Bitcoin requires to close above the essential $81,000 weekly level to prevent more drawback volatility ahead of next week’s Federal Free market Committee (FOMC) conference, which will use financiers more hints on the Federal Reserve’s financial policy for 2025.

Bitcoin (BTC) cost tipped over 3% throughout the previous week, to trade above $83,748 since 9:33 a.m. in UTC, Cointelegraph Markets Pro information programs.

Bitcoin cost continues to run the risk of considerable drawback volatility due to growing macroeconomic unpredictability around international trade tariffs, according to Ryan Lee, primary expert at Bitget Research study.

BTC/USD, 1-year chart. Source: Cointelegraph

Closing the week above $81,000 will be essential to prevent more Bitcoin drawback, the expert informed Cointelegraph, including:

” The essential level to expect the weekly close is $81,000 variety, holding above that would signify durability, however if we see a drop listed below $76,000, it might welcome more short-term selling pressure.”

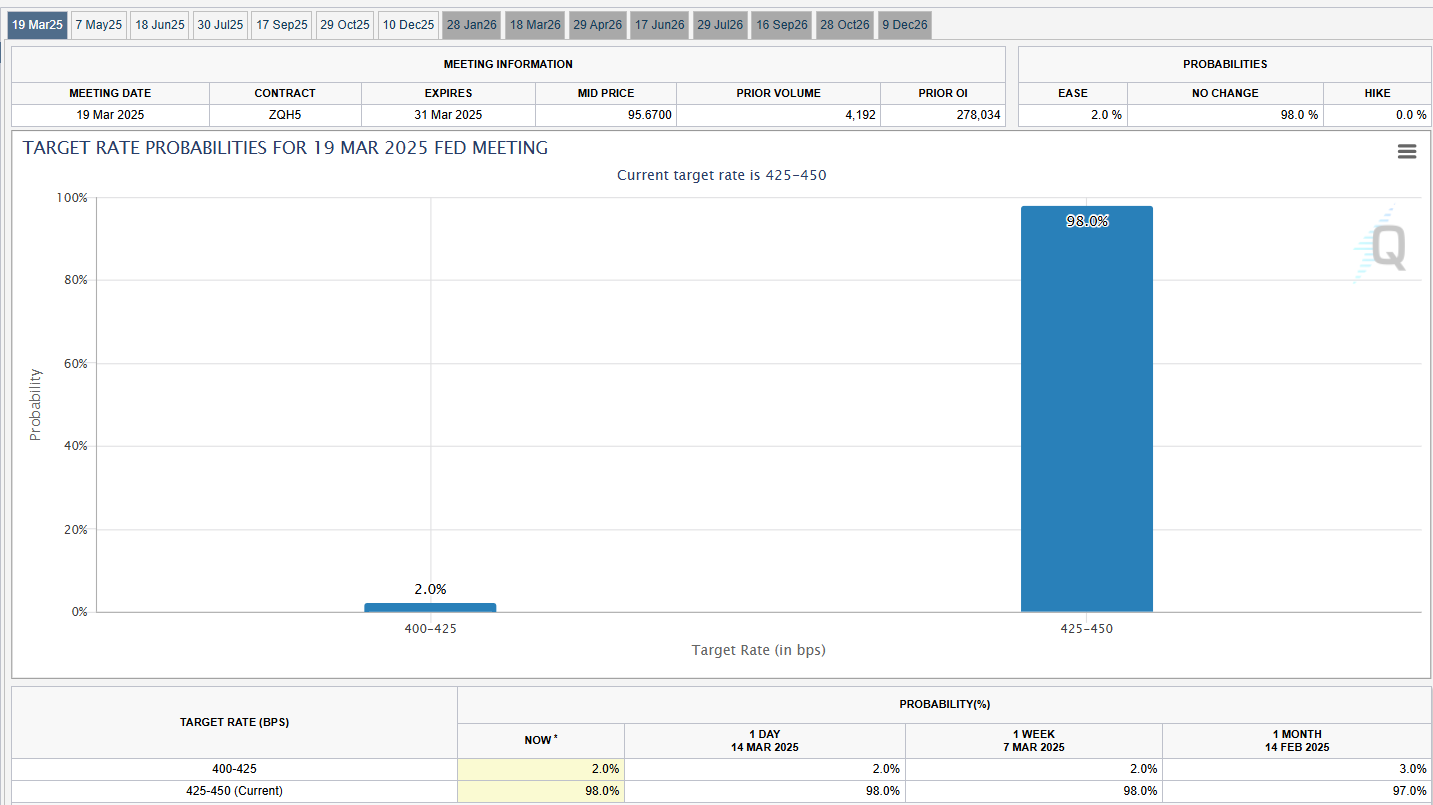

The expert’s remarks come days ahead of the next FOMC conference arranged for March 19. Markets are presently pricing in a 98% possibility that the Fed will keep rates of interest constant, according to the current price quotes of the CME Group’s FedWatch tool.

Source: CME Group’s FedWatch tool

The result of the conference might considerably affect Bitcoin financier belief, stated Lee, including:

” The marketplace mostly anticipates the Fed to hold rates constant, however any unforeseen hawkish signals might put pressure on Bitcoin and other threat properties.”

” Even a dovish surprise, like a rate cut, may not be the instant increase some are expecting, as financiers are still weighing macro unpredictabilities,” included the expert.

Related: United States Rep. Byron Donalds to present costs codifying Trump’s Bitcoin reserve

Bitcoin close above $85k might reignite financier optimism for more benefit: expert

Other experts are seeing a silver lining in Bitcoin’s stagnant cost action.

A weekly close above $85,000 might motivate more financier self-confidence and cause the next breakout, according to Enmanuel Cardozo, market expert at Brickken real-world property tokenization platform.

The marketplace expert informed Cointelegraph:

” Traders and financiers alike are keeping a close eye on the $80,000 assistance and the $85,000–$ 90,000 resistance, with a break above the latter possibly triggering a strong upward motion.”

While Bitcoin’s short-term momentum might be restricted by the upcoming financial releases, the regulative advancements around Trump’s Bitcoin reserve strategy might slowly bring more market optimism and mass adoption, included the expert.

Related: Bitcoin’s next driver: End of $36T United States financial obligation ceiling suspension

Trump’s Bitcoin reserve came one action more detailed to fulfillment on March 14, after United States Agent Byron Donalds presented an expense that looks for to guarantee the Bitcoin reserve ends up being a long-term component, avoiding future administrations from dismantling it through executive action.

If the costs is passed, it would guarantee that the Strategic Bitcoin Reserve and the United States Digital Property Stockpile might not be removed through executive actions by a future administration.

The costs will need a minimum of 60 votes in the Senate and a Home bulk to pass. With Republicans holding a Senate bulk– and amidst an usually more crypto-friendly environment– the costs has an opportunity of passing.

Publication: SCB suggestions $500K BTC, SEC hold-ups Ether ETF alternatives, and more: Hodler’s Digest, Feb. 23– March 1