Blockchain video gaming and decentralized financing (DeFi) stayed the most active sectors in Web3 in October, regardless of a 3% decrease in overall day-to-day active wallets to 16 million, according to a brand-new report from DappRadar.

Web3 video gaming represented 27.9% of all decentralized application (DApp) activity over the previous month, its greatest share of the year, while DeFi kept strong engagement at 18.4%, regardless of market volatility and continuous regulative pressure.

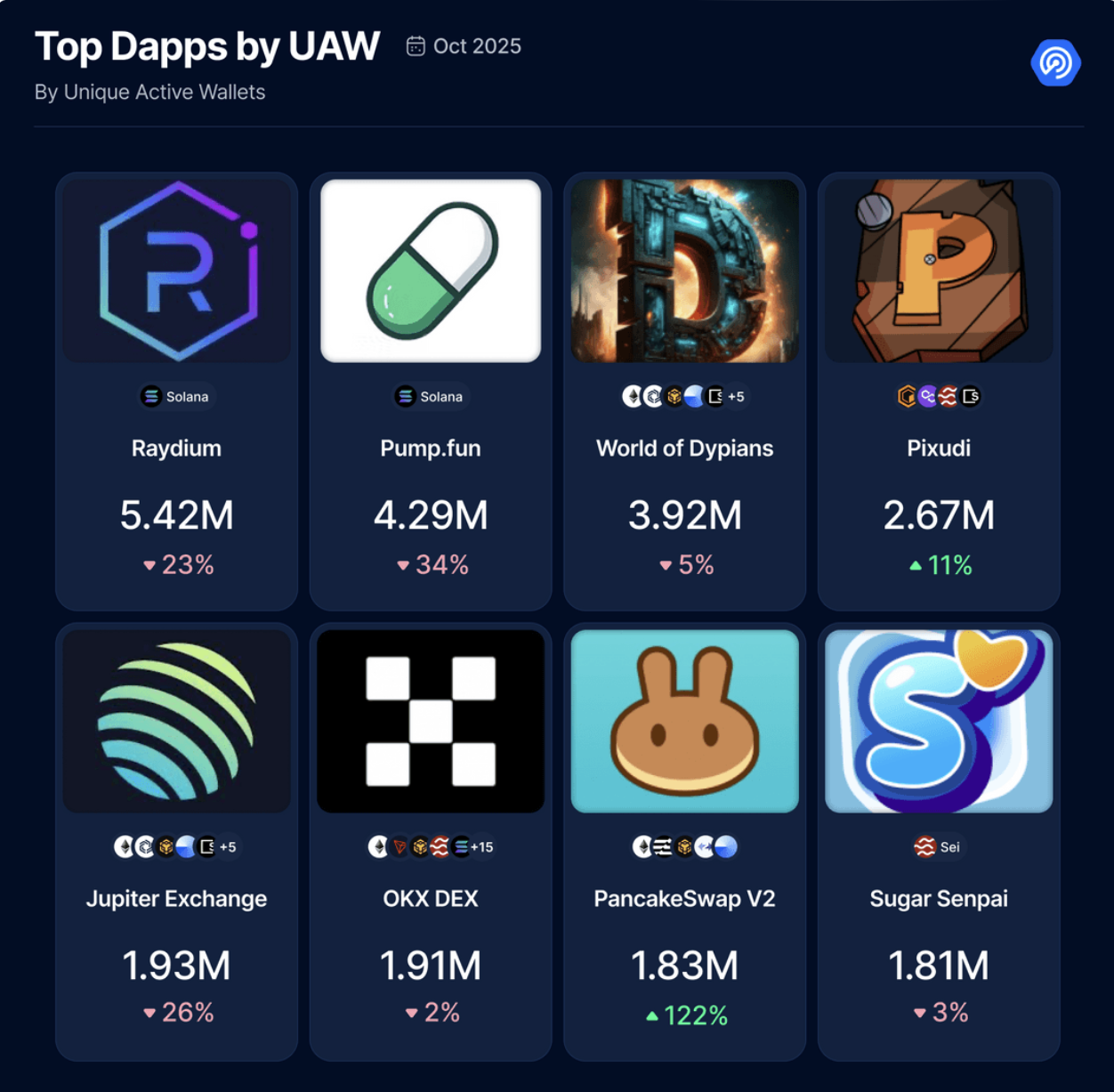

The most extensively utilized DApps consist of Raydium, Pump.fun, Jupiter Exchange, OKX Dex and PancakeSwap v2.

Yet, the overall worth locked (TVL) in DeFi fell 6.3% in October to $221 billion and dropped another 12% in early November to $193 billion, thanks to wider market decrease and regulative unpredictability.

On the other hand, trading of non-fungible tokens (NFTs) increased by 30% in October to $546 million, reaching 10.1 million deals– the greatest month-to-month count of 2025.

Related: Balancer make use of swells to $116M in outflows as group provides 20% bounty

DeFi takes a hit however reacts

DeFi’s October slump was intensified by the Oct. 10 market crash, which erased about $20 billion in leveraged positions throughout providing platforms and significant exchanges.

The pressure continued when DeFi procedure Stream Financing suffered a $93 million loss on Wednesday, raising issues about stablecoin credit direct exposure and triggering experts to reveal another $284 million in associated vulnerabilities throughout the community.

Regulative unpredictability likewise weighed on DeFi in October after a number of senate Democrats proposed extending Know Your Consumer (KYC) guidelines to non-custodial wallets, a relocation critics alerted might drive DeFi activity offshore.

On Thursday, significant Ethereum stakeholders introduced the Ethereum Procedure Advocacy Alliance (EPAA), joining leading DeFi structures, consisting of Aave, Uniswap, Lido, Curve and The Chart, to collaborate policy efforts and make sure that decentralized facilities is represented in crypto policy.

Likewise on Thursday, the modular oracle network RedStone introduced Credora, a DeFi-focused danger rankings platform developed to improve openness and credit evaluation throughout providing procedures.

Publication: Best of luck taking legal action against crypto exchanges, market makers over the flash crash