In 2025, continuous decentralized exchanges (DEXs) got in a stage of quick development, marked by growth in trading volume and other crucial metrics. The increase of hybrid main limitation order book (CLOB) designs significantly enhanced efficiency and user experience, narrowing the space with central exchanges (CEXs).

In this report, HTX Research study analyzes the landscape of continuous DEXs, their advancement, present patterns and the brand-new exchanges becoming crucial gamers.

How the advancement of continuous DEXs drives market development

Decentralized continuous futures exchanges emerged in 2019 and have actually given that gone through considerable development and advancement. They have actually shown to be among the most effective and useful usage cases for DeFi.

Continuous DEXs very first embraced CLOB-based styles, led by dYdX, which mirrored CEXs by integrating offchain order books with onchain settlement. As the marketplace developed, a brand-new generation of onchain designs emerged, which utilized automatic market maker (AMM) mechanics with oracle-priced pooled liquidity, such as GMX and Perpetuals Procedure.

Today, hybrid CLOB styles, exhibited by Hyperliquid, control the continuous DEX market. These exchanges integrate onchain custody and settlement with order-matching systems on customized appchains or rollups to attain near-instant execution. This method offers clear technical benefits, consisting of more precise cost discovery, tighter spreads and assistance for high-frequency trading.

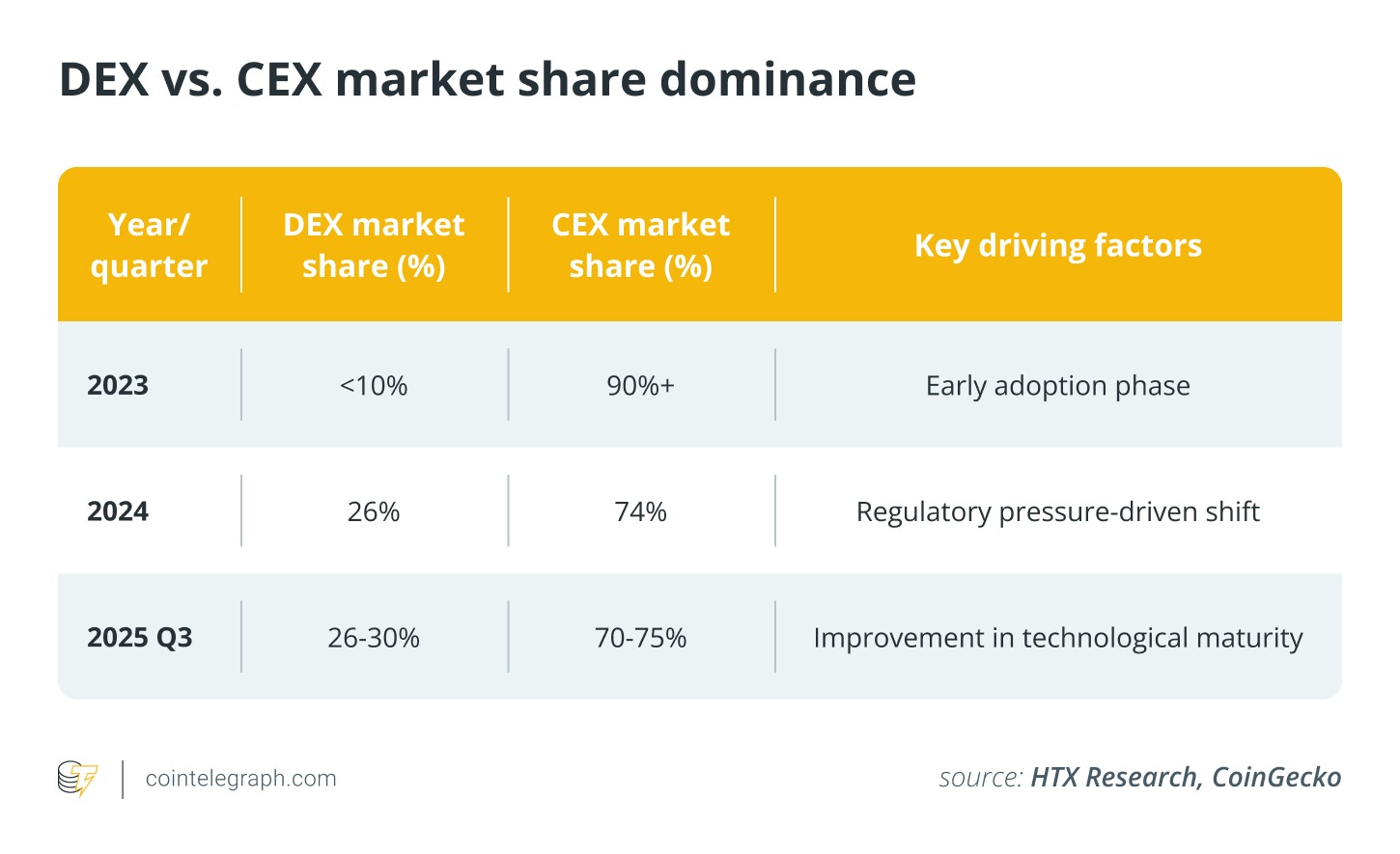

These technical improvements, together with simpler user onboarding and the lack of KYC requirements, have actually driven the adoption of continuous DEXs. Their share of the worldwide continuous futures market increased from 2.7% at the end of 2023 to 26% by mid-2025, highlighting the growing need for decentralized trading facilities.

Check out the complete report to see how continuous DEX development is improving decentralized derivatives trading.

Leading perp exchanges and emerging gamers

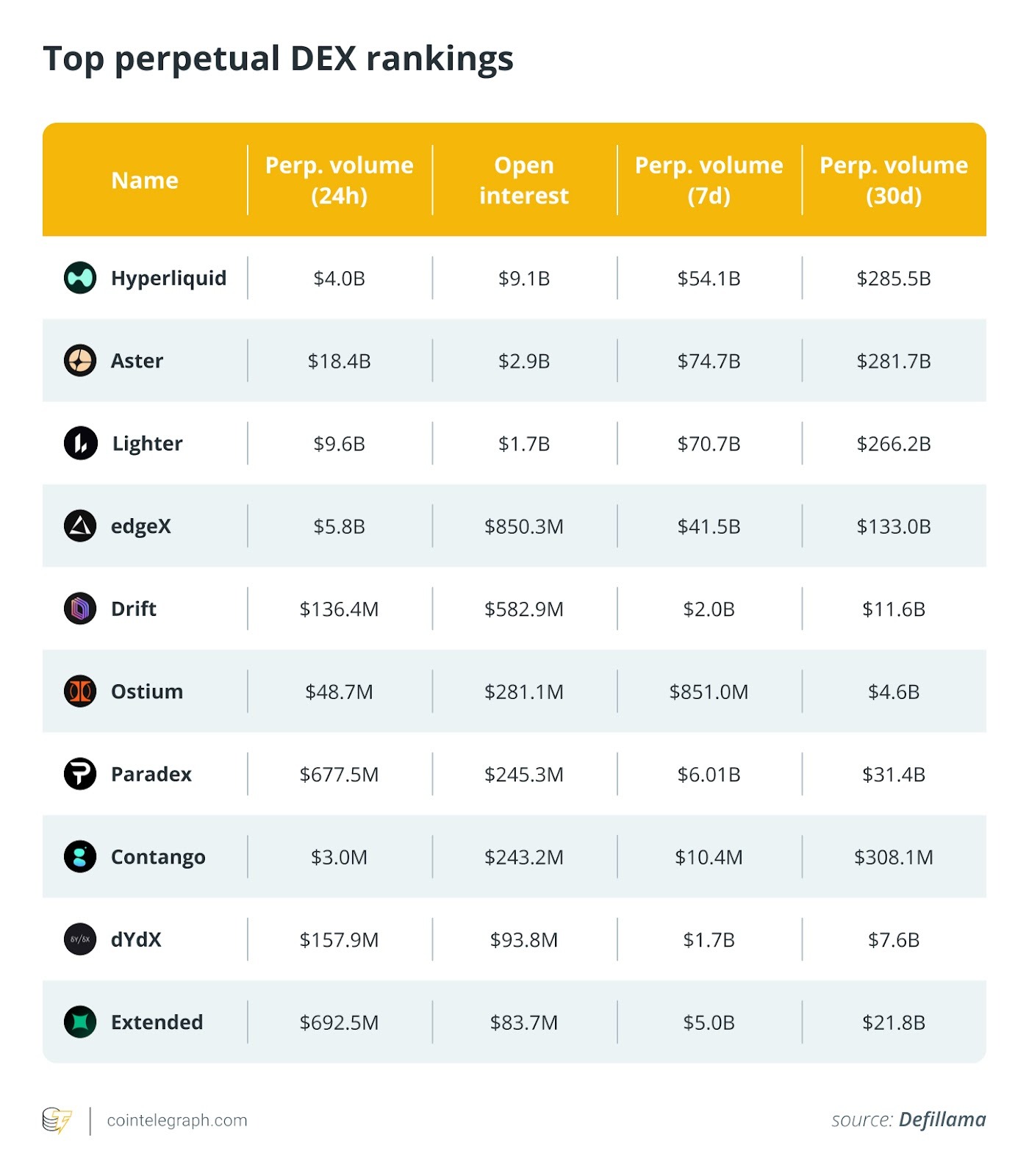

Hyperliquid introduced in early 2023 and ended up being a market leader within a year and a half. Its market share peaked at 73% in the 2nd quarter of 2025 before brand-new rivals drew part of its user base. It now holds about 32% of overall trading volume and an open interest of $9 billion, which is more than 54% of continuous futures open interest.

Among the primary elements behind Hyperliquid’s success was its airdrop technique, which motivated users to trade actively on the platform over a prolonged duration. The task dispersed a large airdrop that created more momentum as its native token, BUZZ, exceeded the marketplace in the weeks following the circulation.

A comparable method was quickly embraced by the brand-new entrants Aster and Lighter, which ended up being significant rivals with Hyperliquid. These 2 exchanges recorded part of Hyperliquid’s market share. Aster leveraged its close combination with the Binance environment to attain quick development and now ranks 2nd by open interest.

While airdrop projects assisted draw in users, competitors in the sector continues to heighten. In the short-term, the market will stay an arms race concentrated on functions and charges. In the medium term, success will depend upon liquidity depth, institutional preparedness and crosschain availability.

See more information on the leading Perp DEXs in 2025, their technical functions and traction in the complete report.

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.

This short article is for basic info functions and is not planned to be and need to not be taken as legal or financial investment suggestions. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.

Cointelegraph does not back the material of this short article nor any item discussed herein. Readers need to do their own research study before taking any action associated to any item or business discussed and bring complete duty for their choices