Decentralized financing (DeFi) trading platform dYdX revealed its first-ever token buyback program on March 24, intending to reinvest in its environment to improve security and governance.

According to the statement, 25% of the procedure’s net charges will be committed to regular monthly buybacks of its native dYdY (DYDX) token on the free market.

Following the statement, DYDX rose over 10% and was trading at around $0.731 at the time of composing, according to CoinGecko. The token has actually gotten more than 21% over the previous 2 weeks.

DYDX spikes on buyback news. Source: CoinGecko

Related: dYdX checks out sale of derivatives trading arm

New dYdX circulation design

Formerly, dYdX dispersed 100% of its platform profits to environment individuals. Under the brand-new allowance design, 25% will be utilized for token buybacks, another 25% will money its USDC liquidity arrangement program, MegaVault, 10% will be directed to its treasury, and the staying 40% will continue as staking benefits.

dYdX kept in mind that the existing allowance of 25% to token buybacks might increase, with continuous neighborhood conversations possibly pressing this portion to as high as 100% with time.

Related: DeFi market phases a return as derivatives rise

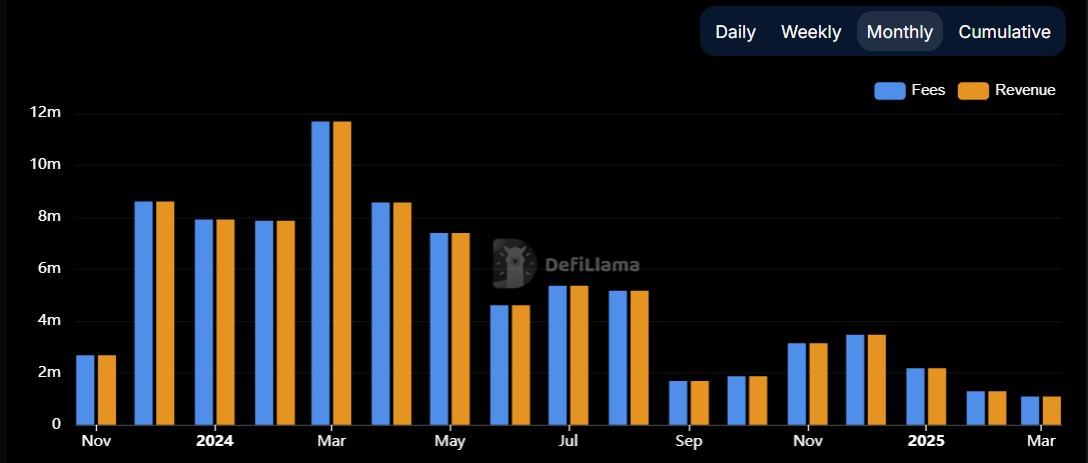

The platform presently holds an overall worth locked (TVL) of $279 million, according to DefiLlama. It produced $1.29 million in profits from charges in February and $1.09 million up until now in March.

Token buybacks get 25% of profits, which has actually been dropping. Source: DefiLlama

” DeFi celebration” awaits summer season to end

The DeFi market frequently referrals the DeFi summer season of 2020 as a criteria, defined by fast user development driven by yield farming and decentralized applications.

In a current interview with Cointelegraph, dYdX Structure CEO Charles d’Haussy forecasted that the next substantial DeFi boom would take place quickly after summer season, possibly starting as early as September and lasting “months and months.”

dYdX existed in mid-2020 mostly as a DeFi platform for area trading, loaning, loaning, and margin trading. Its appeal appeared 2021 following the launch of its layer-2 continuous futures exchange and the intro of its native DYDX token.

In its 2024 environment report, dYdX forecasted that the decentralized derivatives market would broaden to $3.48 trillion by 2025, up from $1.5 trillion in derivatives volume processed by decentralized exchanges (DEXs) in 2024.

Publication: Memecoins are ded– However Solana ‘100x much better’ regardless of profits plunge