Secret takeaways

-

Ghost chains are blockchains that are technically functional however have little to no real-world use, advancement, or neighborhood engagement.

-

Typical indication consist of stagnant designer activity, low deal volume, non-active neighborhoods, and exchange delistings.

-

Even well-funded or corporate-backed jobs like Diem, KodakCoin, and Luna can stop working if adoption and environment development stall.

-

Financiers and designers can prevent ghost chains by keeping track of on-chain activity, GitHub devotes, token liquidity, and neighborhood health before dedicating resources.

Ghost chain discussed: Comprehending inactive and non-active blockchain jobs

A ghost chain describes a blockchain that, while technically still running, has actually been deserted by its designers and neighborhood. These are often called dead blockchain networks or inactive crypto jobs.

While the chain might when have actually had momentum or buzz, in time, designer activity stalls, user engagement drops and deal volume plunges. Slowly, indications of failure end up being obvious: no current updates, lessened user activity and very little real-world energy. Apparently, they might typically be functional and active on the surface area, however are lacking any beneficial activity and seem fading into obscurity.

Basically, it’s a blockchain that is technically alive however functionally dead. The increase of ghost chains originates from numerous overlapping elements. Typically, the initial designers or groups stop contributing, leaving repositories unblemished for months. Ultimately, the core advancement group stops interaction, roadmap updates stop and users move to more active communities. Neighborhoods lessen and liquidity dries up.

In time, the network ends up being a ghost chain, detached from the lively user base it when wished to draw in. From once-promising Ethereum killers to odd layer-1s, the crypto landscape is dotted with examples of such jobs that slowed after preliminary buzz. Whether due to an absence of energy, neighborhood or financing, these chains now wander in the blockchain graveyard. Finding the indication can assist prevent being captured in a “digital ghost town.”

Did you understand: In June 2024, Binance delisted WAVES, OMG Network (OMG), NEM (XEM), and Covered NXM (WNXM) due to low trading volume, weak liquidity and minimal advancement activity, all symptomatic indications of chains wandering towards ghost status.

Typical qualities of a ghost chain

Not every decreasing blockchain certifies as a ghost chain. Nevertheless, numerous repeating signs can assist recognize a job on the edge of irrelevance. These are the secret indications of a stopped working task (or on its method to turning into one):

-

Lessened designer activity: An absence of current code devotes, variation releases or updates.

-

Non-active neighborhoods: Online forums and social platforms reveal very little or no engagement.

-

Damaged or out-of-date sites: Job details is stagnant and documents is insufficient.

-

Low onchain deal volume: Just a handful of deals take place daily, typically automated or internal.

-

Exchange delistings and low trading volume: The native token of the chain might be delisted or show incredibly thin liquidity.

These warnings typically appear together in inactive crypto jobs, where the energy of the token is doubtful and user trust is deteriorated.

How to examine and recognize ghost chains?

To safeguard time, capital and resources, it is important to proactively evaluate any blockchain before engagement. The table listed below lists some crucial concerns that you should ask before engaging with a blockchain:

-

Take a look at deal information: Utilize public blockchain explorers to evaluate how often blocks are being produced and if users are in fact sending out deals. If block explorers reveal very little day-to-day deals or wallet activity, that’s a huge indication. Some chains procedure just a handful of deals daily, with many blocks almost empty.

-

Examine DApp activity: A successful chain will have decentralized apps, DeFi procedures, NFT markets and other clever agreements in usage. If the environment is barren, opportunities are it’s not bring in contractors or users and is on its method to decrease.

-

Examine GitHub or repository updates: Examine the task’s GitHub to see if designers are still dedicating code and repairing bugs. If the last significant devote was 6 months previously, then that might be a warning and need more penetrating.

-

Display social networks and interaction channels: Search for AMA sessions, dev updates or community-driven material. Telegram groups without any mediators, Discord with more bot spamming than users or X accounts that have not published in months– these are all indications of stopped working chains. If the neighborhood feels deserted, it most likely is and is a crucial and simple warning to see.

-

Evaluation token efficiency: A plunging token rate with minimal trade volume typically shows more comprehensive desertion. While rate alone does not figure out success, a token that regularly decreases without any trading volume or liquidity is an issue.

-

Crypto occasions: Look for any active involvement and existence of the chain in current crypto occasions such as a cubicle, speaker conversation, meetups, and so on. Constant absence of the group to display its offerings signifies decrease.

Remember that overpromising and weak or no shipment to match the preliminary buzz is something to try to find. “The fastest chain,” “Solana killer,” or “100,000 TPS” are some lavish pledges typically made in the blockchain environment however hardly ever provided. If the roadmap is dated and no updates are upcoming, it may be time to carry on.

Did you understand: Feathercoin, introduced in 2013 by Peter Bushnell, the head of IT at Oxford University’s Brasenose College, as a quicker Litecoin option, gathered preliminary interest however mainly ended up being a ghost chain amidst stiff competitors and its own decreasing advancement, resulting in a general decrease in interest.

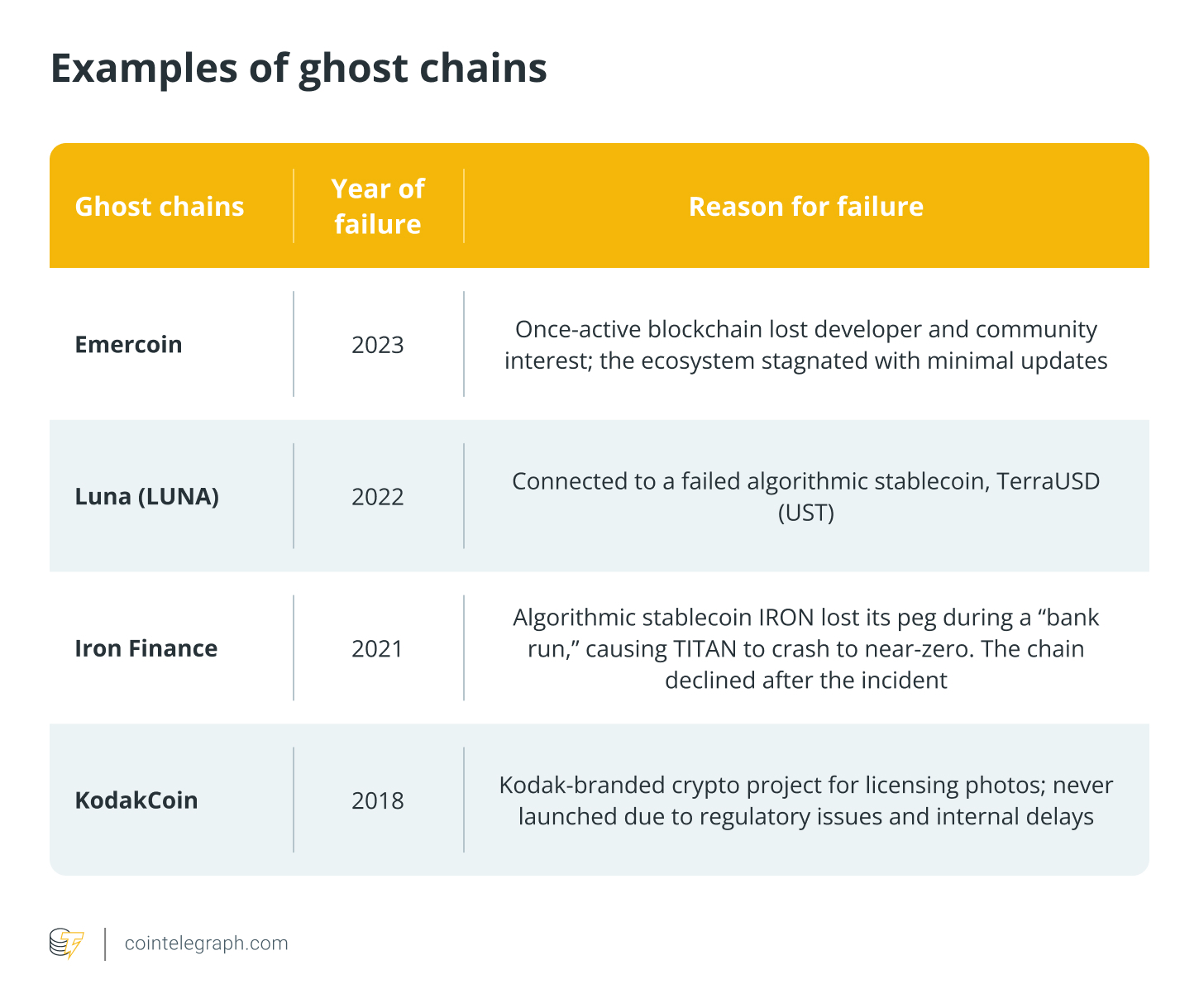

Ghost chain examples: Tasks that lost momentum

Numerous blockchain jobs, when applauded for development, have actually ended up being ghost chain examples due to decreasing use and presence:

While each task stopped working for various factors, the typical thread is clear: Without active communities and continual designer engagement, even the most well-funded blockchains can fade into obscurity.

Did you understand: Diem, Facebook’s enthusiastic blockchain task previously referred to as Libra, raised over $ 1.3 billion and protected support from significant companies like Visa and PayPal, yet it was deserted in 2022 after extreme regulative pressure, making it among the most prominent business dead jobs in crypto history.

Threats and repercussions of ghost chains

The collapse or stagnancy of blockchain networks has broader ramifications. These dead blockchain jobs add to digital mess networks keeping up no users, consuming resources and producing confusion for financiers and designers.

Significant repercussions consist of:

-

Loss of financier capital due to token decline.

-

Lost advancement time and facilities.

-

Reduced rely on more recent blockchain efforts.

Beyond monetary loss, ghost chains present security threats. Deserted domains, download links and tradition wallets can end up being phishing traps. Scammers might repurpose old clever agreements or reanimate historic information to release harmful code, tricking users who reconnect with the chain anticipating authenticity.

It is very important to keep in mind that not all non-active crypto blockchains are completely doomed. Some might see a revival with restored neighborhood assistance, updates or rebranding. However this is an exception and not the standard.

In the next bull cycle, brand-new blockchains will increase, however just a couple of will stick. Understanding how to separate in between a lively procedure and a ghost chain is among the most important abilities in the area today. Stay sharp, remain hesitant and constantly do your own research study.

This post does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.