Secret takeaways

-

Grok 4 can evaluate real-time X chatter, market information and onchain streams to highlight possible altcoin relocations.

-

Social rises, exchange listing reports, whale deals and utilize spikes are amongst the earliest signs of a pump signal.

-

Traders can utilize Grok 4 triggers to filter sound, rank coins by buzz strength and cross-check signals for greater conviction.

-

While Grok 4 can assist prepare for chances, pump-and-dump groups and low-liquidity traps stay significant threats.

Altcoin pumps do not simply appear out of thin air. They are generally preceded by whispers on X, unexpected trading volume on decentralized exchanges (DEXs) or a suspicious whale transfer. The obstacle has actually constantly been processing this firehose of information on time.

This is where Grok 4, xAI’s most recent design, can be found in. It has real-time access to public X posts and can run live web searches. Rather of scrolling constantly through hashtags and crypto groups, a trader can ask Grok 4: “Which tokens have had the greatest spike in points out in the previous hour, and what’s driving it?”

That mix of social and information awareness makes Grok 4 specifically beneficial for those attempting to capture pumps early before the mainstream notifications.

( Note: Grok can’t access personal Telegram groups.)

Why Grok 4 matters for identifying altcoin relocations

Standard trading tools are mainly backward-looking. By the time volume spikes appear on TradingView or an exchange notes a brand-new set, the “early” part of the pump is currently gone. Traders are left responding rather of preparing for.

What makes Grok 4 various is its capability to scan X in genuine time while likewise drawing in onchain circulations, financing rates and whale activity through linked APIs or relied on sources. To put it simply, it does not simply inform you what has actually currently occurred; it highlights the discussions, reports and wallet habits that generally come before the charts take off.

For instance:

-

If a memecoin unexpectedly doubles in points out on X within one hour, Grok 4 can flag it immediately.

-

If a recognized whale wallet sends out millions to Binance, Grok can pull that along with pertinent neighborhood chatter.

-

If financing rates on a small-cap continuous set warm up, Grok can reveal whether it’s natural interest or made buzz.

This “cross-signal awareness” is something traders typically attempt to piece together by hand by handling several control panels, crypto groups and informs. Grok 4 condenses it into a single conversational user interface where you can actually ask, “Which coins appear like they’re establishing for a pump today, and why?”

That’s why Grok 4 is significantly viewed as a tool for identifying altcoin relocations at the narrative phase, not simply the marketplace phase. As soon as you comprehend the sort of signals that normally precede a rally, you can utilize Grok to filter sound, rank chances and prepare before the larger market stacks in.

Did you understand? Neighborhood chatter typically results in market action. A massive research study research study of subreddit activity discovered that spikes in conversation volume regularly preceded cost boosts, and an easy technique based upon this pattern might have provided greater returns.

The primary signals behind altcoin pumps

1. Social network rises

Tokens like Pepe (PEPE) and Floki (FLOKI) didn’t rally initially on charts; they rallied initially on X timelines. A flood of memes and influencer posts can mark the start of an altcoin wave.

Grok 4 usage case: Ask Grok to scan for tokens with an unexpected dive in points out or hashtags, then sum up the leading 3 factors individuals are discussing them.

Example timely:

” Note the leading 2 altcoins with the fastest development in X points out over the previous 2 hours. For each, describe in a sentence why they are trending and whether the posts look natural or shill-driven.”

2. Exchange listing reports

Central exchange (CEX) listings are among the most constant pump drivers. Tokens typically construct heat on DEXs initially, then rise on the report (or verification) of a Binance or Coinbase listing.

Grok 4 usage case: Display X posts, job statements and neighborhood groups for tips of exchange activity.

Example timely:

” Exist any reputable posts on X in the last 24 hr recommending upcoming exchange listings for altcoins under $200M market cap? Sum up the most likely prospects.”

3. Financing rates and utilize

When financing rates on continuous swaps increase, it reveals traders are strongly wagering in one instructions. That typically fuels explosive relocations however likewise indicates a possible capture.

Grok 4 usage case: Rather of digging into raw numbers, Grok can describe which tokens have actually “overheated” utilize and what that may imply.

Example timely:

” Which altcoin continuous sets presently have financing rates much greater than their 30-day average? Discuss whether this recommends bullish overcrowding or possible liquidation threat.”

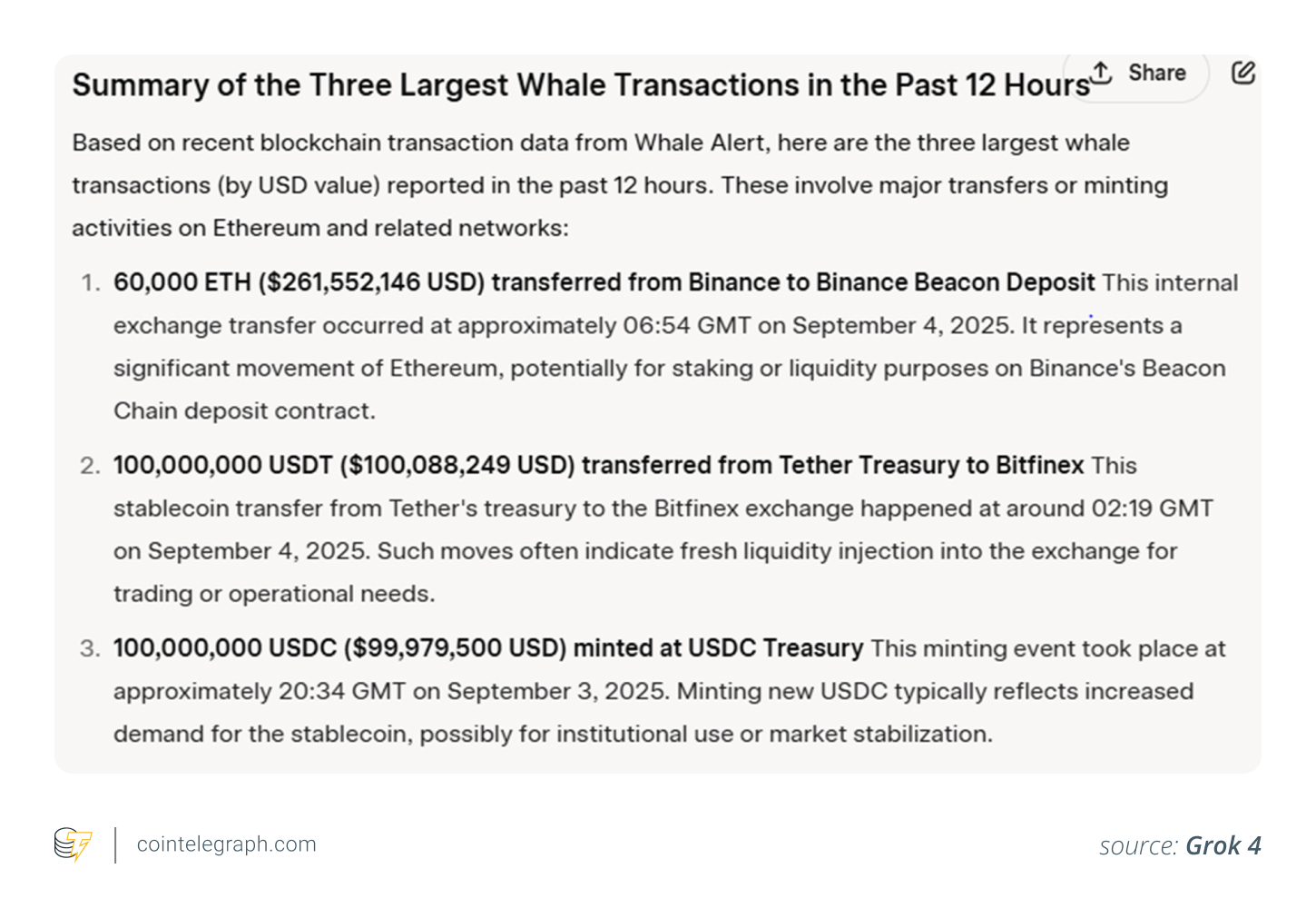

4. Whale deals

Huge wallets typically move before the crowd. An unexpected $10-million transfer onto an exchange, or build-up by a recognized whale, can be an inform.

Grok 4 usage case: Link Whale Alert feeds to Grok, then ask it to contextualize relocations versus market chatter.

Example timely:

” Sum up the 3 biggest whale deals in the previous 12 hours and inspect if there was any significant news or social conversations around the exact same tokens.”

5. Collaborated pump groups

Social network typically sees “pump-and-dumps.” Determining them early works for understanding what to prevent.

Grok 4 usage case: Ask Grok to highlight suspiciously integrated posts or pump-like countdowns.

Example timely:

” Scan X chatter for points out of collaborated pump occasions arranged in the next 24 hr. Flag the tokens discussed and quote reliability.”

6. Putting all of it together

Rather of chasing after every signal, traders can integrate several Grok 4 outputs into a composite view to prepare their own “Early Pump Rating”:

If 2 or 3 of these align, Grok can assist produce a brief “Why now?” summary that discusses why a token is warming up.

Example timely:

” For tokens with high social activity, cross-check with financing rate spikes and whale relocations. Rank them by total pump capacity and describe in plain English why each may move.”

How to start with Grok 4

Unlike conventional information tools, Grok 4 does not need coding to be beneficial. A standard setup appears like this:

-

Gain Access To Grok 4: Through an X Premium+ membership (for direct chat) or through API if you are advanced.

-

Select your focus: Social points out, exchange reports or whale activity. Do not attempt to track whatever simultaneously.

-

Compose clear triggers: The sharper the timely, the much better the output. Usage timespan (” last 2 hours”) and filters (market cap, token type).

-

Cross-check results: Do not count on one signal. Usage Grok to link dots in between buzz, onchain circulations and utilize.

-

Start little: Deal with Grok insights as an early caution system, not an assurance.

Dangers and constraints

Even with Grok 4, traders need to continue thoroughly:

-

Not all buzz is authentic: Numerous altcoin pumps are crafted as collaborated exits by experts or pump groups, leaving late entrants holding the bag.

-

Liquidity traps can be pricey: Small-cap tokens might reveal triple-digit portion gains on charts, however low liquidity can make it almost difficult to leave a position at size.

-

Exchange-driven rallies are brief: Coins that rise on the back of brand-new listings or reports typically backtrack greatly within days as soon as the preliminary enjoyment fades.

-

Backtesting is non-negotiable: Traders need to constantly check whether Grok 4’s recognized signals have actually traditionally anticipated significant relocations before devoting genuine capital.

Altcoin pumps are disorderly, fast-moving and dangerous, however they’re seldom random. With Grok 4’s real-time access to social chatter and information, traders can filter sound, area stories before they go traditional and get ready for volatility.

Utilized sensibly, Grok 4 isn’t about blindly chasing after every pump; it has to do with turning details overload into clear, actionable signals, assisting traders remain an action ahead without ending up being exit liquidity.

This post does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.