The chest taken from decentralized loan provider Radiant Capital in October 2024 has actually almost doubled in worth as Ether climbed up, blockchain information programs.

Decentralized financing (DeFi) procedure Radiant Capital was hacked in mid-October 2024 when the crosschain loaning procedure suffered a $58 million cybersecurity breach on BNB Chain and Arbitrum.

Radiant Capital lost about $58 million in the breach. The assaulter later on switched earnings into Ether (ETH) and now holds 21,957 ETH worth about $103 million, according to Lookonchain, up from an approximated $58 million at the time of the make use of.

Ether closed Oct. 15, 2024, above $2,300, and was trading above $4,700 Thursday at the time of composing.

Related: United States area Ether ETFs see 2nd-biggest inflows on record as ETH nears brand-new high

Not a financial investment bet, experts state

The examinations group at blockchain forensics firm AMLBot informed Cointelegraph that, although it eventually caused benefit, the trade was likely an unintentional effect of evasion strategies. “It’s most likely that the exploiter’s choice to hold ETH was driven by functional security and liquidity factors to consider, instead of an intentional market-timing technique,” the AMLBot group stated.

The detectives stated opponents tend to switch taken funds to Bitcoin (BTC) or ETH. 2 factors for this are to alleviate the danger of token freezes and since Bitcoin and Ether are currently supported by extremely liquid market facilities and prevalent assistance. This makes it simpler to move them throughout communities.

” Provided these patterns, it’s more possible that the ETH holdings merely took advantage of wider market development instead of being the outcome of a mindful financial investment bet on cost gratitude,” the detectives concluded.

Ether’s cost increases as its supply decreases

Ether’s cost increase given that the make use of is credited to several elements.

Ether area ETFs began selling the United States in late July 2024– closing one year of trading last month– and have actually seen an overall net United States dollar circulation of $12.12 billion up until now, according to CoinGlass information.

This information likewise reveals that massive build-up through controlled ways has actually been continuous, resulting in a decline in the quantity of Ether on exchanges. More properties are now out of flow thanks to staking, with mid-June reports revealing that the supply of staked Ether reached an all-time high of over 35 million ETH. More current information from Dune Analytics reveals that this number now surpasses 36 million ETH.

Another aspect is ETH treasuries at corporates. According to a report launched in late July, those business had more than $100 billion of Ether in their coffers at the time.

Regulative tone has actually likewise moved, consisting of the SEC’s June 2024 choice to drop its probe into whether ETH is a security.

Carol Goforth, a teacher at the University of Arkansas School of Law, stated at the time that the case being dropped was a sign the firm wasn’t positive it might persuade a court that ETH is a security.

Related: Ethereum is the ‘greatest macro trade’ for next 10-15 years: Fundstrat

A growing community and enhancing facilities

Ethereum likewise presented its Dencun upgrade simply months before the hackers filled their coffers. This upgrade consists of Ethereum Enhancement Proposition (EIP) 4844. The EIP presented danksharding and proto-danksharding, substantially enhancing network scalability and layer-2 assistance.

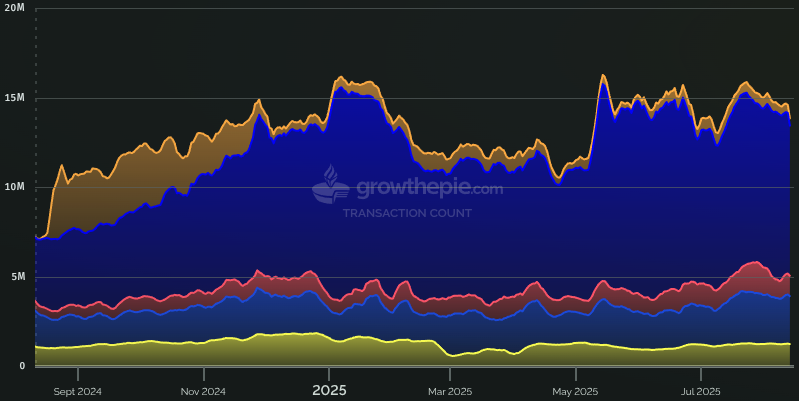

Ethereum’s layer-2 community likewise grew, with everyday deals reaching 12.42 million on Aug. 12, 2024.

That development has actually continued, with GrowThePie information from Wednesday revealing that Ethereum layer-2 procedures processed almost 13.88 million deals that day. Previous highs have actually surpassed 16 million deals in a day.

Publication: How Ethereum treasury business might trigger ‘DeFi Summertime 2.0’