Secret takeaways

-

A misconception of cost systems caused an unintentional overpayment worth more than $60,000 throughout a replace-by-fee deal.

-

The user puzzled sat/vB (cost per byte) with overall satoshis, resulting in a severe overpayment.

-

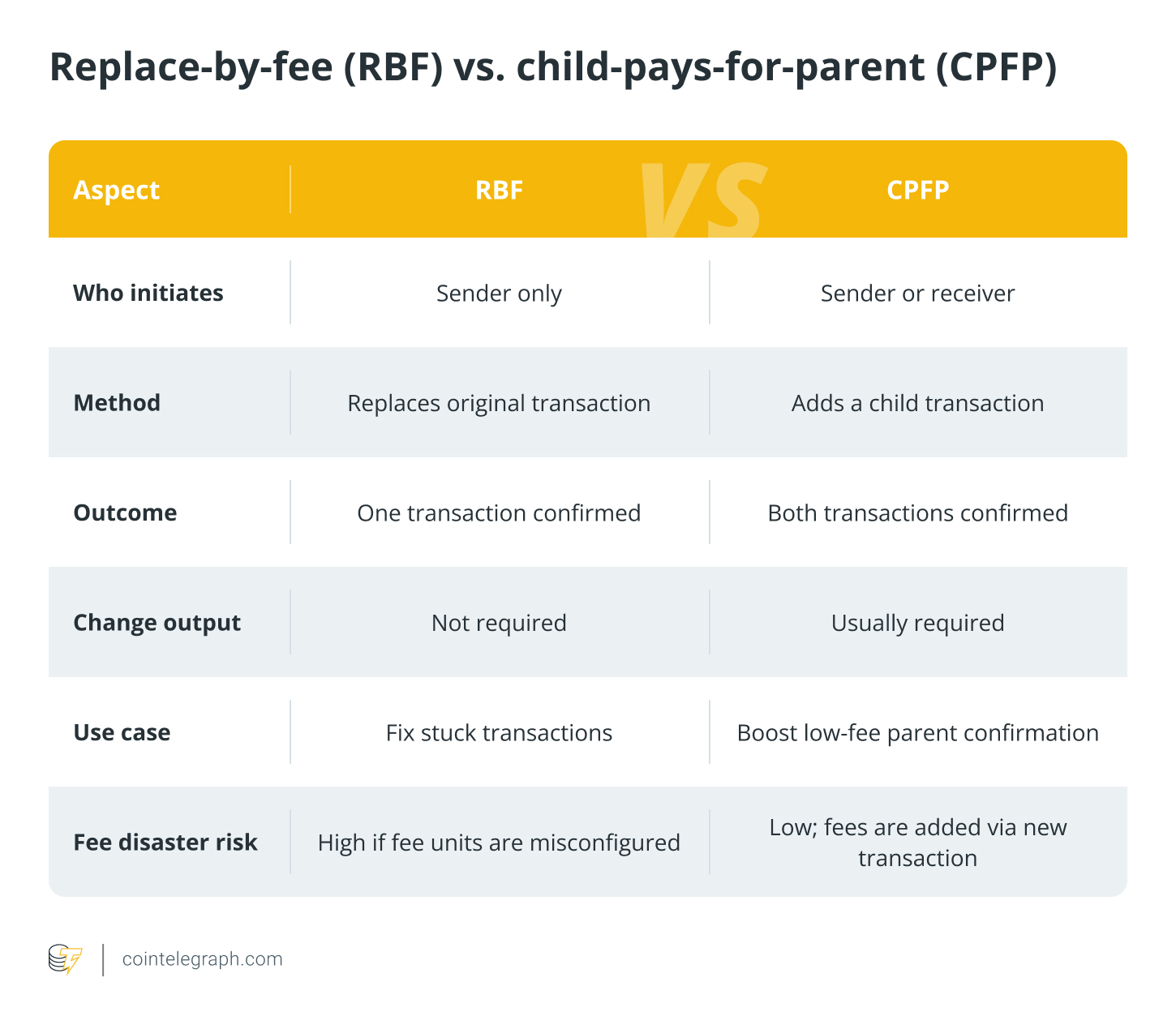

RBF changes a deal with a higher-fee variation, while CPFP includes a brand-new deal to improve the initial; each has various usage cases and dangers.

-

Usage relied on wallets, double-check cost systems, and let the wallet recommend optimum charges. Prevent panic, remain upgraded and constantly validate deals previously striking “send out.”

Around 00:30 UTC on April 8, 2025, a Bitcoin user tried to speed up a pending deal utilizing replace‑by‑fee (RBF). However rather of a modest bump, their wallet erroneously invested 0.75 Bitcoin (BTC), approximately $60,000–$ 70,000, simply on charges.

How does something like this take place? And more significantly, how can you guarantee it does not take place to you?

Let’s simplify.

Why did a Bitcoin user wind up paying $60,000 in charges?

The user wished to send out 0.48 BTC (around $37,770 at that time) utilizing Bitcoin’s RBF function. This function lets you resend a deal with a greater cost if the initial one is stuck in the mempool (the waiting location for unofficial deals). In this case, things failed, extremely incorrect.

The Timeline:

-

Very first deal: Sent out with a basic cost, low enough to verify rapidly.

-

Very first RBF effort: Doubled the cost and altered the recipient (output) address.

-

2nd RBF effort: Included a big unspent deal output (UTXO), about 0.75 BTC, however forgot to reroute the modification back to their own address.

The outcome? That 0.75 BTC was dealt with as a cost and sent out to miners.

Anmol Jain, vice president of examinations at crypto forensics firm AMLBot, informed Cointelegraph that the user most likely begun with a “default or conservative” deal cost, which is absolutely nothing uncommon. Then came the error: puzzling how the cost was being determined.

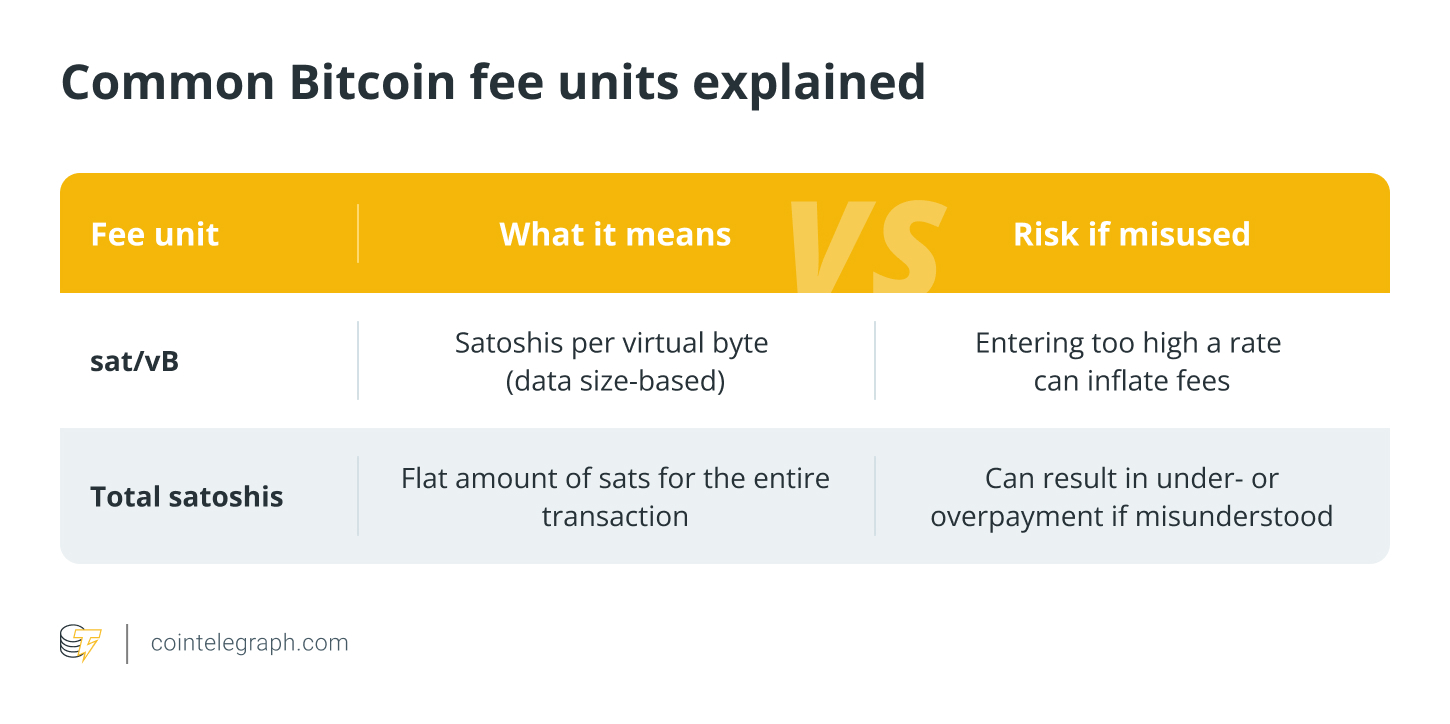

Numerous Bitcoin wallets enable you to set charges in one of 2 methods:

-

Overall cost in satoshis (the tiniest Bitcoin system, like cents to a dollar)

-

Cost per virtual byte (sat/vB), which determines how “heavy” the deal remains in information terms

Here’s where things failed, according to Jain:

” System reads it as 30 sats overall cost, which is method too low, so user types 305000 believing it implies 30.5 sat/vB, and the wallet really uses 305,000 sats/vB, which is outrageous.”

In basic terms, the user might have seen a caution that their cost, simply 30 sats overall, was too low for the deal to be processed rapidly. So, attempting to repair it, they may have enter 305,000, believing it indicated “30.5 sats per byte.”

However rather of changing the cost reasonably, the wallet took that as 305,000 sats per byte, a monstrous cost that blew past any standard and led to a loss of more than $60,000.

Why it matters

This highlights how small confusion in between cost systems can result in significant losses, particularly when by hand getting in numbers rapidly or utilizing innovative wallet settings without completely comprehending them.

So if you ever change Bitcoin charges, verify the system you’re setting. Whether it’s “overall sats” or “sats per byte” makes a world of distinction, as this pricey error shows.

Did you understand? In September 2023, a user paid a $500,000 cost for a single BTC deal. It ended up being a mistake by Paxos, a crypto facilities business.

Replace-by-fee (RBF): What Is It?

Bitcoin deals aren’t last till they’re contributed to a block. If a deal is stuck, you can utilize RBF to resend it with a greater cost to motivate miners to select it up much faster.

It was initially proposed by Bitcoin’s developer, Satoshi Nakamoto, and later on formalized as “opt-in RBF” by designer Peter Todd, according to the BitGo Designer Website.

How it works:

-

You make it possible for RBF when sending out the initial deal.

-

If the deal stays unofficial, you can produce a replacement with a greater cost.

-

Miners will likely pick the higher-fee variation since they’re economically incentivized to do so.

However here’s the catch: if you screw up the inputs or outputs, particularly the modification address, it can cost you a lot.

Especially, RBF varies from child-pays-for-parent (CPFP) because RBF changes the initial unofficial deal with a higher-fee variation, and just the sender can start it. On the other hand, CPFP includes a high-fee kid deal to improve the moms and dad’s verification, and can be started by either the sender or the receiver.

Why did the Bitcoin deal cost spike so high?

There are a couple of theories behind what triggered the ridiculous cost in this case:

-

Confusion over cost systems: The cost surged likely due to a misconception of cost systems. Rather of setting an affordable rate per byte, the user might have unintentionally gotten in a big outright worth, triggering the wallet to use an exceedingly high cost.

-

Automation failed: If the wallet utilizes automated scripts or has bugs in how it processes RBF, a user’s input can be misread or, even worse, carried out without appropriate cautions.

Why RBF is questionable

The RBF function has actually stimulated years of argument within the crypto neighborhood. While it works for repairing stuck deals, critics like Mike Hearn (previous Bitcoin designer) argued on Medium that it:

-

Makes it possible for double-spending attacks, particularly for in-person merchant deals.

-

Motivates miner-fraudster collusion.

-

Includes intricacy, making user mistakes most likely.

-

Weakens finality, as unofficial deals can be changed.

To resolve this problem, Bitcoin Money (BCH), for instance, got rid of RBF assistance and states that unofficial deals are last. Nevertheless, due to how mempools work, comparable RBF-like replacements can still take place, even on BCH.

Did you understand? In November 2023, a 139 BTC deal (worth millions) consisted of a $3.1 million cost.

How to secure yourself from high Bitcoin deal charges

You do not require to fear RBF, however you do require to appreciate it. Here are some pointers to prevent ending up being the next viral cost stop working:

-

Select a safe Bitcoin wallet with transparent cost choices: Select respectable Bitcoin wallets that plainly show and describe cost types.

-

Understand Bitcoin cost systems before sending out: Find out the distinction in between sat/vB (satoshis per virtual byte) and overall satoshis to prevent unexpected overpayments.

-

Constantly verify your deal before verifying: Confirm the recipient address, cost quantity and the modification address to make sure no funds are erroneously utilized as miner charges.

-

Let the wallet recommend the cost, particularly if you’re brand-new: A lot of wallets provide vibrant cost suggestions based upon network blockage, so utilize them rather of by hand getting in worths.

-

Test with a little Bitcoin deal initially: Send out a low-value test deal to verify whatever is set properly before sending out a considerable quantity.

-

Screen Bitcoin network charges in genuine time: Usage sites like mempool.space to examine present cost rates and pick the very best time to send your deal.

-

Avoid panicking over sluggish verifications: Bitcoin deals can require time. Wait before resending or changing deals unless you make sure it’s essential.

-

Stay notified about wallet updates and bugs: Follow your wallet supplier for updates, as software application bugs or user interface modifications can affect how charges are determined or shown.

If you avoid the above preventative measures, you might pay hundreds or perhaps countless dollars in unneeded charges, without any method to recuperate the loss. When it pertains to Bitcoin, one little error can end up being a pricey lesson.

This post does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.