Corporations are progressively seeing Ethereum as a crucial facilities part, sustaining a rise in ETH allotments within business treasuries, according to Ray Youssef, CEO of financing app NoOnes.

” Ethereum begins to appear like a hybrid in between tech equity and digital currency. This interest treasury strategists looking beyond passive storage,” Youssef informed Cointelegraph.

Leading business Ethereum treasuries have actually acquired a minimum of $1.6 billion worth of Ether (ETH) in the previous month. On Monday, BitMine, chaired by Fundstrat’s Tom Lee, exposed that it holds 163,142 ETH, valued at around $480 million.

SharpLink Video gaming, established by Ethereum co-founder Joseph Lubin, leads business ETH holdings with over 280,000 ETH since Sunday, amounting to over $840 million. It has actually obtained big quantities in current days.

Other significant business purchasers consist of Bit Digital, which has more than 100,000 ETH, and Blockchain Innovation Agreement Solutions (BTCS), which increased its holdings to 29,122 ETH following a $62.4 million raise. GameSquare likewise revealed a $100 million ETH treasury strategy.

Youssef stated the shift reveals energy now equals story in driving institutional options. “Bitcoin has actually long held the title of digital gold requirement, however Ethereum is slowly winning over organizations that look for to align their balance sheet with the networks that drive tokenized financing,” he stated.

Related: Ethereum financiers stack into ETH amidst enormous weekly rise

ETH’s yield, compliance drive institutional appeal

Youssef stated ETH’s staking yield, programmability and compliance-friendly roadmap have actually made the cryptocurrency interesting “positive business, specifically those currently associated with the digital economy.”

He forecasted that Ethereum’s impact will continue to grow. “Ethereum progressively ends up being the digital rail for tokenized properties, stablecoins, and wise agreement execution, ending up being a favored reserve cryptocurrency for companies running in these locations.”

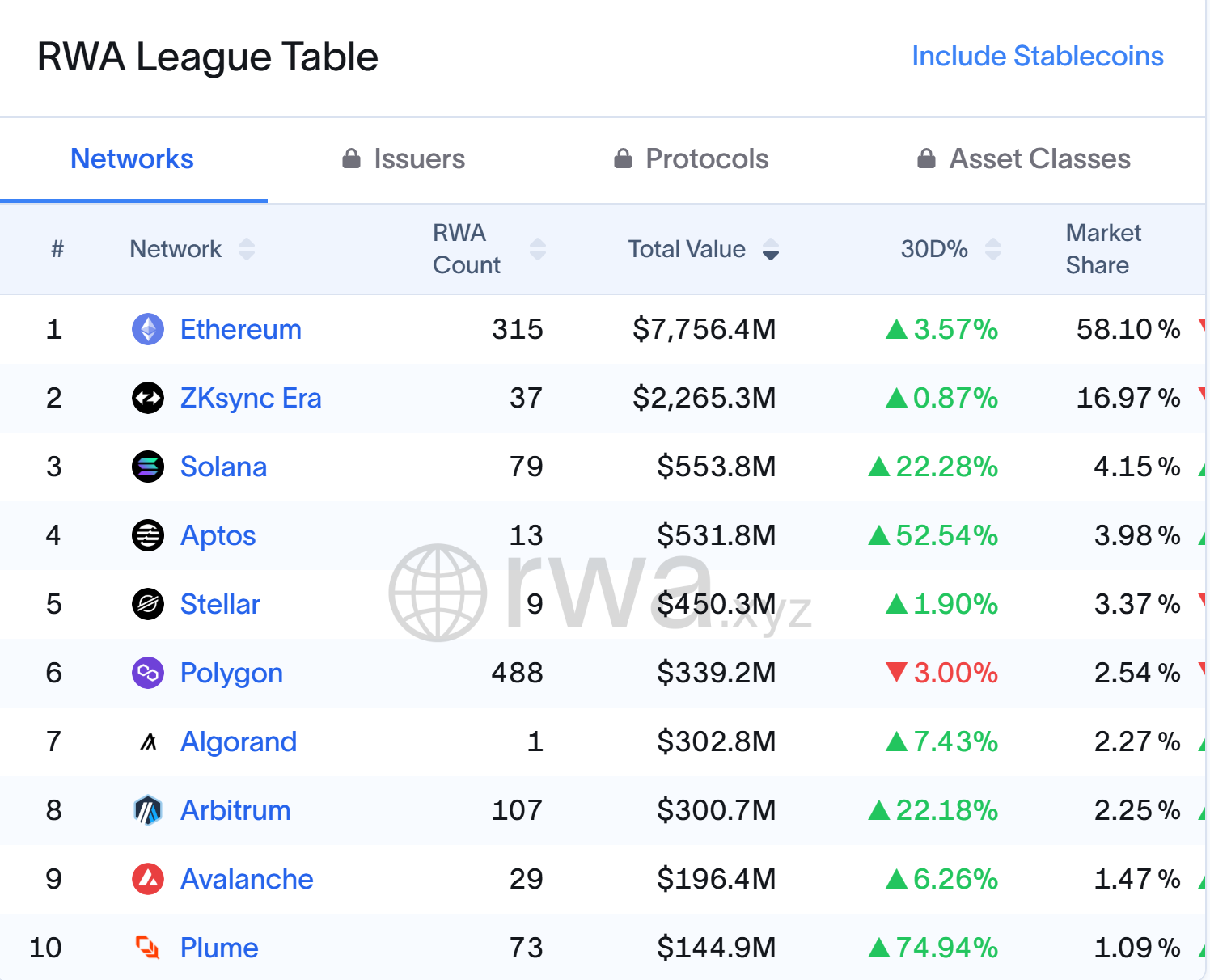

The majority of stablecoins and real-world possession (RWA) procedures are developed on Ethereum or Ethereum-compatible chains. According to RWA.xyz, Ethereum controls the RWA market with 315 tasks valued at $7.76 billion, commanding a 58.1% market share.

Following behind is the Ethereum layer-2 service ZKsync Age, hosting 37 tasks worth $2.27 billion and holding almost 17% of the marketplace. Solana ranks 3rd with 79 tasks valued at $553.8 million and a smaller sized 4.15% market share, though it revealed the greatest development rate of 22.28%.

Youssef called Ethereum’s supremacy in tokenized United States Treasurys the start of more comprehensive adoption for onchain financial obligation, equity and yield items. “Ethereum offers the requirements and liquidity for these instruments to prosper,” he stated.

Related: Bit Digital moves treasury method with 100K ETH buy; stock rises 29%

Laws stay an obstacle

On the other hand, Youssef kept in mind that regulative unpredictability stays a crucial barrier to ETH treasury adoption. He stated there is a requirement for much better assistance on how staking is categorized, whether it counts as a service, a security or something various.

For corporations to leap in, they likewise require clearness on accounting, tax treatment of staking benefits and custody requirements. “Big corporations tend to move gradually since they can’t manage legal uncertainty. As soon as those boxes are ticked, adoption will speed up.”

Publication: United States dangers being ‘front run’ on Bitcoin reserve by other countries– Samson Mow