Update Oct. 8, 12:17 p.m. UTC: This short article has actually been upgraded to consist of remarks from Nansen’s Nicolai Sondergaard and RedStone’s Marcin Kazmierczak.

Update Oct. 8, 12:45 p.m. UTC: This short article has actually been upgraded to consist of a remark from Falcon Financing’s Andrei Grachev.

Ethereum taped its biggest validator exit on record today, with more than 2.4 million Ether worth over $10 billion waiting for withdrawal from its proof-of-stake network, however institutional individuals are changing much of that in the validator entry line.

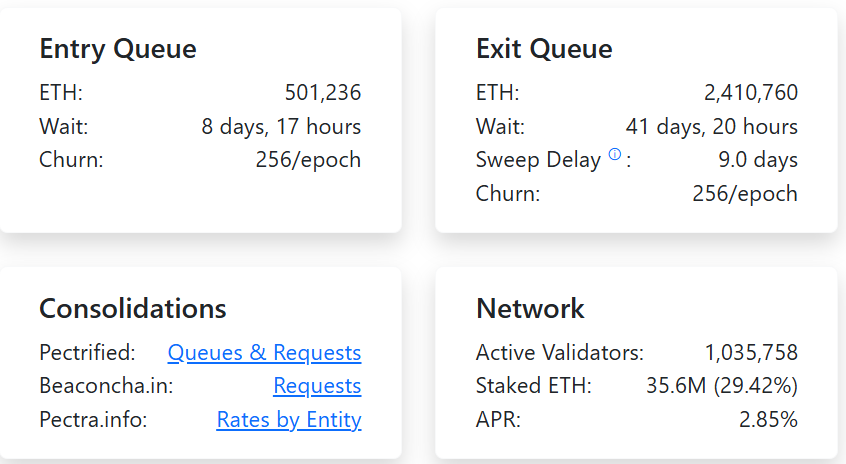

Ethereum’s exit line went beyond 2.4 million Ether (ETH) worth over $10 billion on Wednesday. The spike in exits extended the validator line time to more than 41 days and 21 hours, according to blockchain information from ValidatorQueue.com.

Validators are accountable for including brand-new blocks and confirming deals on the Ethereum network, playing a crucial function in its operation.

” Big withdrawals constantly suggest there is a possibility that tokens can be offered, however it does not always equivalent sales of tokens,” stated Nicolai Sondergaard, research study expert at crypto intelligence platform Nansen, including that “there is no requirement for issue from this alone.”

While the $10 billion withdrawal line is considerable, validators are more than likely “combining from 32 ETH to 2,048 ETH stakes for functional performance,” according to Marcin Kazmierczak, co-founder of blockchain oracle business RedStone.

This consists of growing inflows into liquid staking procedures for enhanced “capital performance,” he informed Cointelegraph, including:

” A big part of withdrawn ETH is redeployed within DeFi, not offered.”

” The 44+ day withdrawal wait time develops a natural throttle avoiding supply shocks,” he discussed, including that Ether’s everyday volume of $50 billion is still 5 times bigger than the validator line.

Related: Older, richer financiers might power crypto adoption through 2100

Ethereum’s growing validator line might likewise indicate “growing need for native yield,” according to Andrei Grachev, establishing partner at artificial dollar procedure Falcon Financing.

” Mass selling is not likely considering that many stakers are designating for onchain returns, not leave liquidity,” as Ether is developing from a speculative property into a “yield-bearing layer of capital,” he stated.

$ 10 billion Ethereum exit line raises offer pressure issues

The rise in pending withdrawals has actually stimulated renewed issue over possible sell pressure for Ether holders.

While this does not suggest that all validators are seeking to take earnings, a substantial quantity of the $10 billion might be offered, thinking about that Ether’s rate has actually increased 83% over the previous year, according to Cointelegraph’s rate index.

Contributing to the issues about offering pressure, the validator exit line has to do with 5 times bigger than the Ethereum entry line, which presently holds over 490,000 Ether set to be staked, with a wait time of 8 days and 12 hours.

While short-term selling pressure issues continue, the $10 billion withdrawal does not threaten the Ethereum network’s stability, which still boasts over 1 million active validators staking 35.6 million Ether, or 29.4% of the overall supply.

Related: Stimulus talk satisfies shutdown: What tariff-funded checks might suggest for crypto

The advancement comes a day after Grayscale staked $150 million in Ether on Tuesday, following the crypto-focused property supervisor’s intro of staking for its Ether exchange-traded items, making it the very first US-based crypto fund provider to use staking-based passive earnings for its funds.

On Wednesday, Grayscale transferred another 272,000 Ether worth $1.21 billion into the staking line, indicating that the business represents “most of coins presently waiting for staking activation,” according to onchain expert EmberCN.

In spite of the ballooning validator exits, Ether’s momentum continues to be driven by institutional inflows through exchange-traded funds (ETFs) and business treasuries, Iliya Kalchev, dispatch expert at digital property platform Nexo, informed Cointelegraph:

” Institutional and business treasuries now hold over 10% of ETH’s overall supply, while October ETF inflows have actually currently surpassed $620 million.”

” The information show Ethereum’s advancement into a yield-bearing, institutionally acknowledged property utilized both for facilities and security functions,” he included.

Publication: How Ethereum treasury business might stimulate ‘DeFi Summertime 2.0’