Secret takeaways

-

ChatGPT can streamline and speed up crypto analysis by translating market information, summing up belief and creating technique design templates.

-

Genuine traders utilize ChatGPT for bot advancement, technical analysis and backtest simulation, revealing useful applications beyond theory.

-

Its strength depends on enhancing, not changing, human trading choices, specifically when coupled with tools like TradingView and LunarCrush.

-

Limitations consist of an absence of real-time information and periodic timely misconception; success depends upon timely clearness and handbook oversight.

-

Integrated with external platforms, ChatGPT enters into an effective hybrid workflow for retail and expert crypto traders.

In the hectic world of cryptocurrency, remaining ahead of market patterns is not simply a benefit– it’s a requirement. With countless coins, ever-shifting costs and worldwide financial aspects affecting worth in genuine time, crypto markets can be frustrating to keep track of and evaluate. Conventional techniques typically fall brief in speed, depth and insight.

Go Into ChatGPT, an AI-powered assistant that changes how traders and financiers engage with information. ChatGPT assists users process large quantities of info with clearness and self-confidence, from deciphering intricate charts to summing up market belief.

This short article checks out how to utilize ChatGPT for crypto analysis, from creating market insights to crafting tailored trading methods utilizing historic information and real-time belief hints.

Whether you’re a novice try out your very first trade or a skilled financier handling a varied portfolio, AI tools like ChatGPT are quickly ending up being important in crypto investing.

Comprehending ChatGPT’s function in crypto analysis

ChatGPT, established by OpenAI, is a language design trained on a huge information set efficient in translating, summing up and creating human-like text based upon input triggers. It comprehends patterns in information and can equate numbers, occasions and belief into actionable insights.

For crypto traders and experts, ChatGPT can assist with:

-

Drawing out insights from technical indications and trading metrics

-

Summing up belief from social networks and crypto news

-

Drafting and refining crypto trading methods

-

Carrying out qualitative danger evaluations and situation preparation

-

Getting conceptual cost forecast situations based upon present information and patterns.

Nevertheless, ChatGPT can not forecast future costs with real-time precision. Any projections or situations it uses are simply theoretical and ought to not be translated as financial investment recommendations.

Even if ChatGPT does not change live information feeds or pro-level analysis tools, it increases efficiency, improves clearness, and matches other technical and analytical platforms.

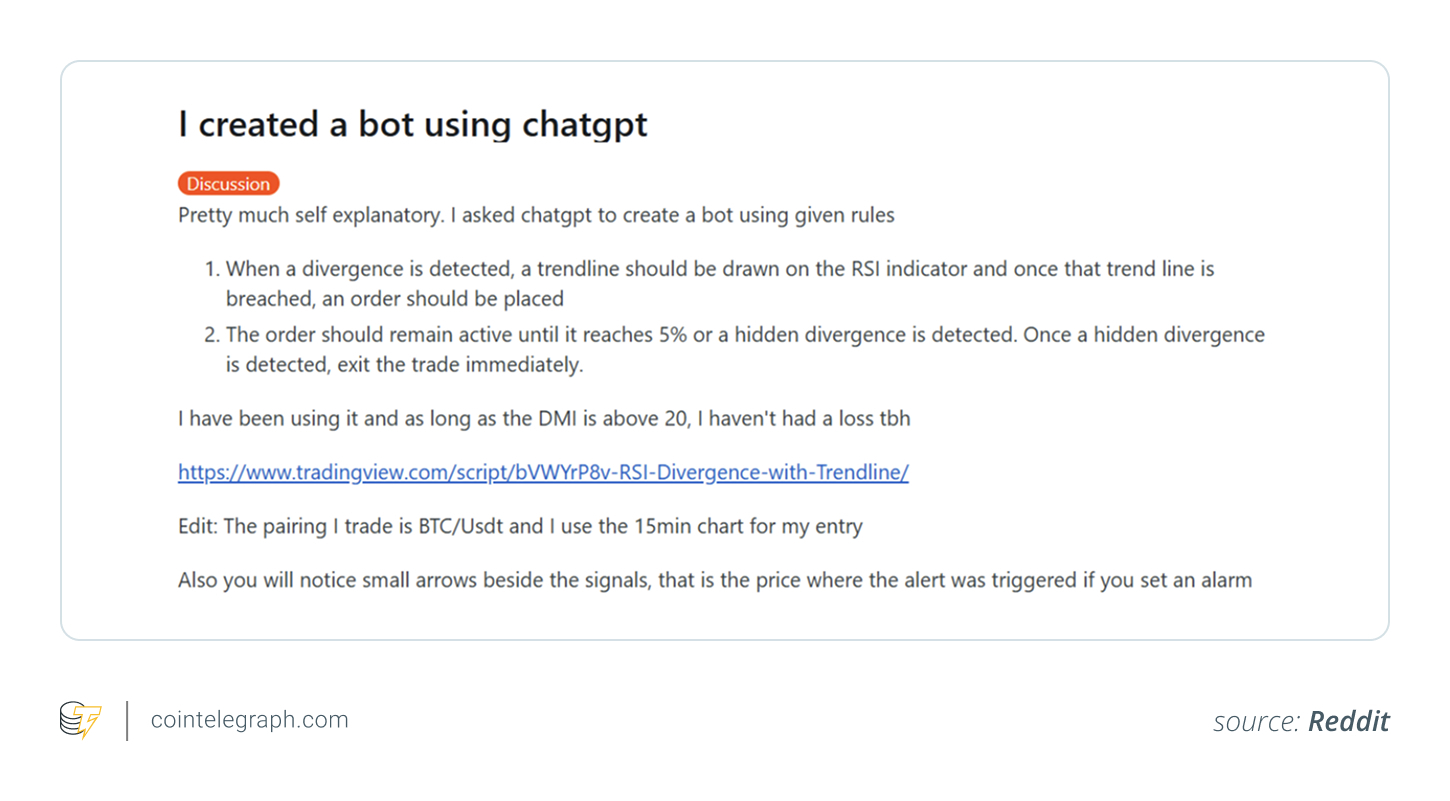

The above is an example of a user who asked ChatGPT to develop a crypto trading bot that puts trades when relative strength index (RSI) divergence pattern lines are broken and exits on concealed divergence or 5% revenue, utilizing BTC/USDT on a 15-minute chart with a directional motion index (DMI) above 20. DMI is a technical analysis indication that assists recognize whether a property is trending and the strength of that pattern.

Detailed guide: How to utilize ChatGPT for crypto market analysis

Action 1: Specify your goal

Before triggering ChatGPT, recognize what you wish to attain:

-

Are you attempting to identify if it’s a great time to get in the marketplace?

-

Are you looking into a particular coin or pattern?

-

Are you creating a brand-new trading algorithm?

Clear, outcome-focused goals lead to sharper, more appropriate AI actions.

Action 2: Usage clear, structured triggers

The efficiency of ChatGPT is mostly driven by the quality of your input. Specify and succinct. Example triggers:

-

” Examine the current BTC cost pattern utilizing historic information and moving averages.”

-

” Sum up Ethereum belief from X, Reddit, and crypto news posts for the previous week.”

-

” Create a scalping technique utilizing RSI, MACD, and 15-minute chart periods.”

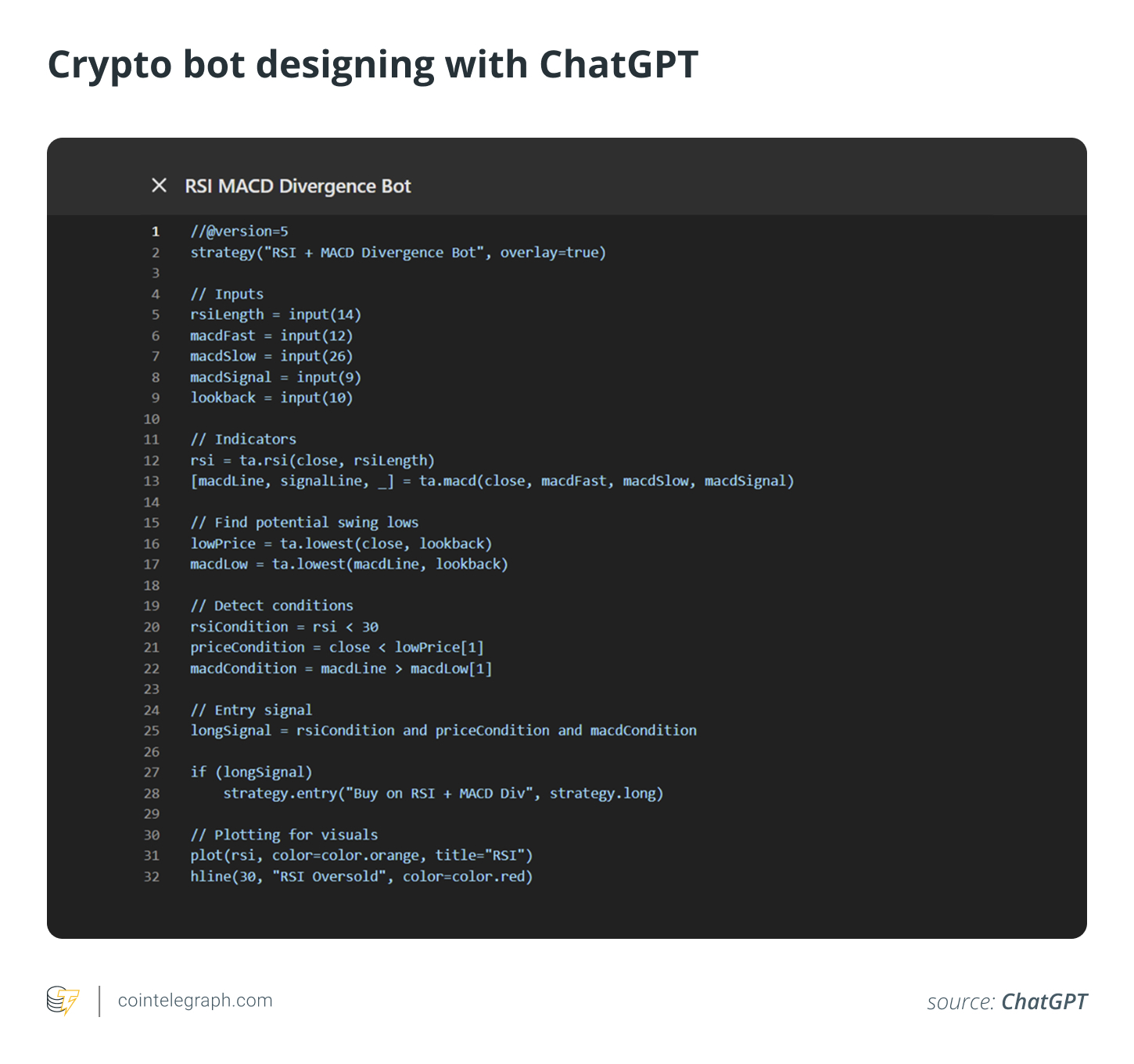

For instance, ChatGPT was entrusted with creating a bot to set off trades just when the RSI dropped listed below 30 and the moving typical convergence/divergence (MACD) revealed divergence. It not just created the Pine Script reasoning however likewise advised including volume filters to lower incorrect signals.

The above script searches for strong purchasing chances when the marketplace is oversold and momentum begins to move up. It examines if the cost has actually just recently struck a low, momentum (MACD) is enhancing, and RSI is extremely low, then it signifies a prospective bounce by positioning a buy order.

Action 3: Examine technical indications

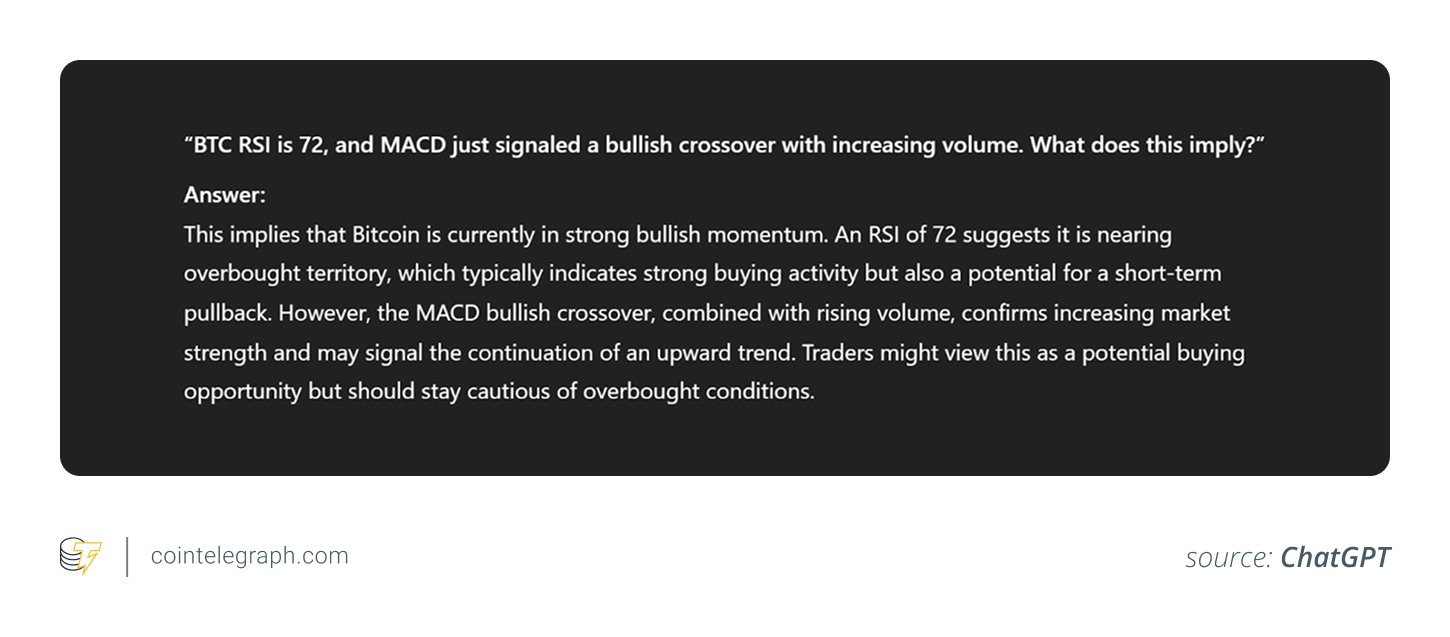

ChatGPT can break down indications like relative strength index (RSI), Bollinger Bands, Fibonacci retracements, moving typical convergence/divergence (MACD) and more. Although it can not access real-time charts, you can input information points such as:

ChatGPT will translate the technical conditions and offer rational descriptions for what those signals might suggest.

Action 4: Assess market belief

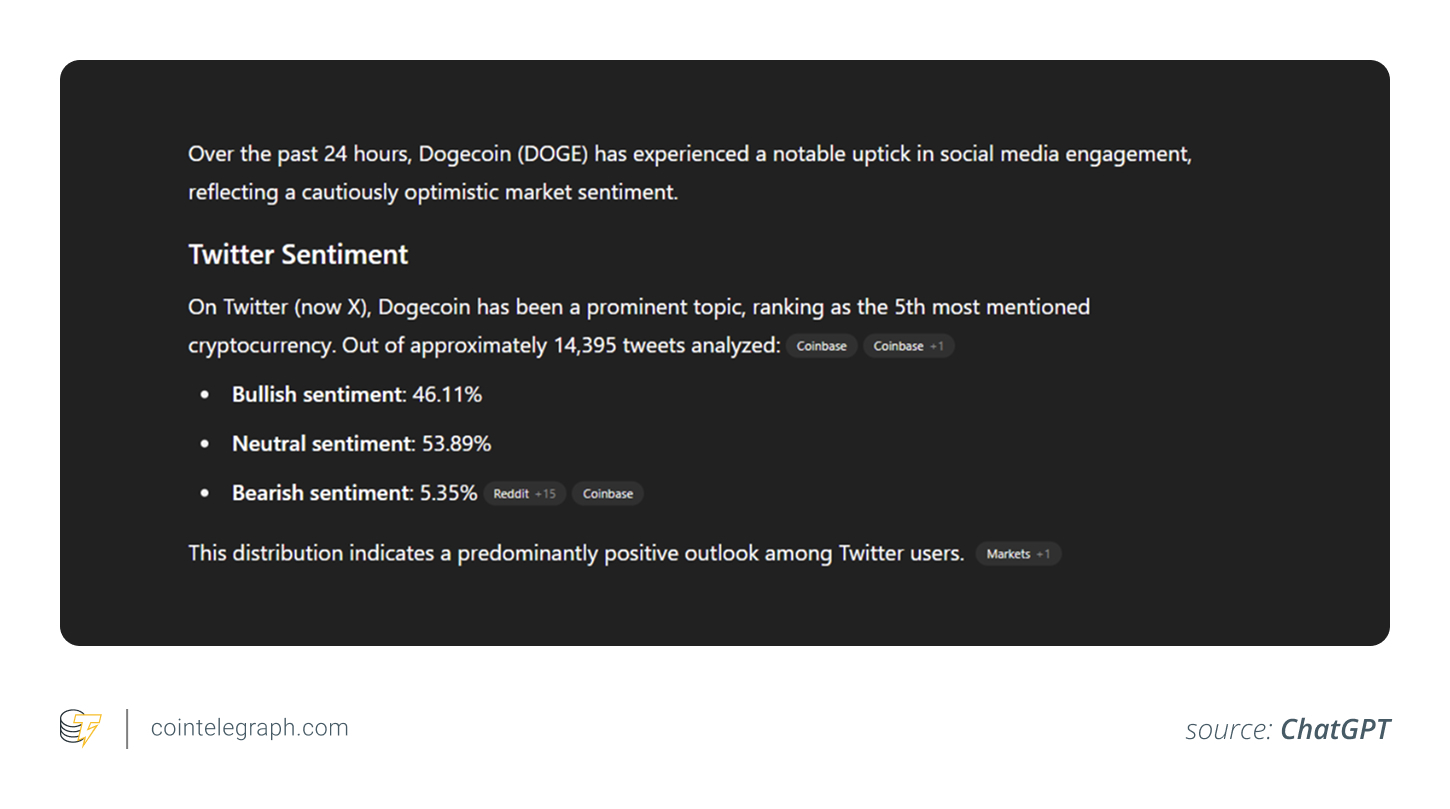

Crypto markets are extremely affected by belief. Worry, buzz and FOMO can drive cost action more than principles. ChatGPT can assist examine the psychological tone of the marketplace by evaluating user-provided summaries or scraped material:

Here’s ChatGPT’s action:

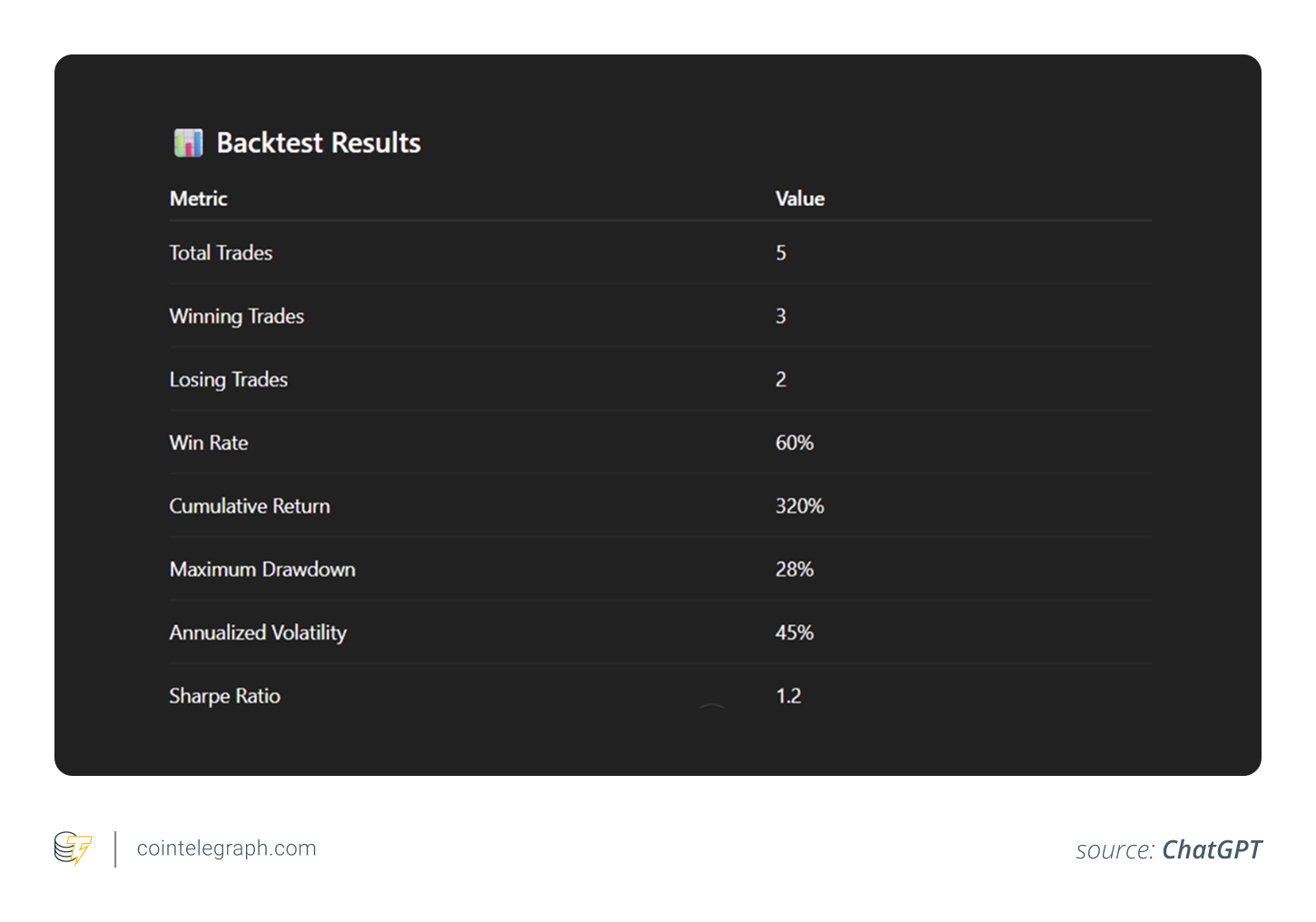

Step 5: Backtest trading methods (conceptually)

While ChatGPT isn’t created to carry out analytical backtesting, it is proficient at conceptual recognition. You can explain a technique and ask it to stroll through how that technique would have carried out under various historic conditions:

ChatGPT will mimic the results (as in the image above) based upon historic presumptions and discuss the strengths and weak points. Still, for mathematical precision, this ought to be cross-checked utilizing real backtesting software application.

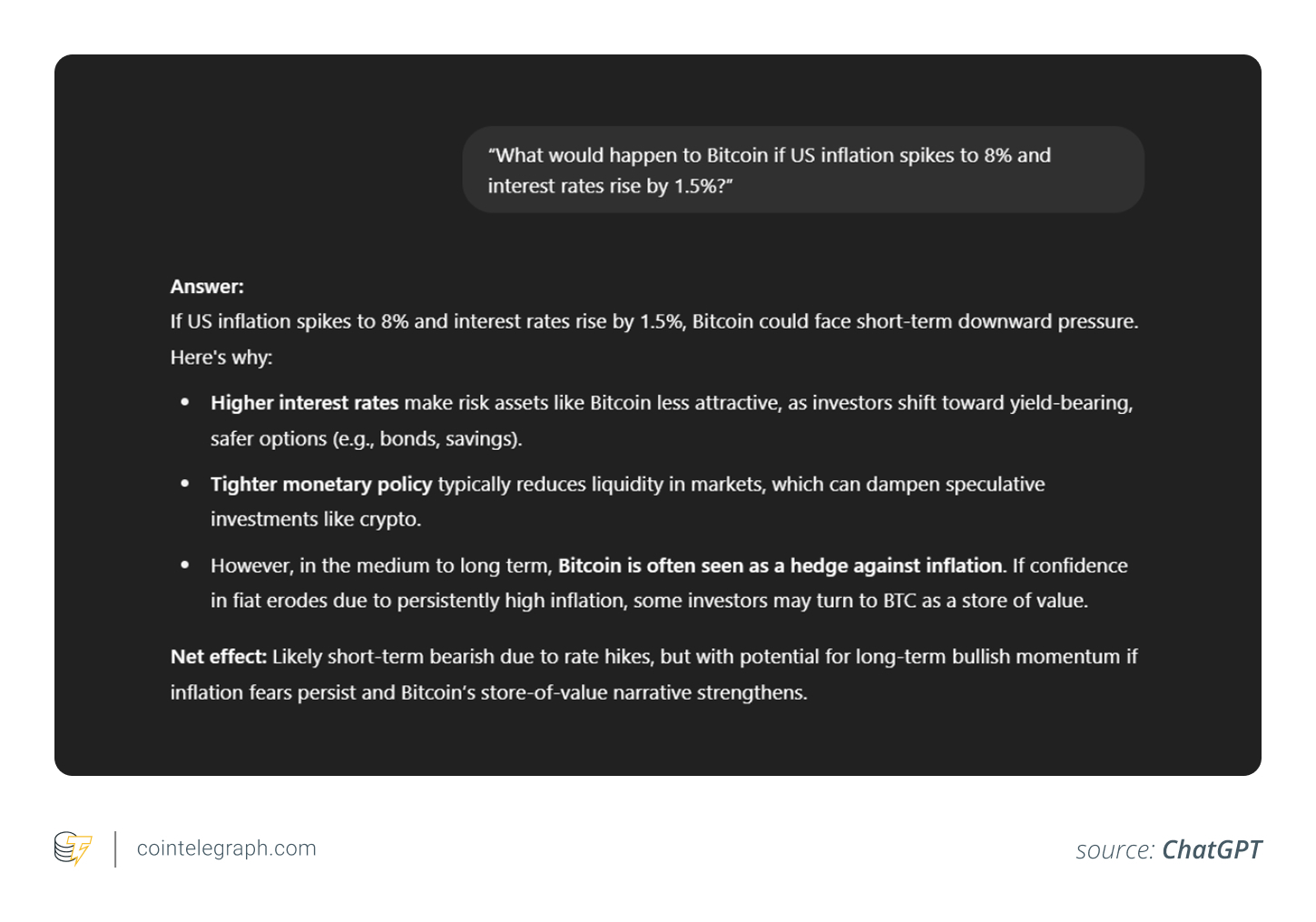

Action 6: Mimic situations and predictive results

Predictive analysis is where ChatGPT might shine as a tactical consultant. Traders can input theoretical situations and demand ramifications:

When asking ChatGPT, it reacted that if United States inflation spikes to 8% and rate of interest increase by 1.5%, Bitcoin (BTC) might deal with short-term bearish pressure due to decreased liquidity however might get long-lasting appeal as an inflation hedge.

It is essential to comprehend that ChatGPT might provide speculative insights based upon historic reasoning and belief patterns, not real-time or statistically driven forecasts.

Examples triggers for ChatGPT-powered crypto trading

The quality of your triggers specifies the quality of insights you’ll get. Below are well-rounded examples customized for active traders, integrating technical, onchain and belief analysis:

-

Develop a swing trading technique for XRP (XRP) utilizing RSI

-

Create a weekly market summary for BTC, ETH and SOL, consisting of cost action, volume modifications and significant news drivers.

-

Compare current onchain patterns in between Polygon and Avalanche. Concentrate on active addresses, gas costs and overall worth locked (TVL).

-

Task DOT cost motion over the next 90 days, presuming Polkadot ETFs are authorized. Think about market belief and historic ETF launch impacts.

-

Sum up current stablecoin-related regulative modifications in the EU and United States and discuss how they may impact DeFi procedures and central exchanges.

These triggers offer examples for traders who wish to utilize AI to support their research study and analysis. While practical for accelerating insights, they ought to not be counted on for making last trading choices.

Advantages of utilizing ChatGPT in crypto trading

ChatGPT for crypto traders is a vibrant extension of your toolkit, whether you’re examining crypto signals, backtesting reasoning or summing up patterns. It empowers crypto traders by offering:

-

Ease Of Access: No coding experience required. Anybody can ask clever concerns and get in-depth responses.

-

Speed: Create thorough analysis, technique design templates or summaries in seconds.

-

Modification: Tailor every action to your particular requirements, from swing trading to long-lasting hodling.

-

Versatility: ChatGPT can move in between basic, technical and sentiment-based viewpoints.

-

Automation: With combinations, ChatGPT can be developed into bots or control panels for continuous analysis.

Limitations of ChatGPT

Regardless of its power, ChatGPT has some restrictions you ought to understand:

-

No real-time information: Unless linked to APIs or plugins (in innovative ChatGPT variations or through third-party tools), ChatGPT can not bring live costs or charts.

-

Not certified monetary recommendations: ChatGPT uses basic assistance, not expert financial investment recommendations. You ought to never ever rely entirely on AI-generated output for monetary choices.

-

Trigger quality matters: The AI is just as excellent as the input it gets. Clearness and information are important.

-

No quantitative precision checks: It can not confirm information accuracy without recognition from external sources or live APIs.

Incorporating ChatGPT with other crypto tools

To open ChatGPT’s complete analytical capacity, it assists to combine it with specialized platforms that provide real-time information, visual analysis and automation.

The following tools function as important extensions that improve ChatGPT’s interpretive power:

-

Real-time market feeds: Usage CoinGecko, CoinMarketCap or Messari to provide ChatGPT with present market statistics through manual input or APIs.

-

Charting platforms: Extract RSI, MACD and other indications from TradingView, CoinGlass, Glassnode or CryptoQuant for ChatGPT to translate.

-

Onchain and belief analytics: Feed information from Santiment, Nansen or LunarCrush into ChatGPT to evaluate wallet circulations, token speed and belief patterns.

-

Automation tools: Usage Zapier, Make or Python bots to set off ChatGPT workflows based upon notifies or cost actions.

-

Advanced plugins (Pro): Extend ChatGPT’s abilities with plugins like Link Reader to bring real-time information straight.

By integrating ChatGPT’s pattern acknowledgment and synthesis with the accuracy of crypto tools, you develop a hybrid analysis stack that’s AI-assisted, data-driven and prepared for action. However constantly keep in mind, AI insights ought to direct, not change, important thinking and due diligence.

This short article does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.