Secret takeaways

-

DCA is a trading technique that utilizes automated, little, routine buys to remain invested without attempting to time every relocation.

-

There’s a clear precedent for scalability: El Salvador has actually been openly DCA’ing 1 BTC daily given that Nov. 17, 2022.

-

Nevertheless, lump-sum investing typically wins in uptrends– traditionally exceeding DCA about two-thirds of the time.

-

It works finest for financiers who make frequently in fiat and choose a stable, rule-based method over spontaneous trading.

What is DCA?

Dollar-cost averaging (DCA) is the practice of purchasing a repaired quantity of a possession at routine periods, such as each week or month, without thinking about rate motions.

By spreading your entries in time, you lower the danger of mistiming a single big purchase and accomplish a typical entry rate that mirrors the marketplace’s ups and downs.

Think of investing $10 in Bitcoin (BTC) each week. When the rate drops, your $10 purchases more systems; when it increases, you purchase less. Gradually, these purchases balance out into a single expense basis.

DCA will not safeguard you from drawdowns if the possession keeps trending lower. In a progressively increasing market, a lump-sum financial investment typically carries out much better. Usage DCA as a tool for discipline and automation to assist you remain constant.

Why crypto financiers utilize DCA

Crypto trades 24/7, with sharp relocations as most likely on a Sunday night as on a Tuesday early morning. In such a constant market, attempting to “choose your minute” is primarily uncertainty, which is why lots of financiers choose a guideline that gets rid of the requirement for ideal timing.

DCA supplies precisely that: You set the possession, quantity and frequency, then let the schedule manage the rest. The outcome is stable direct exposure without the pressure to respond to every market swing.

There’s a mental advantage, too. A basic, pre-set regular assists suppress worry of losing out (FOMO) on green days and panic on red ones. Rather of responding to headings, you adhere to the strategy.

It’s likewise simple to establish. Many significant exchanges and wallets now provide repeating buy or “Auto-Invest” alternatives: Simply pick your coin, choose a weekly or regular monthly schedule and let the orders run immediately.

For anybody constructing a position from routine earnings, such as wage, freelance payments or side hustles, DCA fits nicely into daily financial resources. It likewise keeps decision-making calm and repeatable.

Did you understand? Fundstrat analysis recommends that missing out on simply the 10 finest Bitcoin days in a year can erase most or all of that year’s gains. Timing completely isn’t simply hard; it’s expensive.

Case research study: El Salvador’s Bitcoin DCA

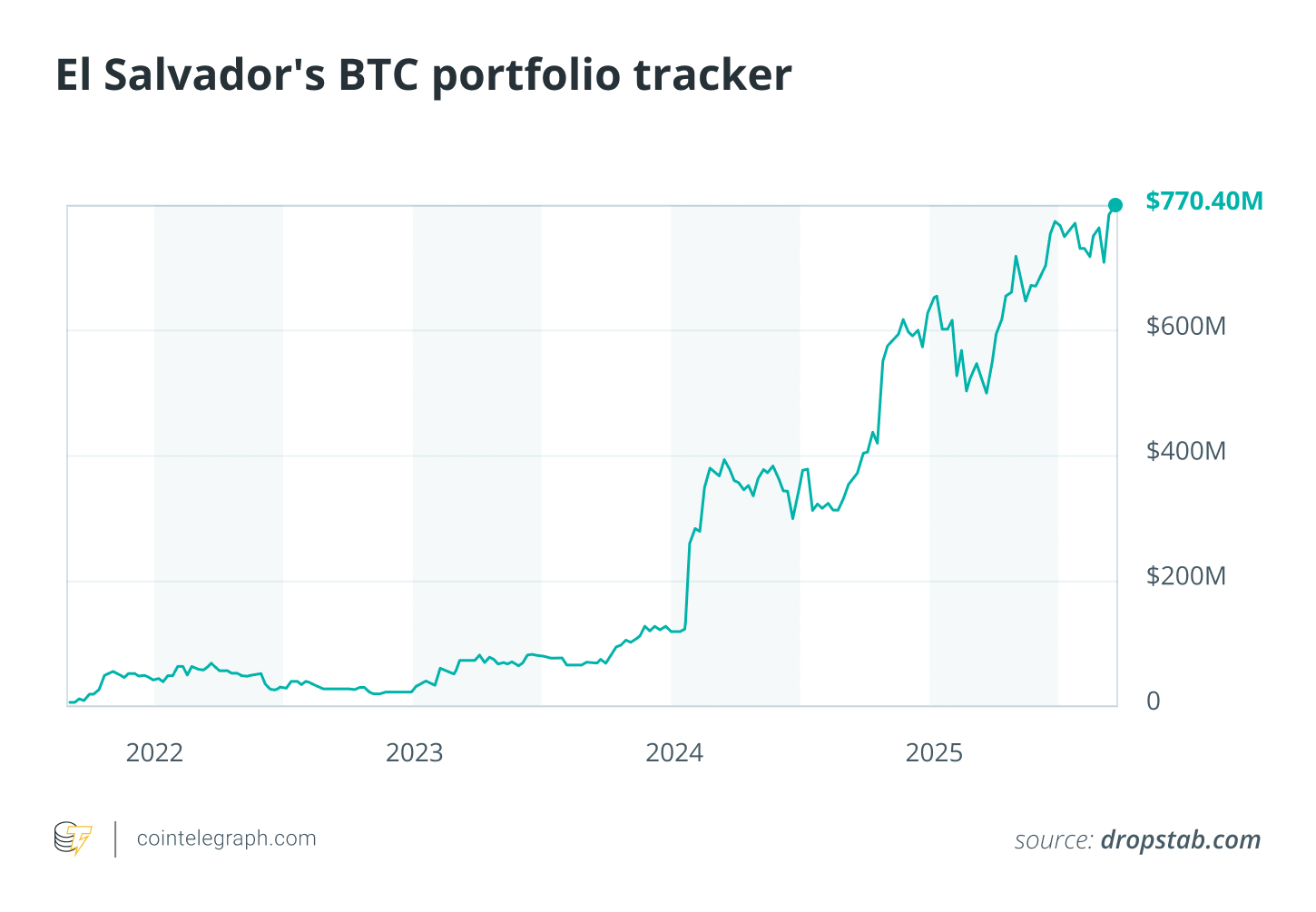

A real-world example: El Salvador made Bitcoin legal tender in 2021 and selected stable build-up rather of headline-grabbing bets. On Nov. 17, 2022, President Nayib Bukele set an easy guideline: purchase one Bitcoin every day– a transparent regular anybody can confirm.

There have actually been symbolic top-ups. On “Bitcoin Day” in September 2025, Bukele revealed a 21-BTC purchase, taking divulged reserves to about 6,313 BTC.

Likewise, not every coin originated from the marketplace; geothermal mining apparently included around 474 BTC over 3 years (little in energy terms, however still additive).

How has it exercised? Throughout the late-2024-to-mid-2025 rally, media approximates pointed to latent gains of $300 million by December 2024, increasing to portfolio worths north of $700 million months later on, indicating numerous millions in revenue at peak. Figures move with rate, however the pattern was clear because increase: Disciplined purchasing constructed a significant position.

Certainly, an easy, repeatable guideline can act both as a policy signal and as a functional routine for long-lasting build-up.

Did you understand? Technique (previously MicroStrategy) has actually ended up being the biggest business Bitcoin holder, reporting 640,000 BTC by late September/early October 2025– an institutional-scale, rules-driven build-up story.

Typical errors and threats in DCA

Even with a prominent example, DCA isn’t without downsides. The primary one is chance expense. In an increasing market, a swelling amount typically wins since more of your capital take advantage of the gains previously. Research studies in equities reveal lump-sum investing outshines expense averaging approximately two-thirds of the time, and the exact same reasoning can reach crypto.

Next, costs and friction. Numerous little orders can increase total expenses. Platforms typically include spreads on top of specific trading costs, and onchain transfers consist of network costs. If your charge structure punishes small orders, making less, bigger purchases might be more effective.

There’s likewise execution and place danger. Standing orders depend upon deposits clearing and automations running efficiently, however blackouts or hold-ups can interfere with the schedule. Utilizing a central platform likewise exposes you to functional, legal and security threats, so choose thoroughly how you’ll hold your possessions.

Habits matters, too. Balancing into a possession that keeps falling still loses cash, and DCA typically tracks lump-sum investing throughout strong booming market.

Lastly, admin and tax: Regular buys develop numerous lots to track. For instance, in the UK, His Majesty’s Earnings and Custom-mades (HMRC) pooling guidelines need mindful record-keeping. Inspect your regional tax assistance before allowing “Auto-Invest.”

Did you understand? Network costs aren’t consistent. Around significant occasions (like the 2024 halving and token-minting crazes), onchain costs surged even as rates supported, so repeating onchain transfers can cost more at hectic times.

DCA or swelling amount? A side-by-side appearance

When (and when not) to utilize DCA

DCA fits individuals who desire stable direct exposure without attempting to time every relocation. If you’re brand-new, brief on time or just choose a calm regimen, a repaired automated buy assists you remain invested through the sound.

It likewise works well for anybody earning in fiat who can reserve a little, routine quantity rather of dedicating a swelling amount. The genuine benefit is behavioral: You change impulse with routine and stop second-guessing every choice.

Still, it’s not for everybody. If you’re resting on a substantial money stack and comfy with danger, history reveals that putting it to work at one time typically carries out much better in increasing markets. And if your design includes short-term trading around drivers, a sluggish, calendar-based strategy will not fit your objectives.

A couple of guardrails assistance: Choose a quantity you can sustain even throughout drawdowns; automate however inspect costs and spreads– if little orders cost more, purchase less typically in bigger quantities; choose ahead of time how you’ll take revenue, rebalance or stop (time-based, target allowance or goal-linked); and make a clear custody strategy, whether through an exchange, broker or self-custody, with standard security in location.

DCA is a discipline tool that rewards simpleness and consistency over speed. Whether it’s ideal for you depends upon your capital, danger tolerance and just how much you value a stable, rule-based procedure.

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.