A regular monthly market evaluation by openly traded US-based crypto exchange Coinbase reveals that while the crypto market has actually contracted, it seems preparing for a much better quarter.

According to Coinbase’s April 15 month-to-month outlook for institutional financiers, the altcoin market cap diminished by 41% from its December 2024 highs of $1.6 trillion to $950 billion by mid-April. BTC Tools information programs that this metric touched a low of $906.9 billion on April 9 and stood at $976.9 billion at the time of composing.

Equity capital financing to crypto jobs has actually apparently reduced by 50%– 60% from 2021– 22. In the report, Coinbase’s international head of research study, David Duong, highlighted that a brand-new crypto winter season might be upon us.

” Numerous converging signals might be indicating the start of a brand-new ‘crypto winter season’ as some severe unfavorable belief has actually embeded in due to the beginning of international tariffs and the capacity for additional escalations,” he stated.

Related: How trade wars effect stocks and crypto

Macroeconomic issues trigger crypto chaos

The report keeps in mind that lower investor interest “considerably restricts the onboarding of brand-new capital into the environment,” which is felt mostly in the altcoin sector. The reason for that, according to Duong, is the existing macroeconomic environment:

” All of these structural pressures originate from the unpredictability of the more comprehensive macro environment, where standard danger possessions have actually dealt with continual headwinds from financial tightening up and tariff policies, adding to the paralysis in financial investment choice making.”

According to Coinbase scientists, those truths have actually led to “a challenging cyclical outlook for the digital possession area,” and require continued care in the next 4 to 6 weeks. Still, the report’s author stated that the marketplace is most likely to alter instructions explosively:

” When the belief lastly resets, it’s most likely to occur rather rapidly and we stay useful for the 2nd half of 2025.”

Duong mentioned some metrics to show when the crypto market is moving in between bull and bearishness stages, consisting of risk-adjusted efficiency and the 200-day moving average.

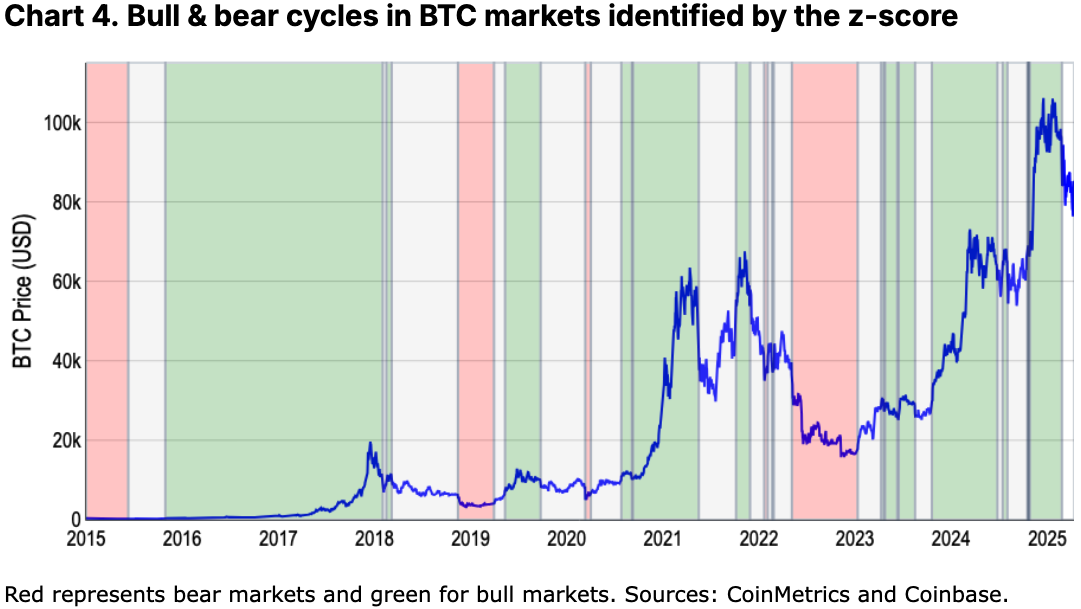

Another metric was the Bitcoin (BTC) Z-score, which compares market price and understood worth to recognize overbought and oversold conditions. A Z-score demonstrates how uncommon existing rate efficiency is when compared to historical information.

Bitcoin’s risk-adjusted efficiency. Source: Coinbase

This metric “naturally represents crypto’s bigger volatility,” however it is likewise sluggish to respond. This metric tends to produce couple of signals in steady markets. Coinbase’s design, based upon it, figured out that the booming market ended in late February however has actually considering that considered the marketplace neutral.

Coinbase’s Z-score Bitcoin design. Source: Coinbase

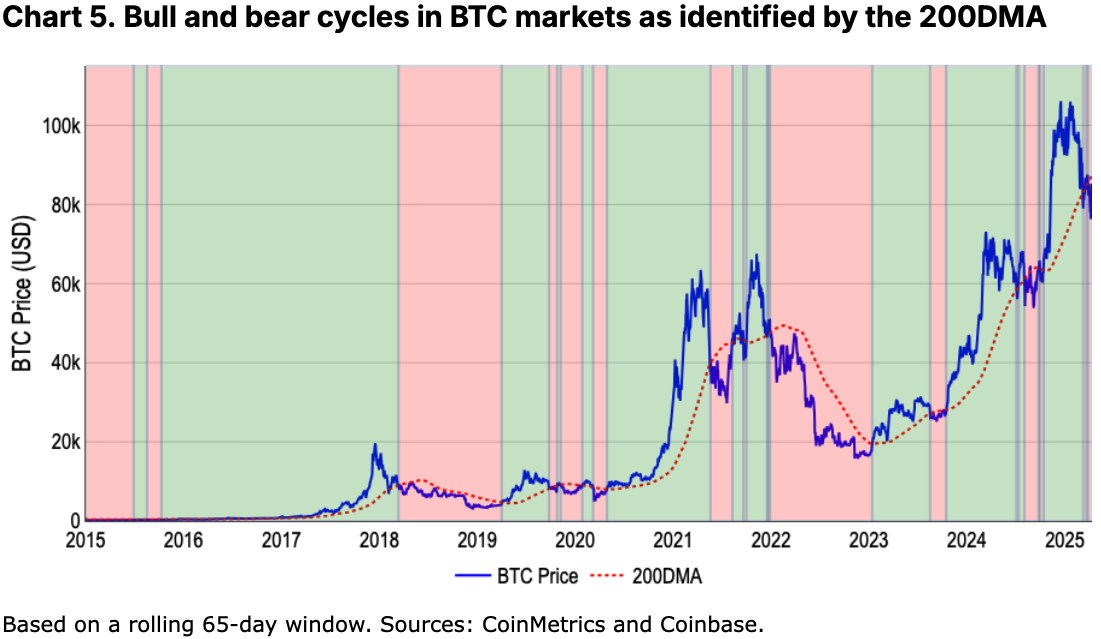

Rather, Coinbase’s expert recommended that the 200-day moving average is a much better sign for figuring out market patterns. It ravels short-term sound while mattering by thinking about the last 200 days’ worth of market information.

Coinbase’s 200-day moving typical Bitcoin design. Source: Coinbase

The report likewise stated that evaluating the more comprehensive crypto market’s pattern by the instructions in which Bitcoin is moving is significantly less trusted. This is due to the fact that crypto broadens into brand-new sectors with decentralized financing (DeFi), decentralized physical facilities networks (DePIN), expert system representatives, and more, all with specific market forces independent of Bitcoin.

Related: Bitcoin’s large rate variety to continue, no longer a ‘long just’ wager– Expert

Are we in a bearish market?

Duong mentions that the 200-day moving average recommends that Bitcoin’s current decrease moved it into bearishness area in late March. Still, using the exact same design to the Coin50 Coinbase index based upon the leading 50 crypto possessions reveals a bearish market considering that completion of February.

Coinbase’s 200-day moving typical design used to the Coin50 index. Source: Coinbase

Current reports showed that Bitcoin is revealing growing durability to macroeconomic headwinds compared to standard monetary markets. “Bitcoin’s decrease was relatively modest, reviewing rate levels from around the United States election duration, “according to Wintermute.

Duong sees Bitcoin ending up being less of a generalized crypto sign as an effect of this pattern. He composed:

” As Bitcoin’s function as a ‘shop of worth’ continues to grow, we believe a holistic examination of crypto’s aggregate market activity will be required to much better specify bull and bearish market for the possession class.”

Publication: Bitcoin eyes $100K by June, Shaq to settle NFT claim, and more: Hodler’s Digest, April 6– 12