Cryptocurrency markets continued their decrease for a 4th successive week today, raising issues over the status of the booming market cycle.

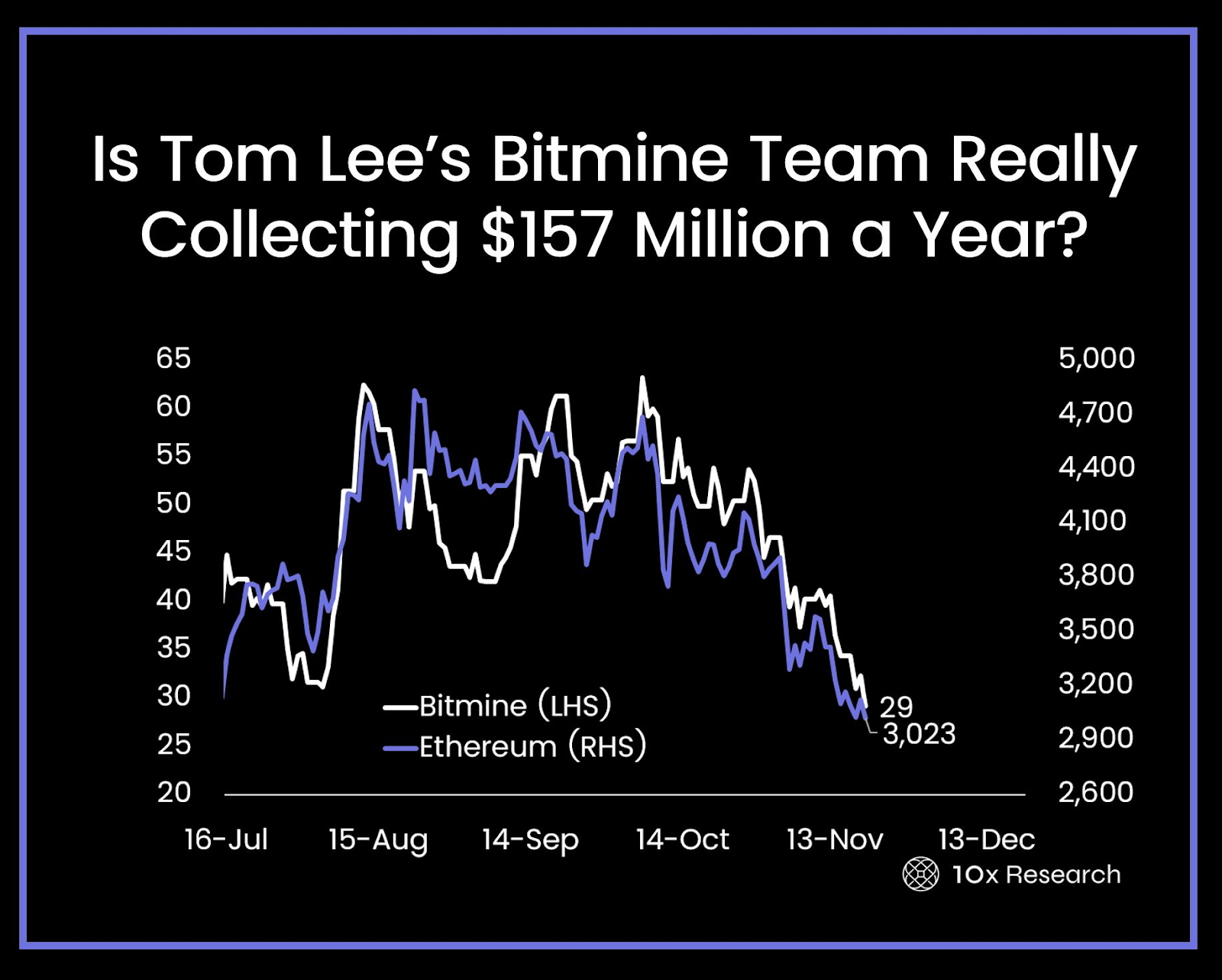

Financier issues grew on Thursday after a 10X Research study report exposed that BitMine Immersion Technologies, the world’s biggest business Ether (ETH) holder, is resting on a cumulative latent loss of $3.7 billion on its overall holdings.

Many digital property treasuries (DATs) have actually suffered decreases in their net property worth (NAV), making it challenging to raise funds for brand-new financial investments or to draw in brand-new retail financiers, leaving existing investors “caught” with growing paper losses, according to 10x Research study creator Markus Thiele

DATs are likewise dealing with considerable pressure from the MSCI stock exchange index, which is thinking about omitting business crypto treasuries with a balance sheet consisting of more than 50% of crypto properties.

The assessment is open up until Dec. 31, with the outcomes set to be revealed on Jan. 15, 2026. The resulting modifications will work in February.

Somewhere Else, Bitcoin (BTC) sank to a six-month low of $82,000 on Friday, a level last seen in April when the marketplaces were recuperating from United States President Donald Trump’s Freedom Day tariff statement, TradingView information programs.

BitMine rests on $3.7 billion loss as DAT “Hotel California” satisfies BlackRock’s staked ETH ETF

Issues are installing over the sustainability of business crypto-treasury companies as BlackRock progresses with a staked Ether fund that experts state might contend straight with existing digital-asset treasuries.

BitMine Immersion Technologies, the world’s biggest business Ether holder, is presently down $1,000 per bought ETH, indicating a cumulative latent loss of $3.7 billion on its overall holdings, according to a Thursday research study report from crypto insights business 10x Research study.

The decrease in net property worth (NAV) throughout these companies is making it challenging to draw in brand-new retail financiers while leaving lots of existing investors successfully “caught” unless they cost a high loss, 10x Research study creator Markus Thielen composed in a LinkedIn post.

” When the premium undoubtedly diminishes to no, as it is doing now, financiers discover themselves caught in the structure, not able to go out without considerable damage, a real Hotel California circumstance,” he stated. He included that, unlike exchange-traded funds (ETFs), digital-asset treasury business, or DATs, “layer on complex, nontransparent, and frequently hedge-fund-like cost structures that can silently wear down returns.”

The mNAV ratio compares a business’s business worth to the worth of its crypto holdings. An mNAV above 1 enables a business to raise funds by releasing brand-new shares to build up digital properties. Worths listed below 1 make it much more difficult to broaden capital and holdings.

BitMine’s standard mNAV stood at 0.77 while its diluted mNAV stood at 0.92, according to information from Bitminetracker.

Continue reading

SEC to hold personal privacy and monetary monitoring roundtable in December

The United States Securities and Exchange Commission’s Crypto Job Force has actually arranged a roundtable conversation fixated personal privacy and monetary monitoring for December, as a restored concentrate on personal privacy grips the cryptocurrency market.

The personal privacy roundtable is slated for Dec. 15. Like other SEC roundtables, crypto market executives and SEC authorities will talk about typical discomfort points and options, however no difficult policy propositions will be sent.

Personal privacy has actually ended up being a hot-button subject following a number of advancements, consisting of the partial guilty decision in Twister Money designer Roman Storm’s trial in June, the Samourai Wallet designer sentencing in November and the personal privacy token rate rally over the last 2 months.

” Authoritarians flourish when individuals have no personal privacy. When those in charge start being hostile to personal privacy securities, it is a significant warning,” stated Naomi Brockwell, creator of the Ludlow Institute, a company promoting for liberty through innovation.

The restored interest in personal privacy hearkens back to crypto’s cypherpunk roots, and among the core reasons the cryptographic innovation that underpins crypto was created– to make sure safe and secure interaction channels in between celebrations in hostile environments.

Continue reading

Coinbase releases ETH-backed loans as onchain loaning tops $1.25 billion

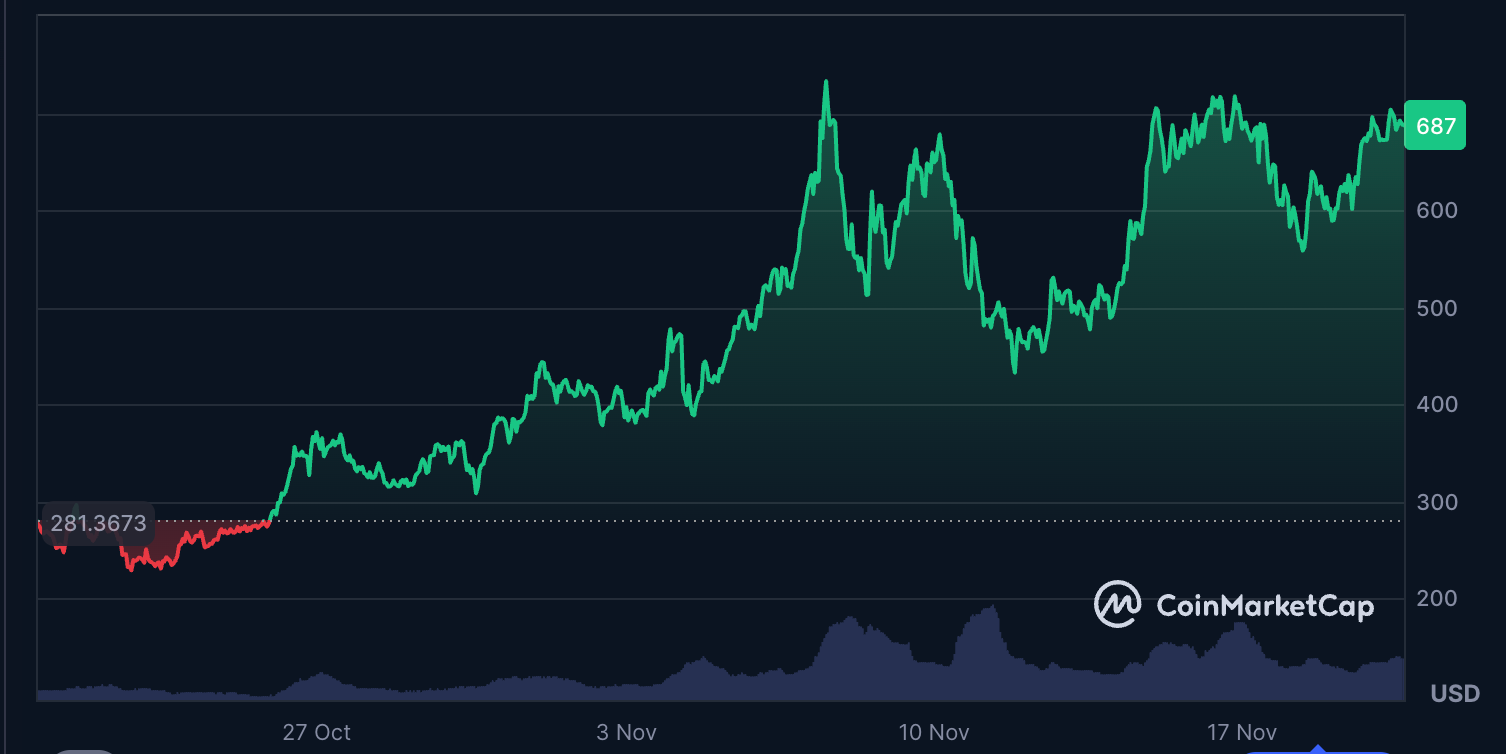

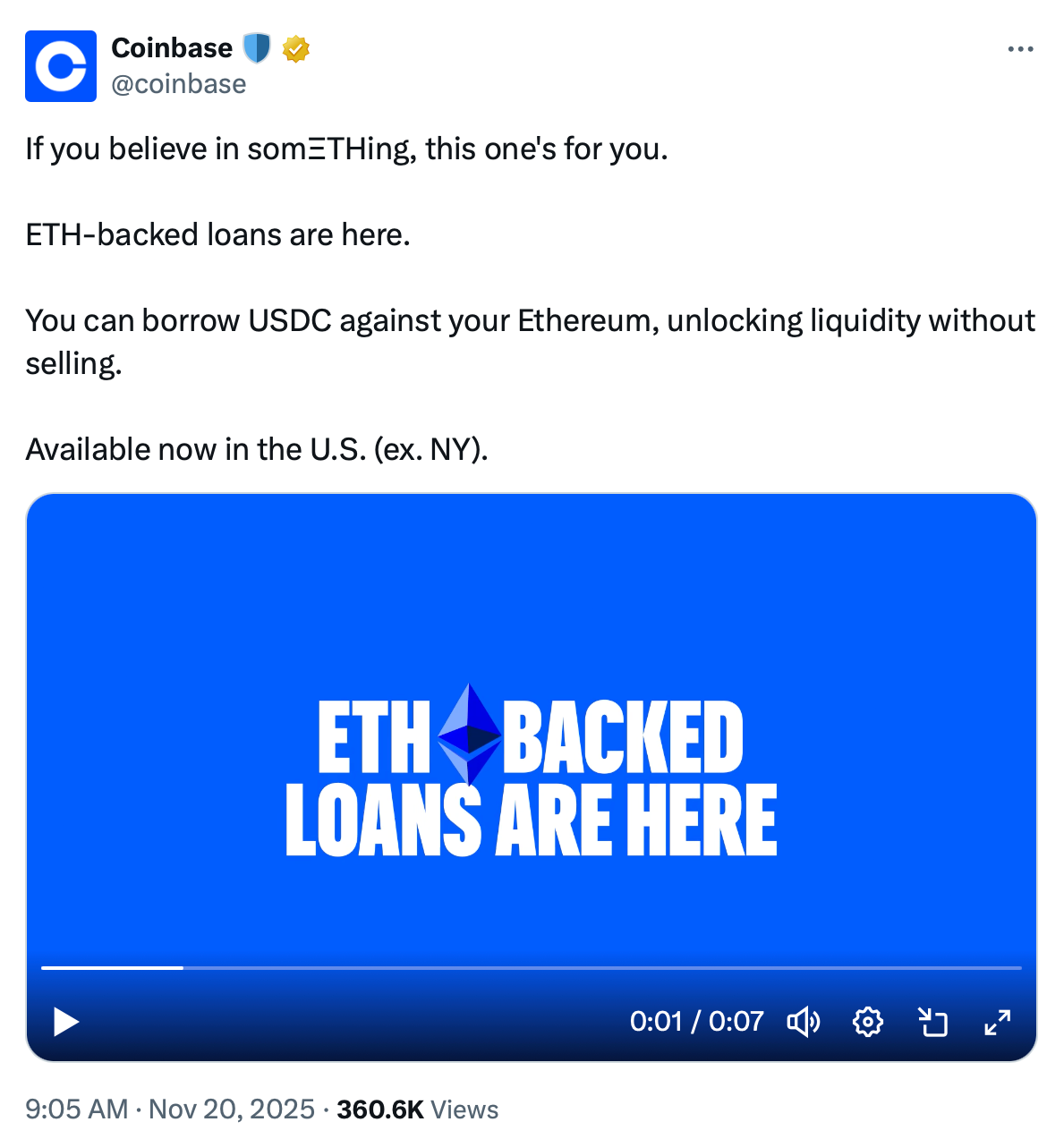

Coinbase has actually released Ether-backed loans for United States users, enabling consumers to obtain USDC versus their ETH holdings without selling, in a brand-new offering powered by Morpho and operating on Base.

The exchange stated the item is readily available throughout a lot of US states, other than New york city, with variable rates and liquidation threat connected to market conditions. Users can obtain as much as $1 million in USDC (USDC) stablecoin.

Coinbase prepares to broaden the program to other properties, consisting of loans backed by its staked Ether token, cbETH.

The brand-new item is being released in partnership with Morpho, a decentralized financing (DeFi) loaning procedure. In September, Coinbase incorporated Morpho into the Coinbase app, providing users a yield of as much as 10.8% on their USDC holdings.

According to Dune information, Coinbase’s onchain loaning markets have actually processed more than $1.25 billion in loan originations, backed by about $1.37 billion in transferred security. Approximately $810 million in loans is exceptional, with more than 13,500 wallets holding active obtain positions.

Continue reading

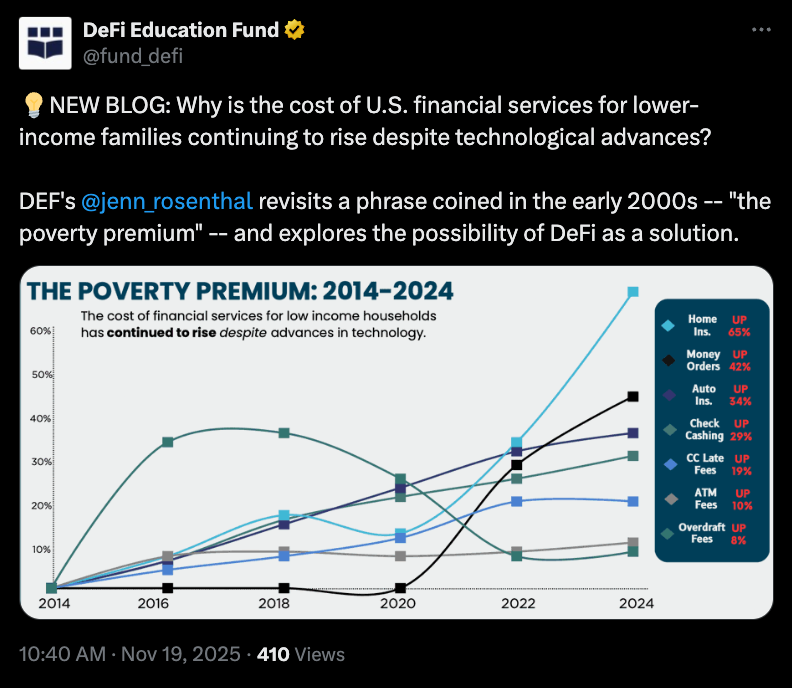

Advocacy group proposes DeFi options to resolve international hardship

The DeFi Education Fund, an advocacy company concentrated on decentralized financing, has actually proposed making use of the innovation to decrease expenses, intending to resolve hardship in the United States and worldwide.

In a Wednesday post, the group stated DeFi facilities might possibly conserve unbanked and underbanked individuals worldwide about $30 billion yearly by minimizing remittance expenses. The company pointed out examples of employees sending out funds home and paying costs to do so, which might be lowered “by as much as 80%” with DeFi.

” The hardship premium [the expenses incurred by low-income households that wealthier individuals are often able to access at a lower cost] continues due to the fact that the existing, layered, old monetary facilities makes it pricey to serve low-income consumers successfully,” stated the DeFi Education Fund, including:

” Absolutely nothing is totally free, and DeFi does not get rid of expenses completely, however by eliminating intermediaries and leveraging software application instead of out-of-date monetary systems, we can significantly decrease the expense of monetary services for daily individuals and provide higher control of their financial resources.”

Numerous supporters have actually proposed making use of numerous applications of blockchain innovation to resolve elements that add to hardship, such as minimizing deal times, removing or minimizing costs, and increasing access to monetary services. The DeFi Education Fund pointed out the increasing expenses in the United States connected with cashing incomes without a savings account, utilizing cash orders and owning a home.

Continue reading

Mastercard taps Polygon to turn cumbersome crypto addresses into basic usernames

Mastercard is broadening its Crypto Credential program to self-custody wallets, enabling users to send out and get cryptocurrencies utilizing confirmed, username-style aliases rather of long wallet addresses.

Polygon will be the very first blockchain to support the rollout, while payments firm Mercuryo will manage identity confirmation and release the aliases to users, according to a Tuesday news release shown Cointelegraph.

” By improving wallet addresses and including significant confirmation, Mastercard Crypto Credential is developing rely on digital token transfers,” stated Raj Dhamodharan, executive vice president of blockchain and digital properties at Mastercard.

When confirmed by Mercuryo, users can connect a human-readable alias to their self-custody wallet or demand a soulbound token on Polygon that shows the wallet comes from a confirmed person.

Continue reading

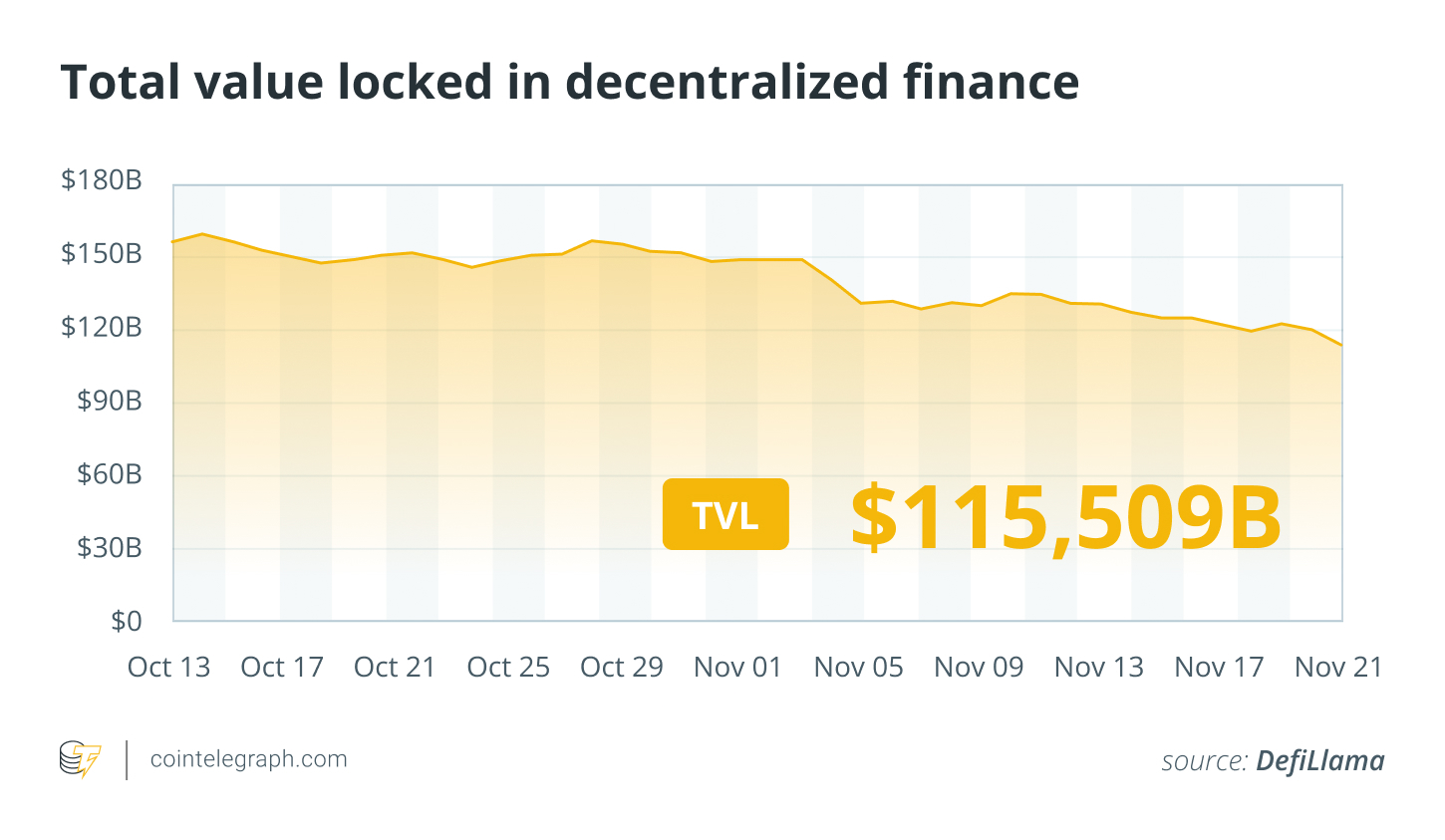

DeFi market introduction

According to information from Cointelegraph Markets Pro and TradingView, the majority of the 100 biggest cryptocurrencies by market capitalization ended the week in the red.

The privacy-centric Canton network’s (CC) token fell 32% marking the week’s most significant decrease, followed by the Story (IP) token, down 29% throughout the previous week.

Thanks for reading our summary of this week’s most impactful DeFi advancements. Join us next Friday for more stories, insights and education concerning this dynamically advancing area.