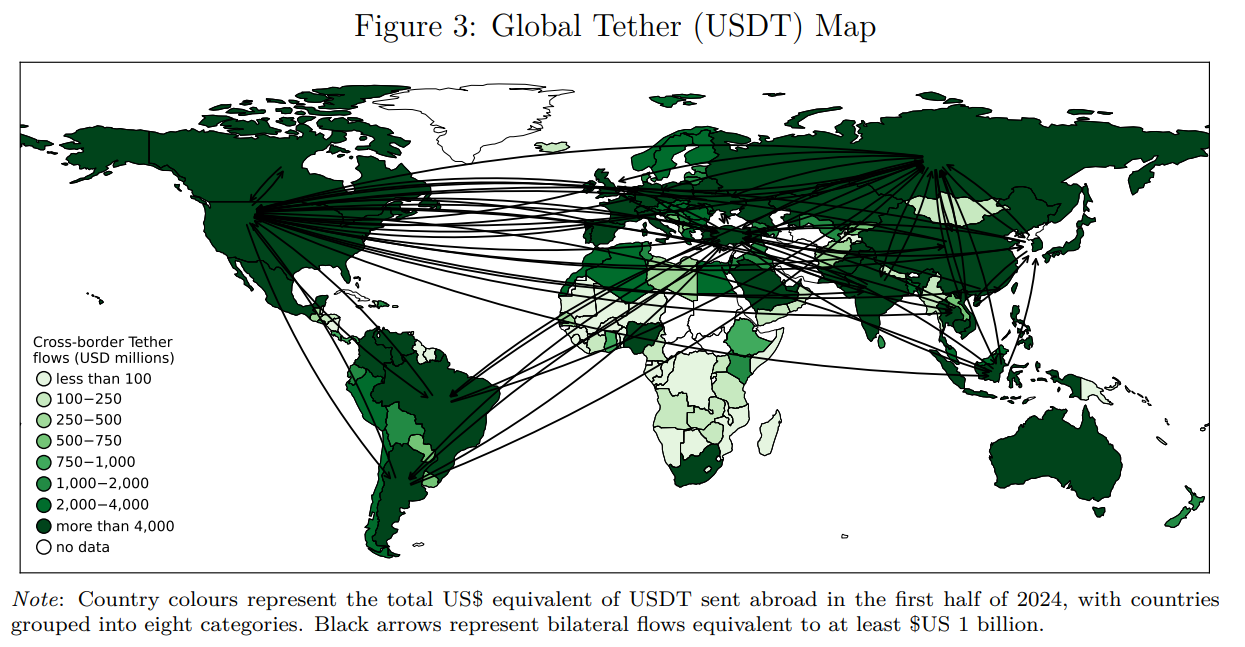

Numerous billions of dollars in cross-border cryptocurrency payments circulation worldwide, driven mostly by speculative financial investment, according to a current report by the Bank for International Settlements (BIS).

The BIS research study, released Might 8, discovered cross-border payments utilizing the 2 biggest cryptocurrencies, Bitcoin (BTC) and Ether (ETH), and the 2 biggest stablecoins, USDt (USDT) and USDC (USDC), amounted to about $600 billion throughout the 2nd quarter of 2024, the last observation duration covered by the analysis.

” Our findings highlight speculative intentions and international financing conditions as essential motorists of native crypto possession streams,” the BIS stated.

Still, the report kept in mind that stablecoins and low-value Bitcoin deals are regularly driven by useful usage cases, especially as options to standard remittances. The scientists explained that geographical barriers have less impact on cryptocurrency deals compared to standard monetary systems.

Related: Spar grocery store in Switzerland begins accepting Bitcoin payments

Speculative crypto activity stays connected to “international conditions for financing in significant crypto markets,” signifying a growing “interconnectedness” in between cryptocurrencies and the tradition monetary system, the scientists stated, including:

” Simultaneously, we observe that tighter international financing conditions, understood to cut risk-taking in standard possession classes, are related to decreased circulations. This shows increasing interconnectedness in between cryptoassets as speculative properties and mainstream financing.”

In addition, crypto-specific dangers and increased public awareness substantially affect crypto financial investment streams, strengthening their function as speculative properties, according to the BIS.

The findings were released almost a month after the BIS alerted that the variety of financiers and quantity of capital in crypto and decentralized financing (DeFi) had “reached an emergency,” posturing a danger to monetary stability and international wealth inequality, Cointelegraph reported on April 19.

Related: $ 400M Web3 mutual fund ABCDE stops brand-new financial investments, fundraising

Stablecoin, low-value Bitcoin payments sustained by fiat inflation, high transfer expenses

Beyond speculative financial investment tools, stablecoins and Bitcoin are likewise utilized as a “transactional medium.”

” Greater chance expenses of fiat currency use, such as high inflation, stimulate bilateral cross-border deals in both unbacked cryptoassets and stablecoins,” the BIS mentioned, including:

” Also, higher financial activity within both sender and receiver nations is typically connected to increased crypto streams most of the times.”

High remittance charges charged by standard banks even more boost crypto adoption for worldwide cash transfers, specifically from established economies to emerging markets, the report mentioned.

The United States and the UK represented a cumulative 20% of cross-border payments utilizing Bitcoin and USDC, and almost 30% utilizing ETH.

When It Comes To USDT, Russia and Turkey represented over 12% of the cross-border deals utilizing the world’s biggest stablecoin.

Publication: Uni trainees crypto ‘grooming’ scandal, 67K scammed by phony females: Asia Express