Property management giant BlackRock is making its very first official relocation into decentralized financing by bringing its tokenized United States Treasury fund to Uniswap, marking a turning point minute for institutional adoption of DeFi.

According to a Wednesday statement, BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) will be noted on the Uniswap decentralized exchange, enabling institutional financiers to purchase and offer the tokenized security.

As part of the plan, BlackRock is likewise buying a concealed quantity of Uniswap’s native governance token, UNI, the statement stated.

The cooperation is being assisted in by tokenization business Securitize, which partnered with the world’s greatest property supervisor on the launch of BUIDL.

According to Fortune, trading will at first be restricted to a choose group of qualified institutional financiers and market makers before broadening more broadly.

” For the very first time, organizations and whitelisted financiers can access innovation from a leader in the decentralized financing area to trade tokenized real-world properties like BUIDL with self-custody,” stated Securitize CEO Carlos Dominigo.

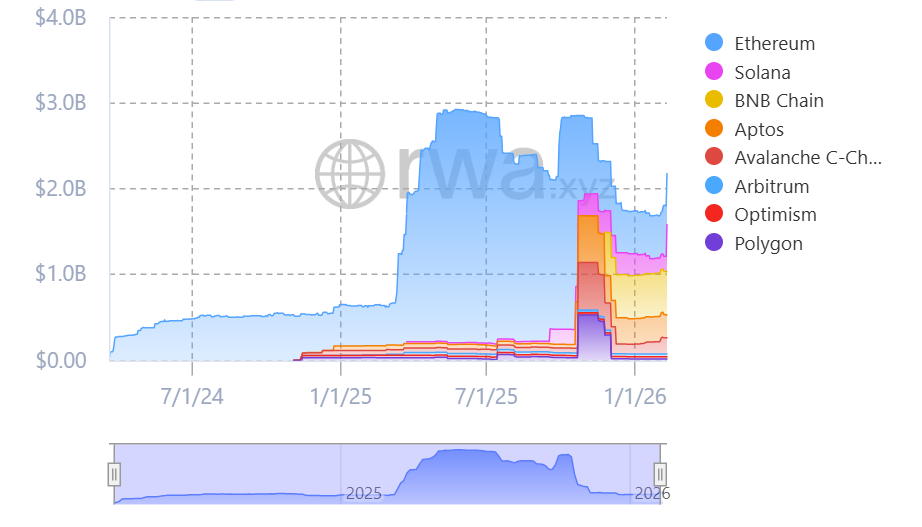

BUIDL is the greatest tokenized cash market fund, with more than $2.18 billion in overall properties, according to information put together by RWA.xyz. The fund is released throughout numerous blockchains, consisting of Ethereum, Solana, BNB Chain, Aptos and Avalanche.

In December, BUIDL reached a crucial turning point, going beyond $100 million in cumulative circulations from its Treasury holdings.

Related: Avalanche tokenization strikes Q4 high as BlackRock’s BUIDL broadens onchain

Wall Street broadens tokenized cash market push amidst stablecoin development

Tokenized cash market funds have actually acquired traction on Wall Street, with a number of significant banks signing up with BlackRock in checking out the innovation. Goldman Sachs and BNY, for instance, have actually partnered to broaden institutional access to tokenized cash market items.

JPMorgan strategists have actually likewise highlighted the property class as a possible counterweight to the fast development of stablecoins. While both depend on blockchain facilities, the GENIUS Act is commonly anticipated to speed up stablecoin adoption, possibly drawing liquidity far from conventional cash market funds.

Tokenization might assist balance out that shift by enabling financiers to publish cash market fund shares as security without compromising yield, JPMorgan strategist Teresa Ho stated in 2015.

To be sure, the GENIUS Act might likewise speed up the development of tokenized real-world properties, according to Solomon Tesfaye, primary organization officer at Aptos Labs, who formerly informed Cointelegraph that clearer stablecoin guidelines might stimulate wider onchain adoption.

Related: Crypto’s 2026 financial investment playbook: Bitcoin, stablecoin facilities, tokenized properties