The launching of the Canary Capital XRP exchange-traded fund (ETF) is indicating restored need for altcoins, after the fund published the greatest first-day efficiency of the more than 900 ETFs introduced in 2025.

Canary Capital’s XRP (XRP) ETF closed its very first day with $58 million in trading volume, marking the most effective ETF launching of 2025 amongst both crypto and conventional ETFs, stated Bloomberg ETF expert Eric Balchunas in a Thursday X post.

The brand-new fund gathered over $250 million in inflows throughout its very first trading day, going beyond the current inflows of all other crypto ETFs.

Part of the factor behind the effective launch was the ETF’s in-kind production design, according to ETF expert Nate Geraci.

” A couple of individuals asking how it’s possible to have ‘just’ $59mil trading volume, however almost $250mil inflows … The response? In-kind productions, which do not appear in trading volume,” composed Geraci in a Thursday X post.

The in-kind redemption design allows the production and redemption of ETF shares through the hidden property, rather than cash-only deal designs. In this case, Canary Capital’s ETF shares can be exchanged for XRP tokens.

The United States Securities and Exchange Commission (SEC) authorized in-kind production and redemption for cryptocurrency ETFs on July 29, Cointelegraph reported at the time.

Smart cash traders turn into XRP longs after ETF launching

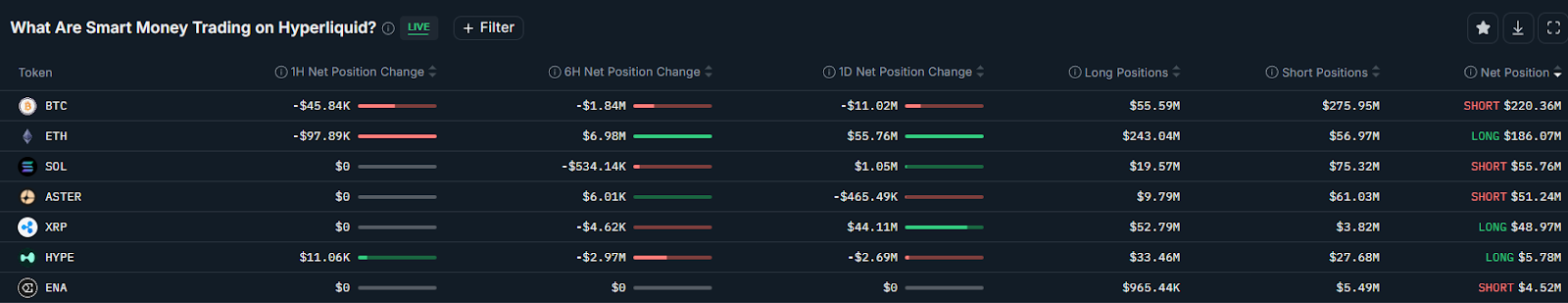

The launch of the ETF influenced a bullish rotation amongst the market’s most effective traders, as tracked by returns and identified as “clever cash” traders on the crypto intelligence platform Nansen.

Related: Circle gets in world’s biggest monetary market with onchain FX engine

Smart cash traders have actually included $44 million worth of net long XRP positions over the previous 24 hr, indicating more upside expectations for the token.

The friend was net long on the XRP token, with a cumulative $49 million, however stayed net brief on the Solana (SOL) token, with $55 million worth of cumulative brief positions on the decentralized exchange Hyperliquid.

Related: Metaplanet’s Bitcoin gains fall 39% as October crash pressures business treasuries

” XRP is holding near $2.30, revealing relative stability however still feeling the impacts of decreasing liquidity and careful financier belief,” Ryan Lee, primary expert at Bitget exchange, informed Cointelegraph.

” In the meantime, the setup appears like a healthy reset, not completion of the cycle, with both SOL and XRP well-positioned to lead the next wave as soon as self-confidence snaps back.”

Area Bitcoin ETFs saw $866 million worth of unfavorable outflows on Thursday, their second-worst day on record, after the $1.14 billion everyday outflows on Feb. 25, 2025, according to Farside Investors.

Publication: Father-son group lists Africa’s XRP Health care on Canadian stock market