Digital possession exchange DigiFT has actually introduced Invesco’s tokenized personal credit technique on Arbitrum, more broadening the usage cases of real-world properties (RWA) and providing institutional financiers access to onchain credit markets.

According to a March 13 statement, Invesco’s United States Senior citizen Loan Technique (iSNR) token is now reside on Arbitrum, a popular Ethereum layer-2 network.

The tokenized possession was introduced on Feb. 19 and is created to track the efficiency of a personal credit fund handled by Invesco, an openly traded financial investment supervisor headquartered in Atlanta, Georgia.

At the time of launch, the Invesco fund had $6.3 billion in properties under management, according to Bloomberg.

DigiFT explained the iSNR token as the “very first and just tokenized personal credit technique.”

The iSNR tokenized fund has a minimum financial investment of $10,000. Source: DigiFT

DigiFT CEO Henry Zhang stated including iSNR to Aribitrum increases its energy by “enabling DeFi applications, DAOs and institutional financiers to incorporate with a managed, onchain personal credit technique.”

Constant with the preliminary launch of iSNR on Ethereum last month, financiers on Arbitrum can acquire tokenized shares utilizing popular stablecoins USDC (USDC) and USDt (USDT).

Related: Cantor Fitzgerald taps Anchorage Digital, Copper as Bitcoin custodians

DeFi tokenization rising

In spite of the current crypto market drop, RWA tokenization seems warming up with the launch of numerous DeFi-oriented items. Favorable regulative advancements, the increase of liquid multichain economies and developments in decentralized exchanges are anticipated to press RWA tokenization into the crypto spotlight this year.

Previously today, tokenization business Securitize revealed that oracle supplier RedStone will provide cost feeds for its tokenized items, that include the BlackRock USD Institutional Liquidity Fund (BUIDL) and the Apollo Diversified Credit Securitize Fund (ACRED).

The combination suggests that Securitize’s funds “can now be used throughout DeFi procedures such as Morpho, Substance or Glow,” RedStone’s chief running officer, Marcin Kazmierczak, informed Cointelegraph.

On the other hand, possession supervisor Franklin Templeton has actually introduced a tokenized cash fund on the Coinbase layer-2 network Base and a United States federal government cash fund on Solana.

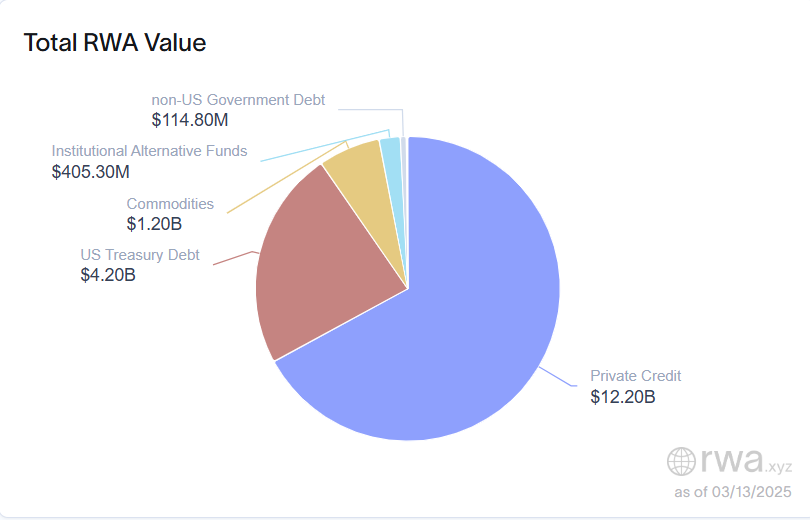

Personal credit ($ 12.2 billion) and United States Treasury financial obligation ($ 4.2 billion) have actually controlled real-world possession tokenization up until now. Source: RWA.xyz

According to market information, the overall worth of RWAs onchain has actually grown by 17.5% over the previous 1 month to reach $18.1 billion. Personal credit and United States Treasury financial obligation represent almost 91% of that overall.

Related: Trump-era policies might sustain tokenized real-world properties rise