frequently described as BTCFi, is experiencing considerable development however still deals with difficulties.

According to DefiLlama information, Bitcoin-based (BTC) DeFi procedures’ overall worth locked (TVL) went from $304.66 million on Jan. 1, 2024, to $6.5 billion by Dec. 31, 2024. Since publication, DefiLlama information reveals that BTCFi has a TVL of $7.05 billion.

This equates to a boost of more than 22 times. A report shared by Bitcoin smart-contract layer Arch Network recommends that “this rise was sustained by brand-new procedure launches, emerging token requirements, institutional inflows, a significant rate rally pressing BTC to an all-time high, and the increase of liquid restaking.”

The study results launched in the report reveal that regardless of some services currently on the marketplace, 36% of the participants do not engage with BTCFi due to an absence of trust. One-quarter prevent interactions with BTCFi due to run the risk of and fear of losses. Many (60%) view smart-contract exploits as the leading security threat.

Continue reading

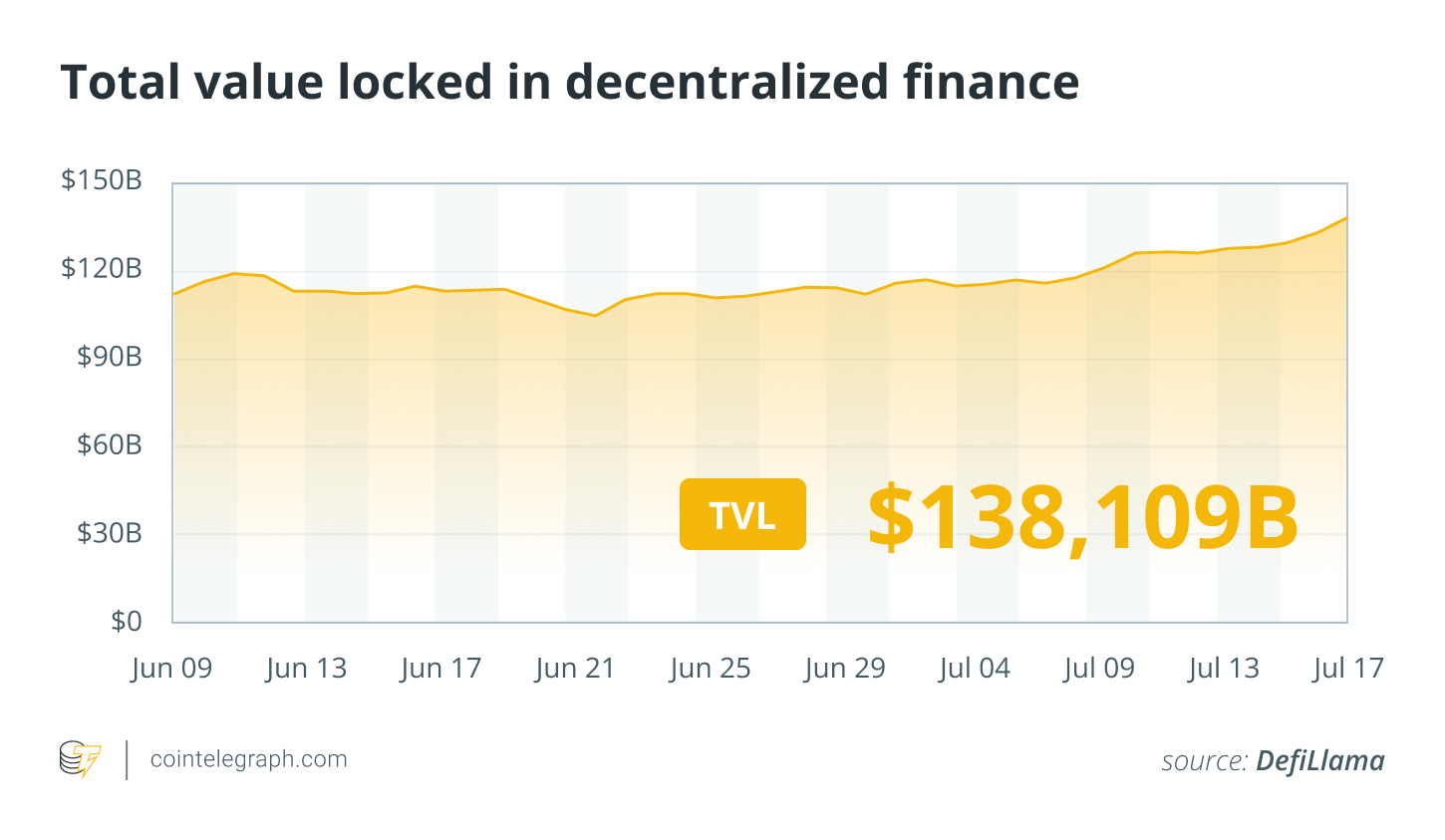

DeFi market introduction

According to Cointelegraph Markets Pro and TradingView information, the majority of the 100 biggest cryptocurrencies by market capitalization ended the week in the green.

The Curve DAO (CRV) token was the greatest gainer in the leading 100, increasing more than 63% over the previous week, followed by the Excellent (XLM) token, up over 63%.

Thanks for reading our summary of this week’s most impactful DeFi advancements. Join us next Friday for more stories, insights and education concerning this dynamically advancing area.