Secret takeaways:

-

CZ’s reference turned meme token “4” into a trade; one early purchaser saw $3,000 grow to $2 million.

-

The trigger was the hack of BNB Chain’s X account, which generated “4.”

-

The rise originated from circulation striking thin liquidity, not principles.

-

Some wallets had actually currently purchased minutes before CZ’s post.

On Oct. 1, 2025, BNB Chain’s authorities X account was pirated and utilized to press phishing links. Within hours, the drama spun into a joke token on BNB Chain called “4,” a spirited nod to reports that the opponent snatched just about $4,000.

Then, Changpeng “CZ” Zhao, Binance’s co-founder and previous CEO, referenced the event.

That single reference turned a specific niche gag into a live market signal as attention flooded into a new swimming pool with hardly any liquidity.

In the rush that followed, one early purchaser put about $3,000 worth of BNB (BNB) into “4” and enjoyed it increase to around $2 million on screen within hours.

Did you understand? When CZ tweets “4,” he’s referencing point # 4 from his 2023 “Do’s & & Do n’ts” list: Neglect FUD, phony news, attacks, and so on. It ended up being a neighborhood shorthand long before the 4 memecoin appeared.

How a meme developed into a relocation

1. BNB Chain account pirated (Oct. 1, 2025)

BNB Chain’s authorities X account was jeopardized and utilized to publish phishing links to approximately 4 million fans. The group later on restored control and provided cautions. Out of the turmoil came a running joke that the opponent snatched just “$ 4k.”

2. A joke gets a ticker

Within hours, a brand-new token called 4 released on BNB Chain– a wink at the “$ 4k” meme. Early purchasers started circling around a new liquidity swimming pool that was hardly moneyed.

3. CZ enhances it

Changpeng “CZ” Zhao referenced the event to his 10.3 million fans, keeping in mind the hacker’s little revenue and how the neighborhood “purchased the memecoin greater.” What started as a joke rapidly developed into a live trade signal. Human traders and bots now had a ticker to chase after.

4. The very first wave of orders hits

Scanners flagged the agreement, copy traders queued buys, and retail streamed through aggregators into the very same shallow swimming pool. With wafer-thin depth, each filled order raised the next quote. Slippage expanded, momentum intensified, and the chart turned near-vertical.

5. The heading wallet is currently in

An address identified “0x872” purchased in early with about $3,000 worth of BNB. As attention flooded the swimming pool and liquidity thinned, that little stake swelled to approximately $2 million within hours.

Inside the winning wallet

The wallet that got headings (” 0x872″) didn’t appear like a mastermind. It put around $3,000 worth of BNB into a newly minted token and, as attention hit, enjoyed its mark-to-market skyrocket.

What turned a modest position into a paper fortune was getting in early a thin swimming pool. When liquidity is shallow, every brand-new purchaser rises the next quote you ‘d offer into– whether you really offer or not.

Then came the minute every speculator both desires and fears: life-altering numbers on screen with nearly no depth below.

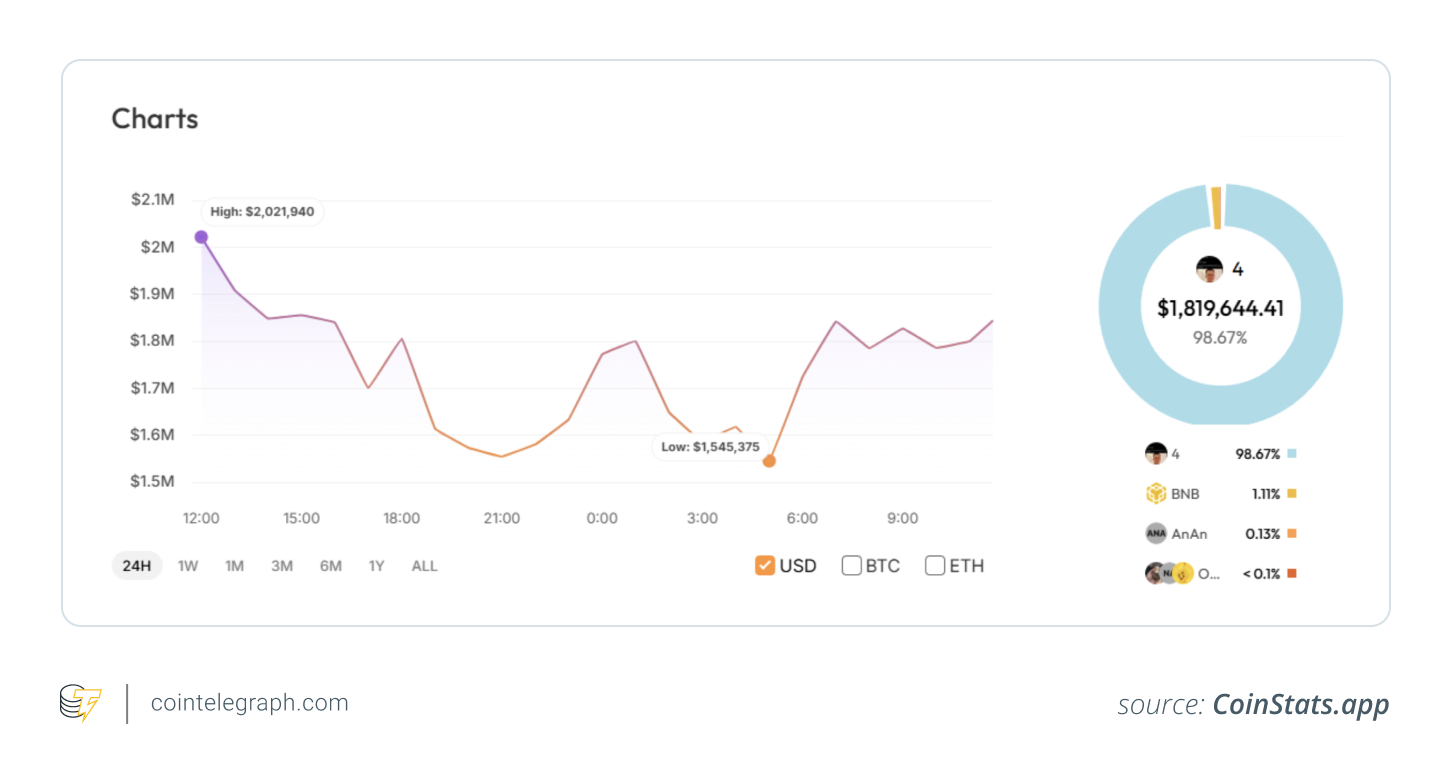

Onchain traces reveal just light profit-taking. The address kept over 98% of its portfolio in 4, still around $1.88 million after the very first spike, taking full advantage of upside if momentum held, however leaving the position exposed if a single good market sell struck the swimming pool.

The screenshots informed the very same story: approximately $1.8 million in latent revenue over the week.

” Latent” is the personnel word. Till an order fills, revenue and loss (PnL) is simply an idea. In locations where one sale can move the cost numerous portion points, even cutting needs intent and a strategy. Numerous traders discover this by round-tripping a recover to par; this wallet, for a time, picked to ride.

Circulation around the wallet fed the loop. “Smart cash” addresses tracked by Lookonchain started purchasing 4, pressing it into the most collected BNB Chain tokens over the next 24 hr.

That feedback loop amplified reflexivity. As more screens illuminated and copy trades fired, the early holder’s latent worth kept climbing up– till a bigger seller lastly checked the swimming pool’s depth.

0x872’s result depended upon 2 options: actioning in ridiculously early and withstanding the instant desire to squander.

Did you understand? 0x872 wasn’t alone. Another wallet had actually apparently purchased minutes before CZ’s post and was up 7 figures within hours– a suggestion that quickly signals and feed tracking can develop a genuine edge in meme-driven bursts.

When buzz outruns depth

So, what remains in shop for the heading wallet? Optimum upside if momentum holds and optimum drawback if a single good sell order strikes a shallow swimming pool.

However we should not forget the driver: a jeopardized authorities account. Spikes like this bring in phishers and look-alike agreements. The takeaway is procedural. Confirm the agreement and the swimming pool size, script an exit beforehand and deal with screenshots as recommendations till a fill clears.

Posts develop circulation, not worth, and the exit door is narrower than it looks.

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.