United States legislators held off a prepared markup of the Digital Possession Market Clearness Act (CLEARNESS), postponing development on a costs meant to specify how cryptocurrencies and decentralized financing (DeFi) platforms are managed and triggering restored pushback from DeFi leaders who state the costs still stops working to properly safeguard designers.

Market groups and crypto endeavor companies cautioned that proposed changes might enforce requirements that are not appropriate for decentralized systems. Agents from Paradigm and Alternative stated the present draft leaves unsolved uncertainty over whether DeFi designers and facilities companies might be required to execute Know Your Client (KYC), register with monetary regulators or adhere to guidelines developed for central platforms.

The hold-up follows installing criticism from throughout the crypto sector, consisting of public opposition from Coinbase CEO Brian Armstrong, which led Senate Banking Committee Chair Tim Scott to reveal a “quick time out.”

Continue reading

Vitalik Buterin requires a brand-new DAO style for onchain disagreements and governance

Ethereum co-founder Vitalik Buterin required a rethink of how decentralized self-governing companies (DAOs) are developed, arguing that the majority of DAOs have actually ended up being little bit more than token-voting treasuries.

Buterin stated that this design mishandles, susceptible and stops working to enhance on standard governance systems. He included that DAOs ought to be purpose-built to support core facilities like oracles, onchain conflict resolution, insurance coverage choices and long-lasting job stewardship.

He likewise laid out how various governance problems need various structures, comparing cases that gain from definitive management and broad compromise.

Buterin cautioned that low involvement, whale supremacy and choice tiredness stay significant obstacles, and stated that personal privacy tools, minimal AI help and much better governance style are important to DAOs.

Continue reading

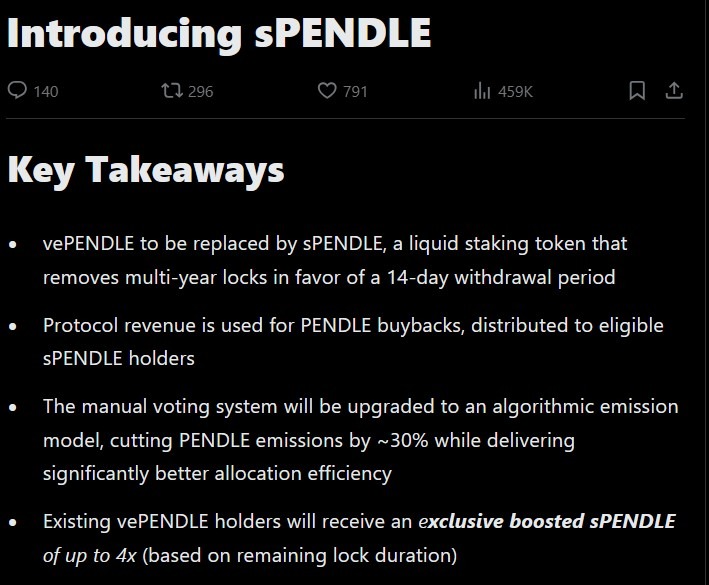

DeFi procedure Pendle revamps governance token, pointing out low adoption

DeFi procedure Pendle is revamping its governance design by phasing out its vePENDLE token and presenting a brand-new liquid staking and governance token, sPENDLE.

The group stated vePENDLE’s long lock-up durations, absence of transferability and complex ballot mechanics minimal involvement, even as the procedure grew to almost $3.5 billion in overall worth locked (TVL).

The brand-new token objectives to decrease the barriers by permitting withdrawals after a 14-day loosening up duration, allowing combinations throughout other DeFi platforms and streamlining governance involvement.

Pendle is likewise simplifying requirements for ballot and prepares to consume to 80% of procedure income for governance benefits and token buybacks.

Continue reading

Brand-new SEC submissions press on self-custody and DeFi policy

2 brand-new submissions to the United States Securities and Exchange Commission’s crypto job force are including pressure on regulators to clarify how self-custody rights and DeFi activity ought to be dealt with under upcoming market structure guidelines.

A filing referencing Louisiana law that secures retail users’ right to self-custody cautioned that excessively broad exemptions in federal propositions can damage financier defenses and increase dangers of scams.

Another submission from the Blockchain Association argued that business trading tokenized equities or DeFi properties from their own accounts ought to not instantly be categorized as managed dealerships.

The filings come as settlements continue in Congress, with policymakers and market figures promoting a compromise.

Continue reading

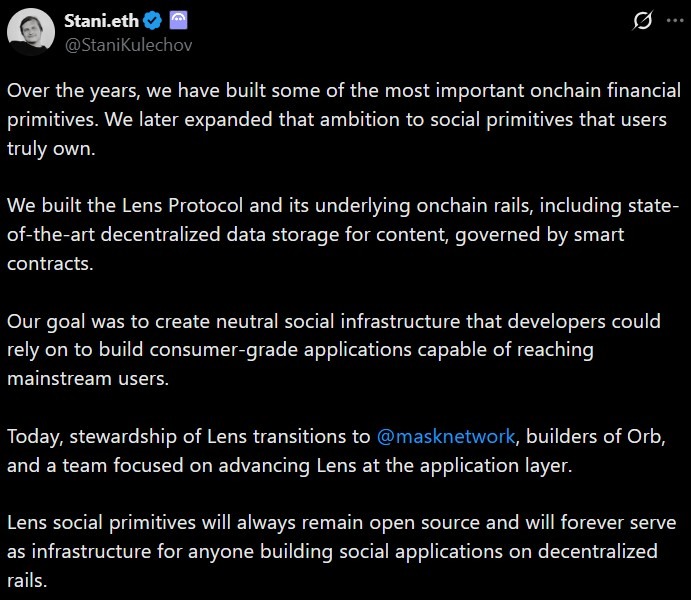

Aave refocuses on DeFi, hands Lens stewardship to Mask Network

Providing procedure Aave handed stewardship of Lens Procedure to Mask Network, narrowing its function to technical advisory assistance as it refocuses on DeFi.

Under the shift, Mask Network will lead consumer-facing advancement and item execution for Lens-based social applications, while the procedure’s core facilities stays permissionless and open-source.

Ethereum co-founder Vitalik Buterin invited the relocation and commented that decentralized socials media developed on shared information layers are necessary for cultivating competitors and enhancing online discourse.

Continue reading

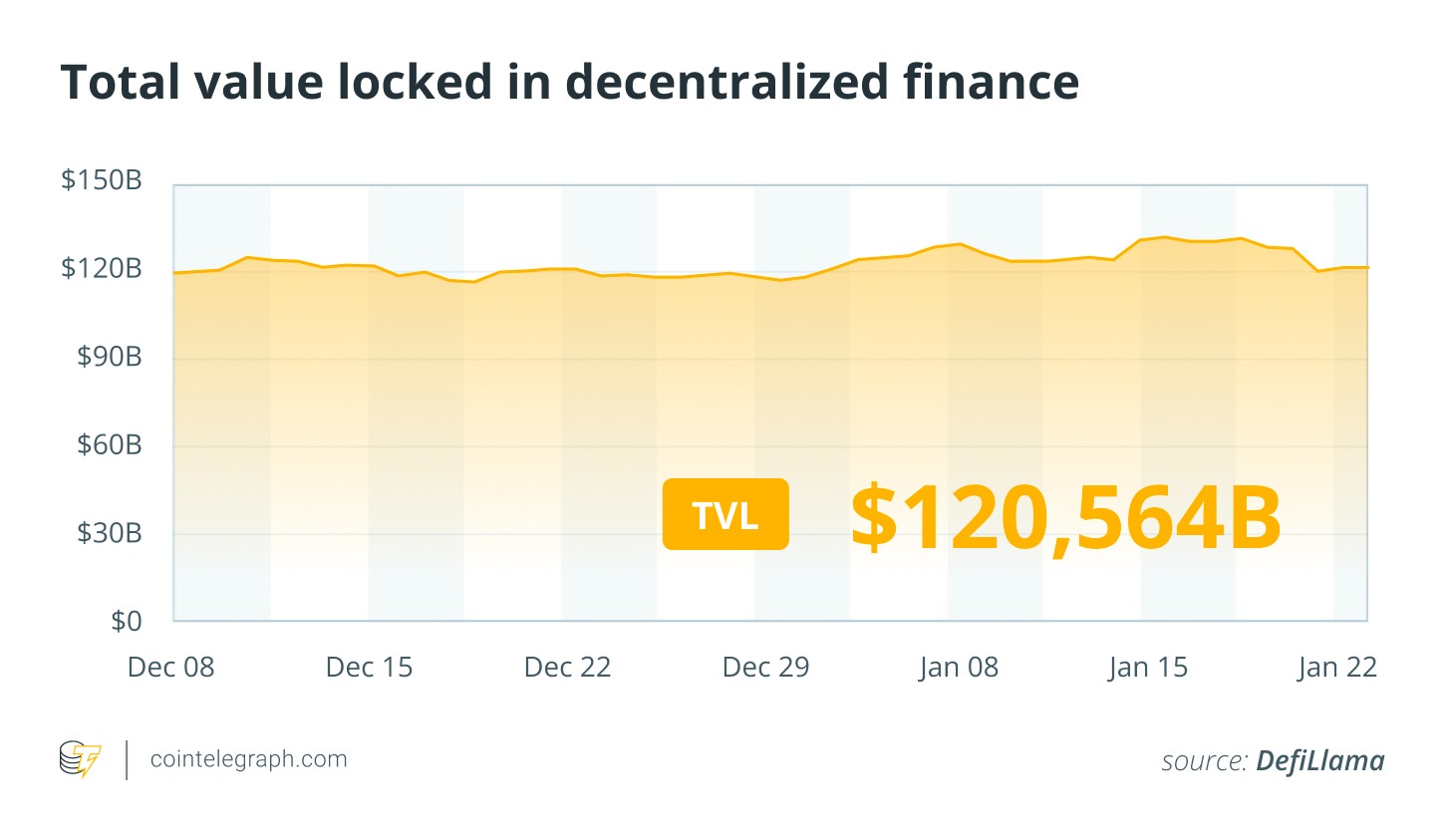

DeFi market summary

According to information from Cointelegraph Markets Pro and TradingView, the majority of the 100 biggest cryptocurrencies by market capitalization ended the week in the red.

The White Whale (WHITEWHALE) token fell by over 57% throughout the week, marking the most significant drop in the last 7 days. This was followed by a token called Merlin Chain (MERL), which dropped 48% recently.

Thanks for reading our summary of this week’s most impactful DeFi advancements. Join us next Friday for more stories, insights and education concerning this dynamically advancing area.