Both cryptocurrency and standard markets will be pressed by worldwide trade war issues up until a minimum of the start of April, however the prospective resolution might bring the next huge market driver.

Bitcoin’s (BTC) rate tipped over 17% because United States President Donald Trump initially revealed import tariffs on Chinese items on Jan. 20, the very first day after his governmental inauguration.

Regardless of a wide range of favorable crypto-specific advancements, worldwide tariff worries will continue pressing the marketplaces up until a minimum of April 2, according to Nicolai Sondergaard, research study expert at Nansen.

BTC/USD, 1-day chart. Source: Cointelegraph/ TradingView

The research study expert stated throughout Cointelegraph’s Chainreaction daily X program on March 21:

” I’m eagerly anticipating seeing what occurs with the tariffs from April second onwards, perhaps we’ll see a few of them dropped however it depends if all nations can concur. That’s the most significant motorist at this minute.”

The Crypto Debanking Crisis: #CHAINREACTION https://t.co/nD4qkkzKnB

— Cointelegraph (@Cointelegraph) March 21, 2025

Danger possessions might do not have instructions up until the tariff-related issues are solved, which might take place in between April 2 and July, providing a favorable market driver, included the expert.

President Trump’s mutual tariff rates are set to work on April 2, in spite of earlier remarks from Treasury Secretary Scott Bessent that showed a possible hold-up in their activation.

Related: Ether threats correction to $1.8 K as ETF outflows, tariff worries continue

Fed’s rates of interest are likewise adding to market downturn

High rates of interest will likewise continue pressing danger cravings amongst financiers up until the Federal Reserve ultimately begins cutting rates, described Sondergaard, including:

” We’re waiting on the Fed to see correct “problem” before they will truly begin cutting rates.”

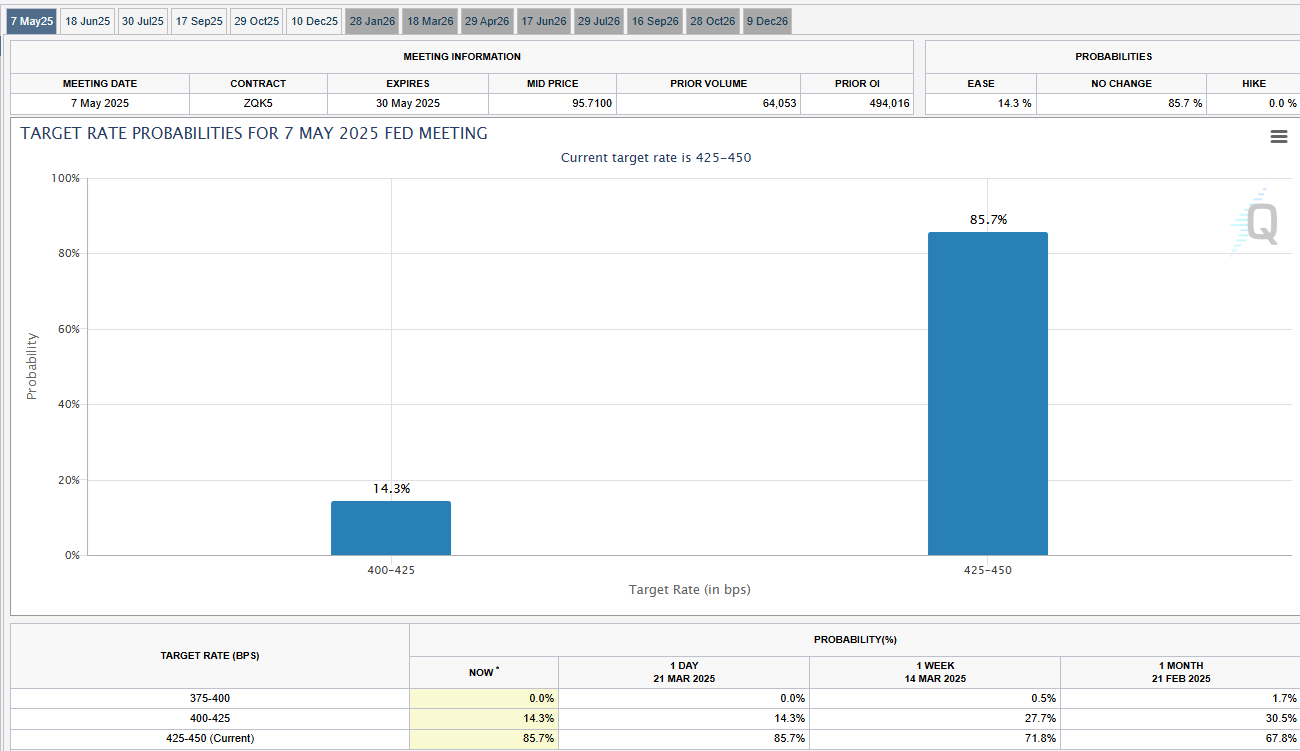

Fed target rate of interest likelihoods. Source: CME Group’s FedWatch tool

Markets are presently pricing in an 85% possibility that the Fed will keep rates of interest stable throughout the next Federal Free market Committee (FOMC) conference on May 7, according to the most recent price quotes of the CME Group’s FedWatch tool.

Related: Crypto debanking is not over up until Jan 2026: Caitlin Long

Still, the Federal Reserve shows that inflation and recession-related issues are temporal, especially relating to tariffs, which might be a favorable indication for financiers, according to Iliya Kalchev, dispatch expert at Nexo digital property financial investment platform.

” Markets might now anticipate upcoming financial information with higher self-confidence,” the expert informed Cointelegraph, including:

” Cooling inflation and steady financial conditions might even more improve financier cravings, driving extra advantage for Bitcoin and digital possessions.”

” Watch on crucial reports, consisting of Customer Self-confidence, Q4 GDP, unemployed claims, and next week’s important PCE inflation release, to determine the probability of future rate cuts,” the expert included.

Publication: SEC’s U-turn on crypto leaves crucial concerns unanswered