Regardless of a week of cost debt consolidation for Bitcoin (BTC), emerging digital possession legislation might offer the next considerable driver for the world’s very first cryptocurrency.

Approaching stablecoin guidelines, such as the Guiding and Developing National Development for United States Stablecoins (GENIUS) Act, might lay the structure for a Bitcoin cycle top of over $150,000, according to Alice Li, financial investment partner and head of United States at crypto equity capital company Insight Ventures.

On the other hand, investor (VC) interest has actually dropped. The variety of VC offers closed taped its least expensive month of the year in Might, with simply 62 financial investment rounds leading to $909 million raised.

A difficult “macro background” coupled with “higher-for-longer policy rates, tense bond markets and fresh tariff headings have actually made it harder for threat properties to get brand-new M&An offers over the goal,” Patrick Heusser, head of financing at Sentora and a previous financial investment lender, informed Cointelegraph.

Bitcoin reserve, stablecoin policies huge 2025 market drivers, states VC

Improving regulative clearness in the United States might press Bitcoin past $150,000 throughout the existing market cycle, according to Alice Li, financial investment partner and head of United States at crypto equity capital company Insight Ventures.

Throughout Cointelegraph’s Domino effect X Areas reveal on June 3, Li stated the crypto market’s 2025 rally had actually been driven generally by moving United States policy.

” Among the greatest chauffeurs is certainly the policy modification,” she stated, referencing United States President Donald Trump’s Bitcoin reserve approval and stablecoin policy advancements as the primary drivers for Bitcoin cost benefit in 2025.

” Stablecoin will be among the greatest locations that I would invest long term,” she included, pointing out regulative development in the United States.

Li’s remarks came as the market was waiting for a complete Senate vote on the Guiding and Developing National Development for United States Stablecoins (GENIUS) Act, which intends to set clear guidelines for stablecoin collateralization and required compliance with Anti-Money Laundering laws.

Continue reading

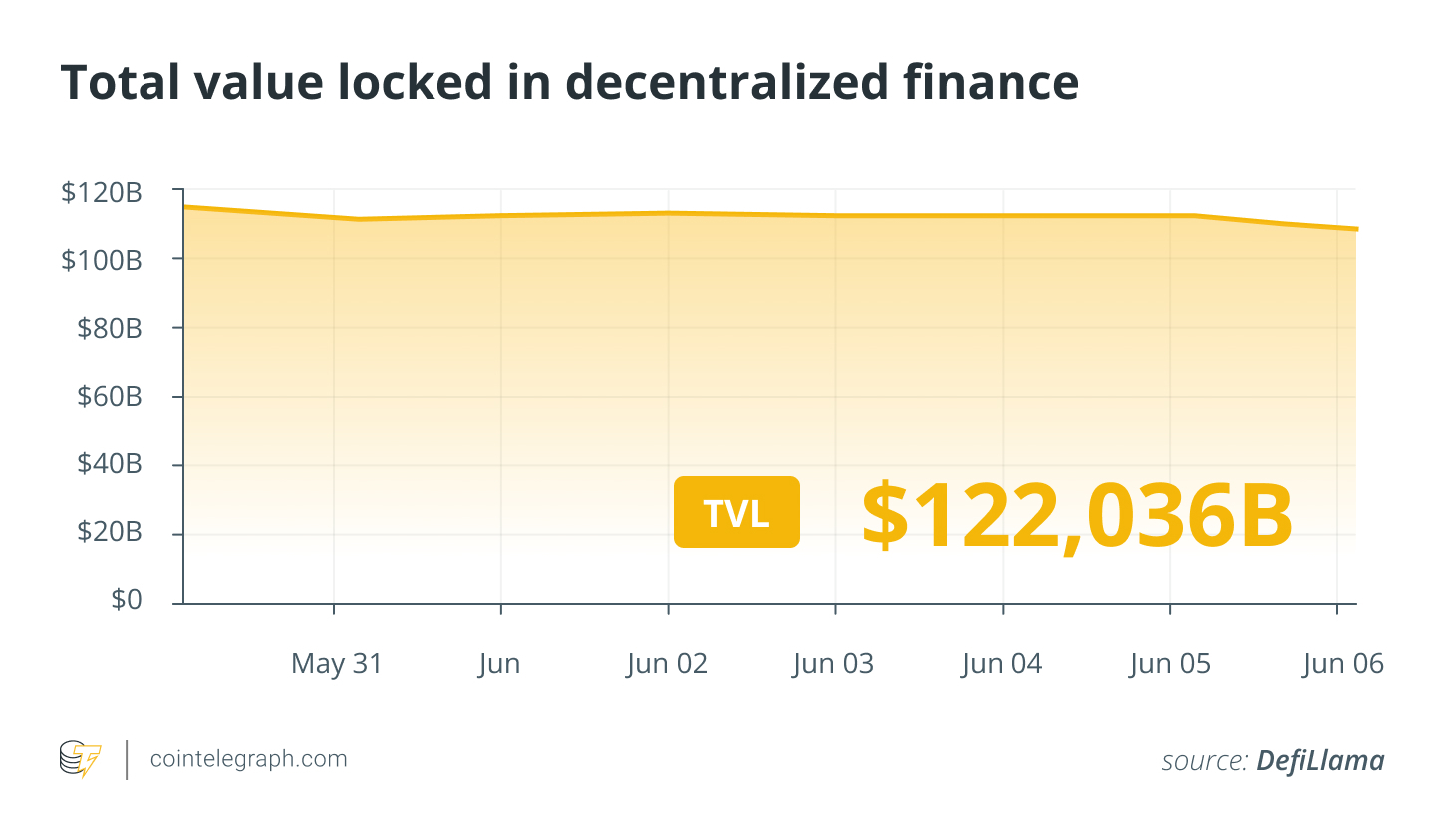

Ethereum recovers DeFi market as bots drive $480 billion stablecoin volume

The Ethereum network is staging a return in 2025 as bot-driven activity and stablecoin development press the mainnet back into the center of decentralized financing (DeFi).

On June 4, crypto trading platform Cex.io reported that automated bots assisted in 4.84 million stablecoin transfers on Ethereum’s layer-1 blockchain in Might. The volume reached $480 billion, its greatest to date.

Illia Otychenko, the lead expert at crypto exchange Cex.io, connected the activity rise to lower deal costs in the very first quarter of 2025, which assisted reverse a multi-year pattern of liquidity and user migration to competing blockchains and Ethereum layer-2 networks.

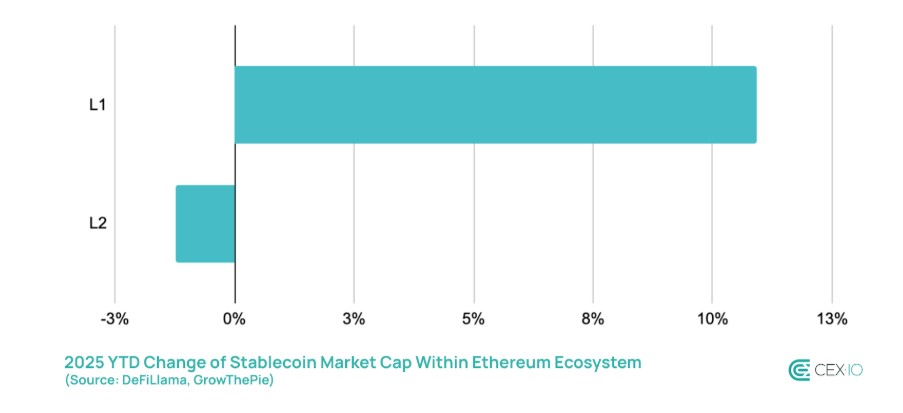

Since of this, the mainnet’s stablecoin market capitalization grew by 11% in 2025, taking market share far from its layer-2s. While the mainnet recovered stablecoin market share, the combined stablecoin market on L2s just diminished by 1%.

Continue reading

Binance co-founder CZ proposes dark swimming pool DEXs to deal with control

Binance co-founder Changpeng “CZ” Zhao proposed producing a dark swimming pool continuous swap decentralized exchange (DEX) to avoid market control.

In a June 1 X post, Zhao stated he has actually “constantly been puzzled with the reality that everybody can see your orders in real-time on a DEX.”

” The issue is even worse on a perp DEX where there are liquidations,” he stated.

Zhao included, “If you’re aiming to buy $1 billion worth of a coin, you normally would not desire others to discover your order till it’s finished.” This is to avoid front-running and optimal extractable worth (MEV) bot attacks, which can lead to increased slippage, even worse rates and greater expenses.

His remarks followed the liquidation of almost $100 million in Bitcoin long positions on Hyperliquid apparently held by a trader called James Wynn. The occasion, which took place after Bitcoin fell listed below $105,000, stimulated claims on X that some users had actually collaborated to “hunt” Wynn’s liquidation.

One X user declared that Tron co-founder Justin Sun revealed interest in taking part, however the claim stayed unofficial. He likewise presumed regarding welcome Eric Trump, the kid of United States President Donald Trump, to the group.

Continue reading

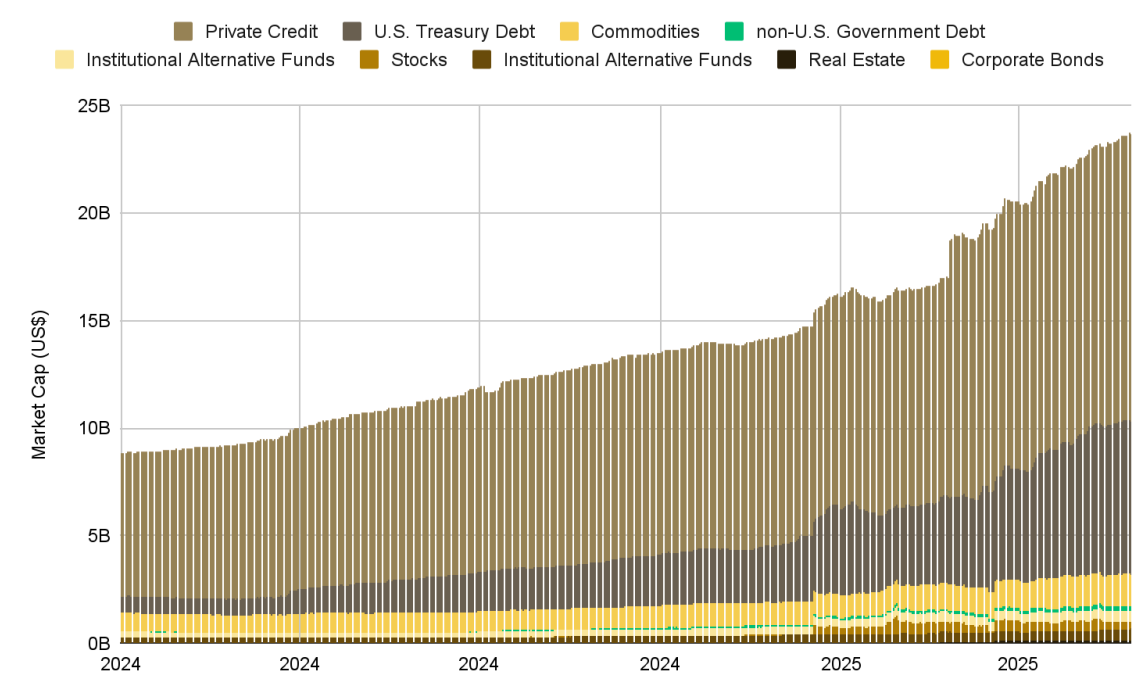

RWA token market grows 260% in 2025 as companies welcome managing crypto

The tokenization of real-world properties (RWAs) rose in the very first half of 2025 as increased regulative clearness sustained more comprehensive adoption of blockchain-based monetary items.

Real-world possession tokenization describes monetary and other concrete properties minted on the immutable blockchain journal, increasing financier availability and trading chances for these properties.

The RWA market rose more than 260% throughout the very first half of 2025, exceeding $23 billion in overall evaluation. It was $8.6 billion at the start of the year, according to a Binance Research study report shown Cointelegraph.

Tokenized personal credit led the RWA market boom, representing about 58% of the marketplace share, followed by tokenized United States Treasury financial obligation, which represented 34%.

” As regulative structures end up being clearer, the sector is poised for ongoing development and increased involvement from significant market gamers,” the report stated.

RWAs have no devoted regulative structure and are thought about securities by the United States Securities and Exchange Commission (SEC). Nevertheless, the sector still gains from regulative advancements in the more comprehensive crypto area.

Continue reading

BitoPro validates $11.5 million make use of, states withdrawals untouched

Taiwan-based cryptocurrency exchange BitoPro verified a security breach that caused the loss of more than $11.5 million in digital properties from its hot wallets on Might 8.

The suspicious deals, which took place throughout hot wallets on Ethereum, Tron, Solana and Polygon, saw possession outflows to decentralized exchanges (DEXs) where they were later on marked as offered, according to onchain detective ZachXBT.

Regardless of the event, BitoPro did not divulge the make use of on X or Telegram for a number of weeks, ZachXBT stated in a June 2 post on X.

Blockchain information revealed properties were transferred into cryptocurrency mixer Twister Money or bridged to Bitcoin by means of THORChain, patterns frequently used by hackers to make funds confidential and untraceable.

On Might 9, BitoPro revealed an upkeep duration for the exchange, which was fixed on the exact same day. Nevertheless, lots of users have actually considering that reported being not able to withdraw USDt (USDT).

3 weeks after the event, BitoPro verified it had actually suffered a wallet make use of. In a June 2 Telegram post, the exchange stated the breach took place throughout a wallet system upgrade, when an enemy made use of an “old hot wallet” throughout internal fund reallocation.

Continue reading

DeFi market summary

According to information from Cointelegraph Markets Pro and TradingView, the majority of the 100 biggest cryptocurrencies by market capitalization ended the week in the red.

The DeXe (DEXE) token tipped over 30%, staging the most significant decrease in the leading 100, followed by the Virtuals Procedure (VIRTUAL) token, down 24% on the weekly chart.

Thanks for reading our summary of this week’s most impactful DeFi advancements. Join us next Friday for more stories, insights and education concerning this dynamically advancing area.