Yield Basis, a procedure established by the decentralized financing (DeFi) platform Curve Financing, reduces impermanent loss for tokenized Bitcoin (BTC) and Ether (ETH) liquidity companies (LPs), while likewise developing a market-based method to token inflation and emissions, according to Curve creator Dr. Michael Egorov.

Impermanent loss in crypto takes place when the cost of properties transferred in a liquidity swimming pool dips or deviates in a manner that leaves the user with less funds than if they had actually just held their crypto and not taken part in liquidity provisioning.

Dr. Egorov informed Cointelegraph that when funds transferred in a liquidity swimming pool are proportional to the square root of Bitcoin’s cost, it produces impermanent loss. The Curve Financing creator stated:

” Impermanent losses occur due to the fact that of this square root reliance. So, we truly wish to eliminate the square root. How do we eliminate the square root? The very best method mathematically to eliminate the square root is to square it.”

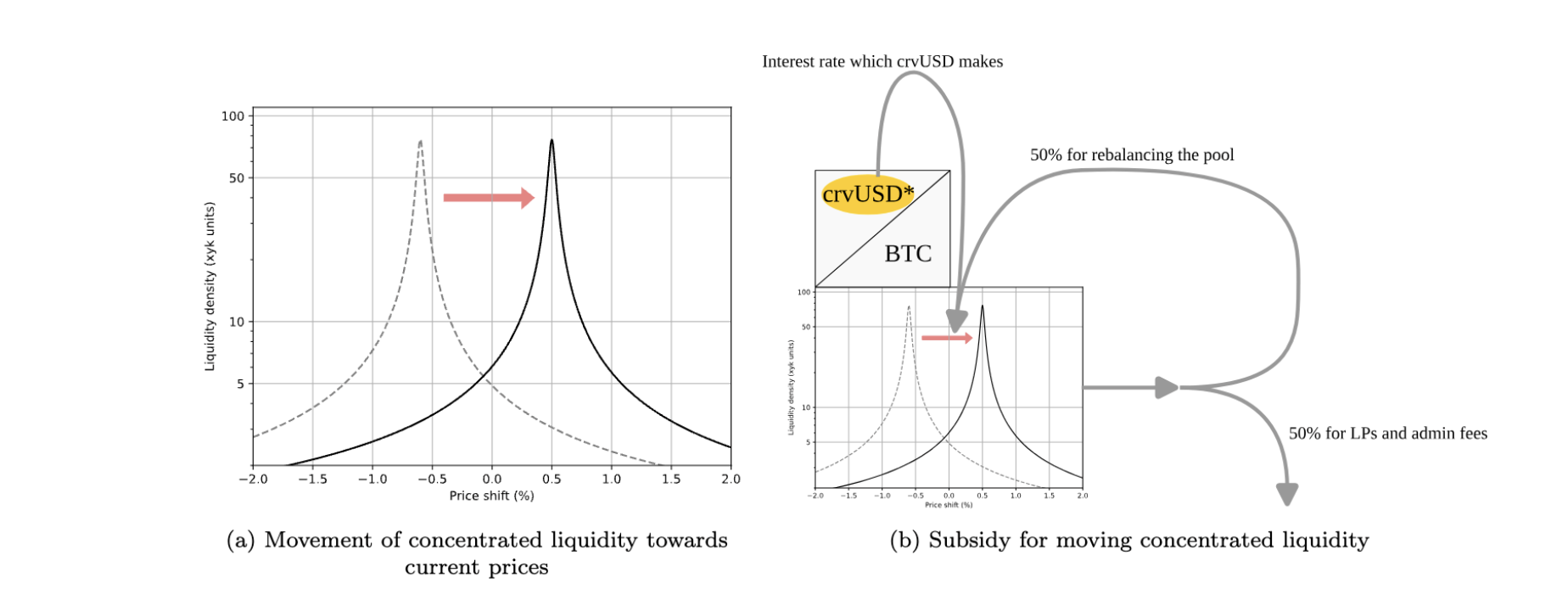

Yield Basis resolves intensifying take advantage of, which keeps a position overcollateralized by precisely 200% at all times by supplementing the positions with obtained crvUSD, the DeFi platform’s United States dollar-pegged decentralized stablecoin.

This keeps the cost of the position at precisely double the security transferred, getting rid of the square root issue at the heart of impermanent loss, Egorov stated.

Impermanent loss has actually afflicted liquidity companies for several years and likewise wards off potential LPs from going into the video game.

Related: Solv Procedure targets over $1T in idle Bitcoin with institutional yield vault

Bifurcated yield choices assistance to set inflation rates and lower token emissions

Users have the choice of getting yield denominated in either tokenized Bitcoin or the Yield Basis token, which produces a market-oriented service for setting inflation rates and managing token emissions, the Curve creator stated.

” In various market conditions, you require to do various things,” he included. Egorov informed Cointelegraph that in speculative booming market, lots of users would likely pick to hold and stake the YB token for cost gratitude, enabling genuine yield to accumulate to the platform.

On the other hand, throughout lengthy bearishness, users will likely pick to play it safe and get their yield in Bitcoin, reversing YB token inflation developed throughout speculative market stages and supplying “optimum” worth accrual to the YB token.

Publication: DeFi will increase once again after memecoins wane: Sasha Ivanov, X Hall of Flame