Secret takeaways:

-

Institutional belief is moving towards ETH as elite funds reallocate capital from Bitcoin to Ether ETFs.

-

BlackRock’s ETH ETF sets protected staking with a low 0.25% cost, developing a significant win for mainstream crypto gain access to.

-

Supremacy in the $20 billion real-world property sector shows that huge cash focuses on network security over low gas costs.

Ether (ETH) has actually stopped working to recover the $2,500 level considering that Jan. 31, leading traders to question what may stimulate sustainable bullish momentum. Financiers are waiting on conclusive indications of a beneficial belief shift; on the other hand, 3 unique occasions might indicate completion of the bear cycle that bottomed at $1,744 on Feb. 6.

Initially glimpse, the $327 million in net outflows from area Ether exchange-traded funds (ETFs) in February is slightly worrying. The obvious absence of institutional hunger while ETH sits 60% listed below its all-time high might be viewed as an uncertainty in the $1,800 assistance level. Nevertheless, these outflows represent less than 3% of the overall possessions under management for Ether ETFs.

Current Ether ETF turning points might improve ETH’s rate

While financiers presently focus nearly solely on short-term circulations, the magnitude of current Ether ETF advancements will ultimately show favorably on ETH rate. In bearish markets, favorable news is typically overlooked or minimized, however tactical relocations from the world’s biggest property supervisors can rapidly turn financier danger understanding.

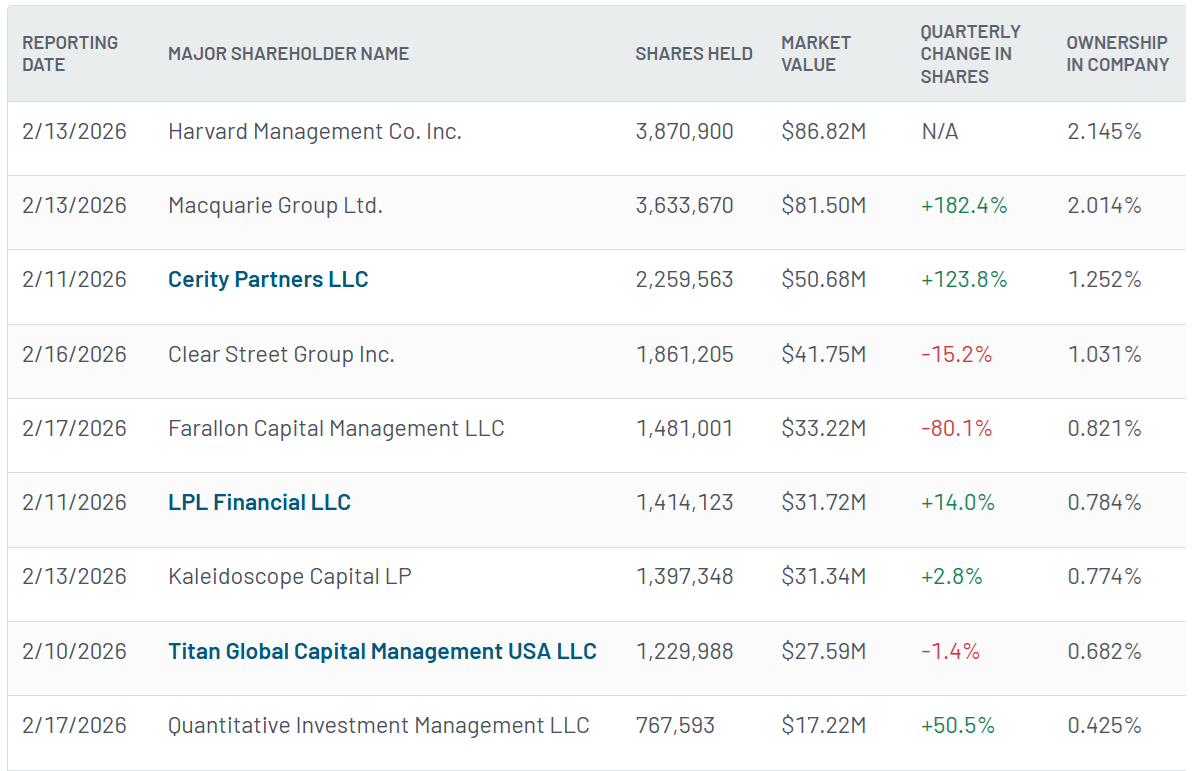

The current United States Securities and Exchange Commission filings revealed on Monday that the Harvard endowment fund included an $87 million position in BlackRock’s iShares Ethereum Trust throughout the last quarter of 2025. Surprisingly, this vote of self-confidence showed up as Harvard minimized its iShares Bitcoin Trust holdings to $266 million, below $443 million in September 2025.

In parallel, BlackRock changed its Staked Ethereum ETF proposition on Tuesday to consist of an 18% retention of overall staking benefits as service charge. While some market individuals slammed the substantial cost, the ETF sponsor should compensate intermediaries like Coinbase for staking services. Additionally, the fairly low 0.25% expenditure ratio stays a net favorable for the market.

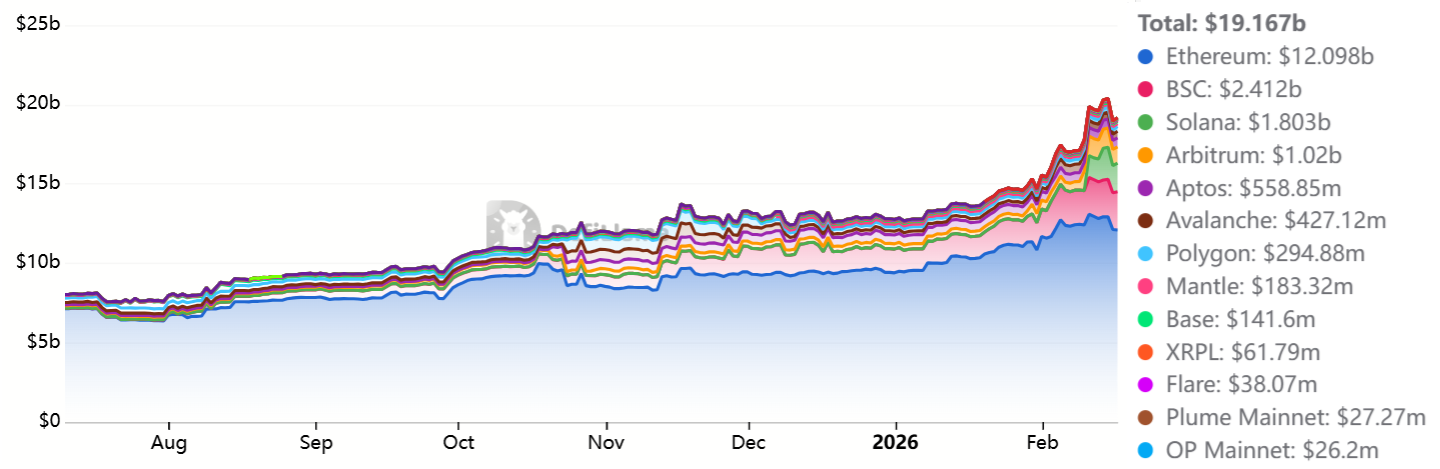

The last piece of proof indicating growing institutional adoption depends on real life property (RWA) tokenization, a sector that has actually exceeded $20 billion in possessions. Ethereum stands as the outright leader, hosting offerings from BlackRock, JPMorgan Chase, Fidelity and Franklin Templeton. This crossway of blockchain applications and standard financing might activate sustainable need for ETH.

Almost half of the $13 billion in RWA deposits on Ethereum represent tokenized gold, though financial investments in United States Treasurys, bonds and cash market funds grew to an outstanding $5.2 billion. By contrast, the combined RWA listings on BNB Chain and Solana total up to $4.2 billion, a strong indication that institutional cash is less worried with costs and more concentrated on security.

Related: Tokenized RWAs climb up 13.5% regardless of $1T crypto market drawdown

Even if RWA providers presently concentrate on closed-end systems utilizing special decentralized financing swimming pools or their own layer-2 networks, intermediaries will ultimately discover methods to get in touch with the more comprehensive Ethereum community. Crypto equity capital company Dragonfly Capital’s most current $650 million financing round indicates a strong hunger for tokenized stocks and personal credit offerings.

Instead of backing layer-1 blockchains and consumer-focused applications, financiers are directing capital towards RWA facilities, institutional custody and trading platforms, a clear indication of market maturation. Although it is hard to forecast for how long these shifts will require to effect Ether’s rate, these occasions plainly suggest that a recover to $2,500 in the near term is practical.

This post does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding. While we make every effort to supply precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this post. This post might consist of positive declarations that undergo threats and unpredictabilities. Cointelegraph will not be responsible for any loss or damage occurring from your dependence on this info.