Bitcoin cost is poised to strike $110,000 before retesting the $76,500 variety, according to Arthur Hayes, indicating relieving inflationary issues and more beneficial financial policy conditions in the United States that are set to strengthen danger properties, consisting of the world’s very first cryptocurrency.

Still, the decentralized financing (DeFi) market took another struck after an unidentified whale made use of Hyperliquid’s algorithms to produce over $6 million in revenue on a memecoin brief position.

Bitcoin “most likely” to strike $110,000 before $76,500– Arthur Hayes

Bitcoin might reach a brand-new all-time high of $110,000 before any considerable retracement, according to some market experts who mention relieving inflation and increasing international liquidity as crucial aspects supporting a rate rally.

Bitcoin (BTC) has actually increased for 2 successive weeks, accomplishing a bullish weekly close simply above $86,000 on March 23, TradingView information programs.

Integrated with fading inflation-related issues, this might set the phase for Bitcoin’s rally to a $110,000 all-time high, according to Arthur Hayes, co-founder of BitMEX and primary financial investment officer of Maelstrom.

BTC/USD, 1-week chart. Source: Cointelegraph/ TradingView

Hayes composed in a March 24 X post:

” I wager $BTC strikes $110k before it retests $76.5 k. Y? The Fed is going from QT to QE for treasuries. And tariffs do not matter reason for “temporal inflation.” JAYPOW informed me so.”

Source: Arthur Hayes

” What I imply is that the cost is most likely to strike $110k than $76.5 k next. If we struck $110k, then it’s yachtzee time and we ain’t recalling till $250k,” Hayes included a follow-up X post.

Quantitative tightening up (QT) is when the United States Federal Reserve diminishes its balance sheet by offering bonds or letting them grow without reinvesting profits, while quantitative easing (QE) implies that the Fed is purchasing bonds and pumping cash into the economy to lower rate of interest and motivate costs throughout tough monetary conditions.

Other experts explained that while the Fed has actually slowed QT, it has not yet totally rotated to relieving.

” QT is not ‘essentially over’ on April 1st. They still have $35B/mo coming off from home mortgage backed securities. They simply slowed QT from $60B/mo to $40B/mo,” according to Benjamin Cowen, creator and CEO of IntoTheCryptoVerse.

Continue reading

Hyperliquid whale still holds 10% of JELLY memecoin after $6.2 million make use of

A crypto whale who presumably controlled the cost of the Jelly my Jelly (JELLY) memecoin on decentralized exchange Hyperliquid still holds almost $2 million worth of the token, according to blockchain experts.

The unknown whale made a minimum of $6.26 million in revenue by making use of the liquidation specifications on Hyperliquid.

According to a postmortem report by blockchain intelligence company Arkham, the whale opened 3 big trading positions within 5 minutes: 2 long positions worth $2.15 million and $1.9 million and a $4.1 million brief position that efficiently balanced out the longs.

Source: Arkham

When the cost of JELLY increased by 400%, the $4 million brief position wasn’t right away liquidated due to its size. Rather, it was taken in into the Hyperliquidity Service Provider Vault (HLP), which is created to liquidate big positions.

The entity might still be holding almost $2 million worth of the token’s supply, according to blockchain detective ZachXBT.

” 5 addresses connected to the entity who controlled JELLY on Hyperliquid still hold ~ 10% of the JELLY supply on Solana ($ 1.9 M+). All JELLY was acquired because March 22, 2025,” he composed in a March 26 Telegram post.

Continue reading

Fidelity strategies stablecoin launch after SOL ETF “regulative base test”

Fidelity Investments is apparently in the lasts of evaluating a United States dollar-pegged stablecoin, indicating the company’s newest push into digital properties amidst a more beneficial crypto regulative environment under the Trump administration.

The $5.8 trillion property supervisor prepares to introduce the stablecoin through its cryptocurrency department, Fidelity Digital Assets, according to a March 25 report by the Financial Times mentioning confidential sources knowledgeable about the matter.

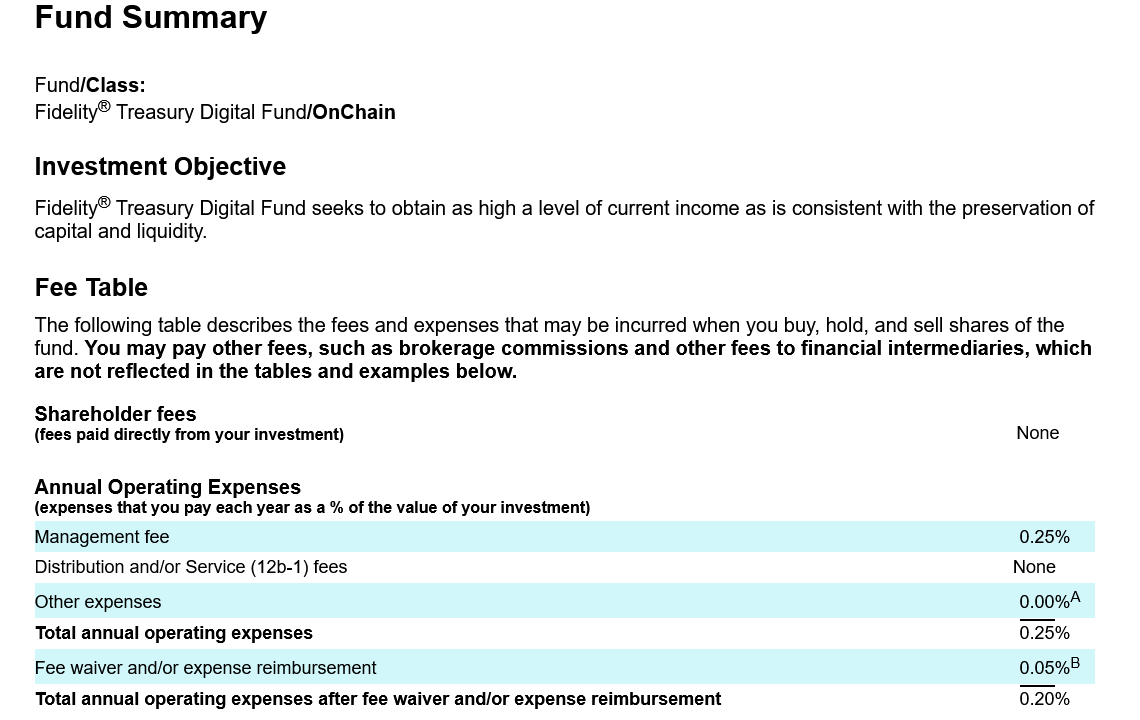

The stablecoin advancement is apparently part of the property supervisor’s larger push into crypto-based services. Fidelity is likewise introducing an Ethereum-based “OnChain” share class for its United States dollar cash market fund.

Fidelity’s March 21 filing with the United States securities regulator mentioned the OnChain share class would assist track deals of the Fidelity Treasury Digital Fund (FYHXX), an $80 million fund consisting nearly totally of United States Treasury expenses.

While the OnChain share class filing is pending regulative approval, it is anticipated to work on Might 30, Fidelity stated.

Fidelity’s filing to sign up a tokenized variation of the Fidelity Treasury Digital Fund. Source: Securities and Exchange Commission

Progressively more United States banks are introducing cryptocurrency-based offerings after President Donald Trump’s election indicated a shift in policy.

Continue reading

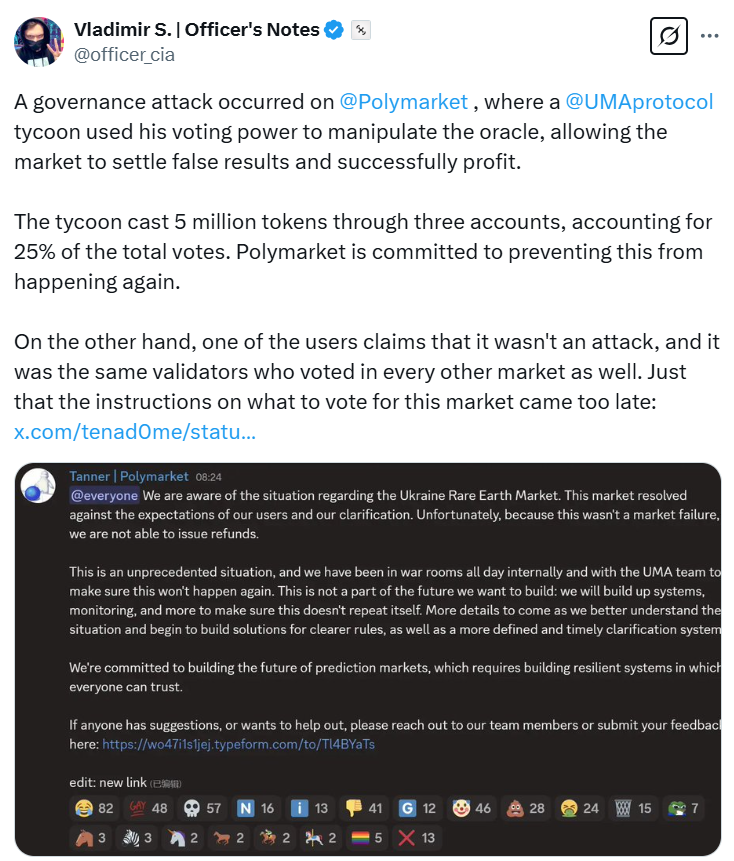

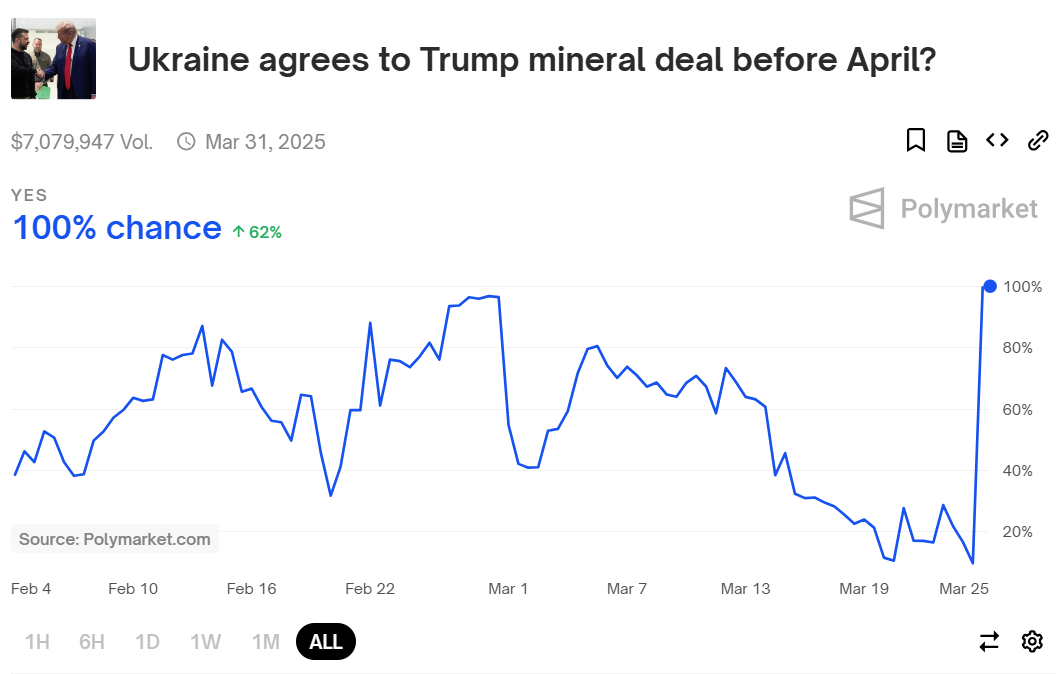

Polymarket deals with examination over $7 million Ukraine mineral offer bet

Polymarket, the world’s biggest decentralized forecast market, is under fire after a questionable result raised issues over prospective governance adjustment in a high-stakes political bet.

A wagering market on the platform asked whether United States President Donald Trump would accept an unusual earth mineral handle Ukraine before April. Regardless of no such occasion happening, the marketplace was settled as “Yes,” activating a reaction from users and market observers.

This might indicate a “governance attack” in which a whale from the UMA Procedure “utilized his ballot power to control the oracle, enabling the marketplace to settle incorrect outcomes and effectively revenue,” according to crypto hazard scientist Vladimir S.

” The magnate cast 5 million tokens through 3 accounts, representing 25% of the overall votes. Polymarket is dedicated to avoiding this from taking place once again,” he composed in a March 26 X post.

Source: Vladimir S.

Polymarket uses UMA Procedure’s blockchain oracles for external information to settle market results and validate real-world occasions.

Polymarket information reveals the marketplace collected more than $7 million in trading volume before choosing March 25.

Ukraine/US mineral offer wagering swimming pool on Polymarket. Source: Polymarket

Still, not everybody concurs that it was a collaborated attack. A pseudonymous Polymarket user, Tenadome, stated that the result was the outcome of carelessness.

Continue reading

DWF Labs releases $250 million fund for mainstream crypto adoption

Dubai-based crypto market maker and financier DWF Labs released a $250 million Liquid Fund to speed up the development of mid- and large-cap blockchain jobs and drive real-world adoption of Web3 innovations.

DWF Labs is set to sign 2 financial investment offers worth $25 million and $10 million as part of the fund.

The effort intends to grow the crypto landscape by using tactical financial investments varying from $10 million to $50 million for jobs that have the prospective to drive real-world adoption, according to a March 24 statement shown Cointelegraph.

Source: DWF Labs

The fund will concentrate on blockchain jobs with considerable “use and discoverability,” according to Andrei Grachev, handling partner of DWF Labs.

” We’re focusing our assistance on mid-to-large-cap jobs, the tokens and platforms that generally act as entry points for retail users,” Grachev informed Cointelegraph, including:

” Nevertheless, excellent innovation and energy alone isn’t enough. Users initially require to find these jobs, understand their worth and establish trust.”

” Our company believe that tactical capital, combined with hands-on community advancement, is the crucial to opening the next wave of development for the market,” he stated.

Continue reading

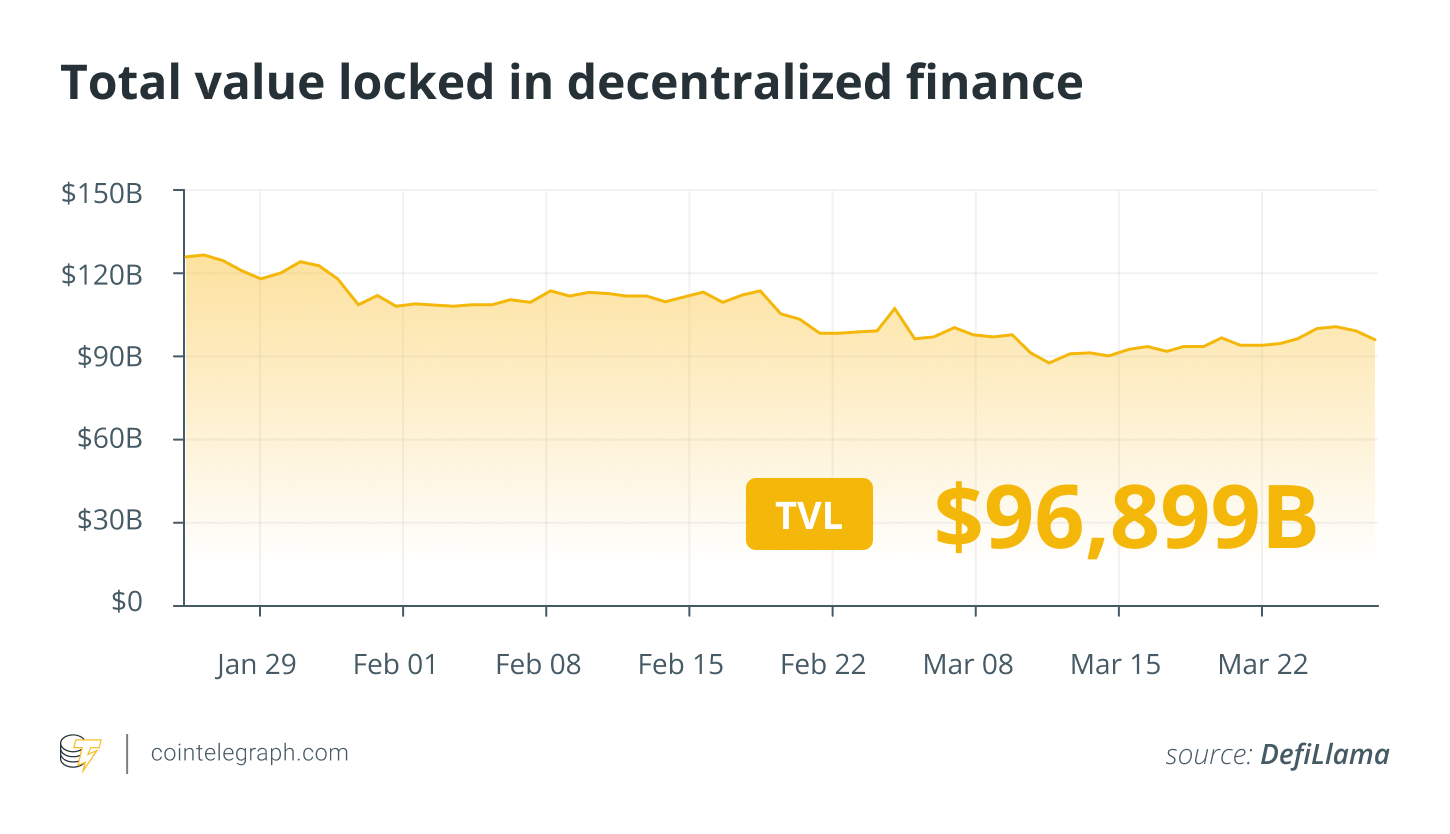

DeFi market summary

According to information from Cointelegraph Markets Pro and TradingView, the majority of the 100 biggest cryptocurrencies by market capitalization ended the week in the green.

Of the leading 100, the BNB Chain-native 4 (KIND) token increased over 40% as the week’s greatest gainer, followed by the Cronos (CRO) token, up over 37% on the weekly chart, regardless of blockchain private investigators implicating Crypto.com of controling the CRO token supply, after reissuing 70 billion tokens that were “completely” burned in 2021.

Overall worth secured DeFi. Source: DefiLlama

Thanks for reading our summary of this week’s most impactful DeFi advancements. Join us next Friday for more stories, insights and education concerning this dynamically advancing area.