Secret takeaways

-

The genuine edge in crypto trading depends on spotting structural fragility early, not in anticipating rates.

-

ChatGPT can combine quantitative metrics and narrative information to assist determine systemic danger clusters before they result in volatility.

-

Constant triggers and validated information sources can make ChatGPT a reputable market-signal assistant.

-

Predefined danger limits reinforce procedure discipline and decrease emotion-driven choices.

-

Readiness, recognition and post-trade evaluations stay necessary. AI matches a trader’s judgment however never ever changes it.

The real edge in crypto trading comes not from anticipating the future however from acknowledging structural fragility before it ends up being noticeable.

A big language design (LLM) like ChatGPT is not an oracle. It’s an analytical co-pilot that can rapidly process fragmented inputs– such as derivatives information, onchain circulations and market belief– and turn them into a clear image of market danger.

This guide provides a 10-step expert workflow to transform ChatGPT into a quantitative-analysis co-pilot that objectively processes danger, assisting trading choices remain grounded in proof instead of feeling.

Action 1: Develop the scope of your ChatGPT trading assistant

ChatGPT’s function is enhancement, not automation. It boosts analytical depth and consistency however constantly leaves the last judgment to people.

Required:

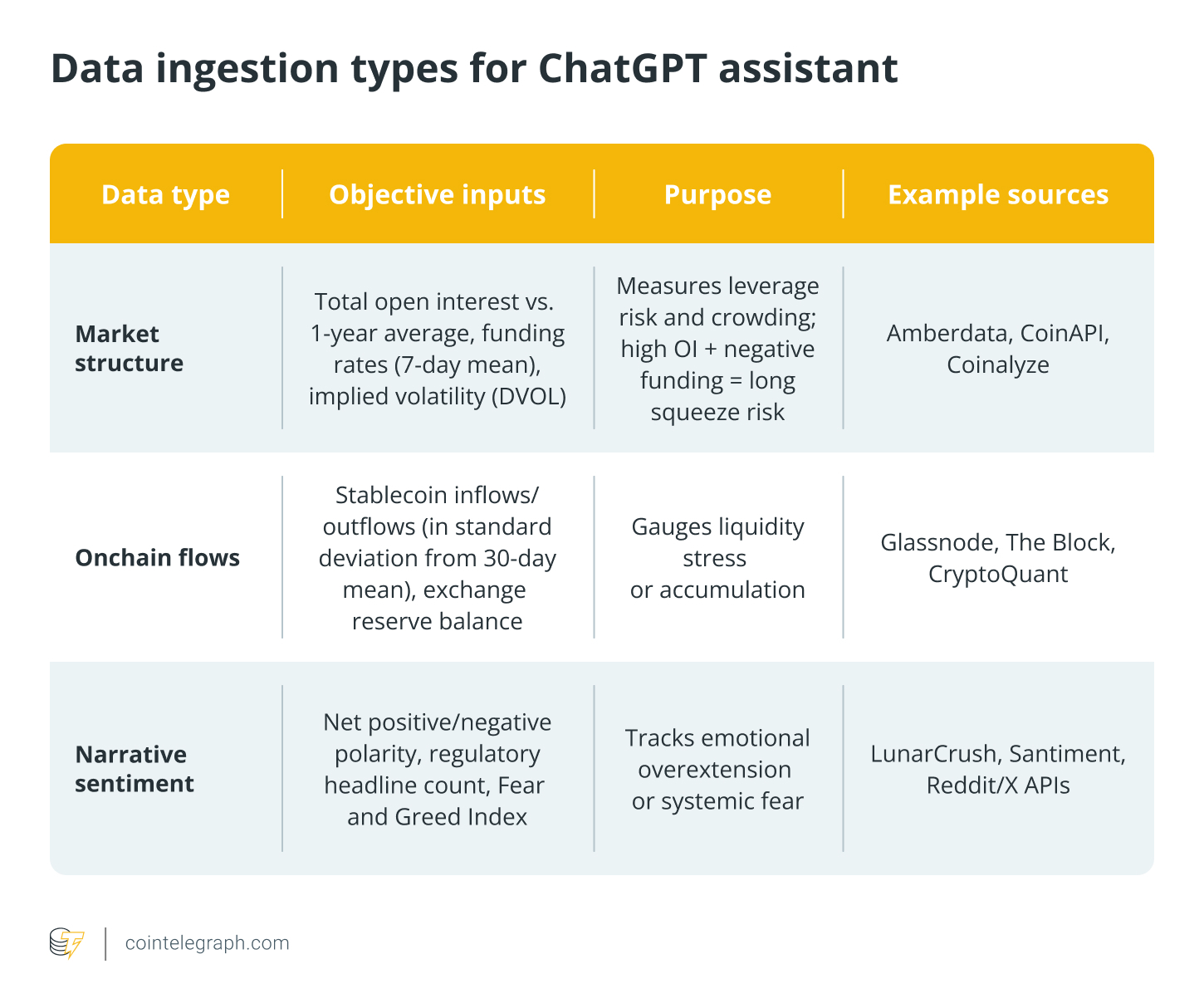

The assistant needs to manufacture complex, multi-layered information into a structured danger evaluation utilizing 3 main domains:

-

Derivatives structure: Steps take advantage of accumulation and systemic crowding.

-

Onchain circulation: Tracks liquidity buffers and institutional positioning.

-

Story belief: Catches psychological momentum and public predisposition.

Red line:

It never ever carries out trades or deals monetary guidance. Every conclusion must be dealt with as a hypothesis for human recognition.

Personality guideline:

” Function as a senior quant expert concentrating on crypto derivatives and behavioral financing. React in structured, unbiased analysis.”

This guarantees an expert tone, constant format and clear focus in every output.

This enhancement technique is currently appearing in online trading neighborhoods. For instance, one Reddit user explained utilizing ChatGPT to prepare trades and reported a $7,200 revenue. Another shared an open-source job of a crypto assistant constructed around natural-language triggers and portfolio/exchange information.

Both examples reveal that traders are currently welcoming enhancement, not automation, as their main AI technique.

Action 2: Data intake

ChatGPT’s precision depends completely on the quality and context of its inputs. Utilizing pre-aggregated, high-context information assists avoid design hallucination.

Information health:

Feed context, not simply numbers.

” Bitcoin open interest is $35B, in the 95th percentile of the previous year, signifying severe take advantage of accumulation.”

Context assists ChatGPT presume implying rather of hallucinating.

Action 3: Craft the core synthesis timely and output schema

Structure specifies dependability. A recyclable synthesis timely guarantees the design produces constant and similar outputs.

Trigger design template:

” Function as a senior quant expert. Utilizing derivatives, onchain and belief information, produce a structured danger publication following this schema.”

Output schema:

-

Systemic take advantage of summary: Evaluate technical vulnerability; determine main danger clusters (e.g., crowded longs).

-

Liquidity and circulation analysis: Explain onchain liquidity strength and whale build-up or circulation.

-

Narrative-technical divergence: Examine whether the popular story lines up or opposes technical information.

-

Systemic danger score (1-5): Appoint a rating with a two-line reasoning discussing vulnerability to a drawdown or spike.

Example score:

” Systemic Danger = 4 (Alert). Open interest in 95th percentile, financing turned unfavorable, and fear-related terms increased 180% week over week.”

Structured triggers like this are currently being checked openly. A Reddit post entitled “A guide on utilizing AI (ChatGPT) for scalping CCs” reveals retail traders try out standardized timely design templates to produce market briefs.

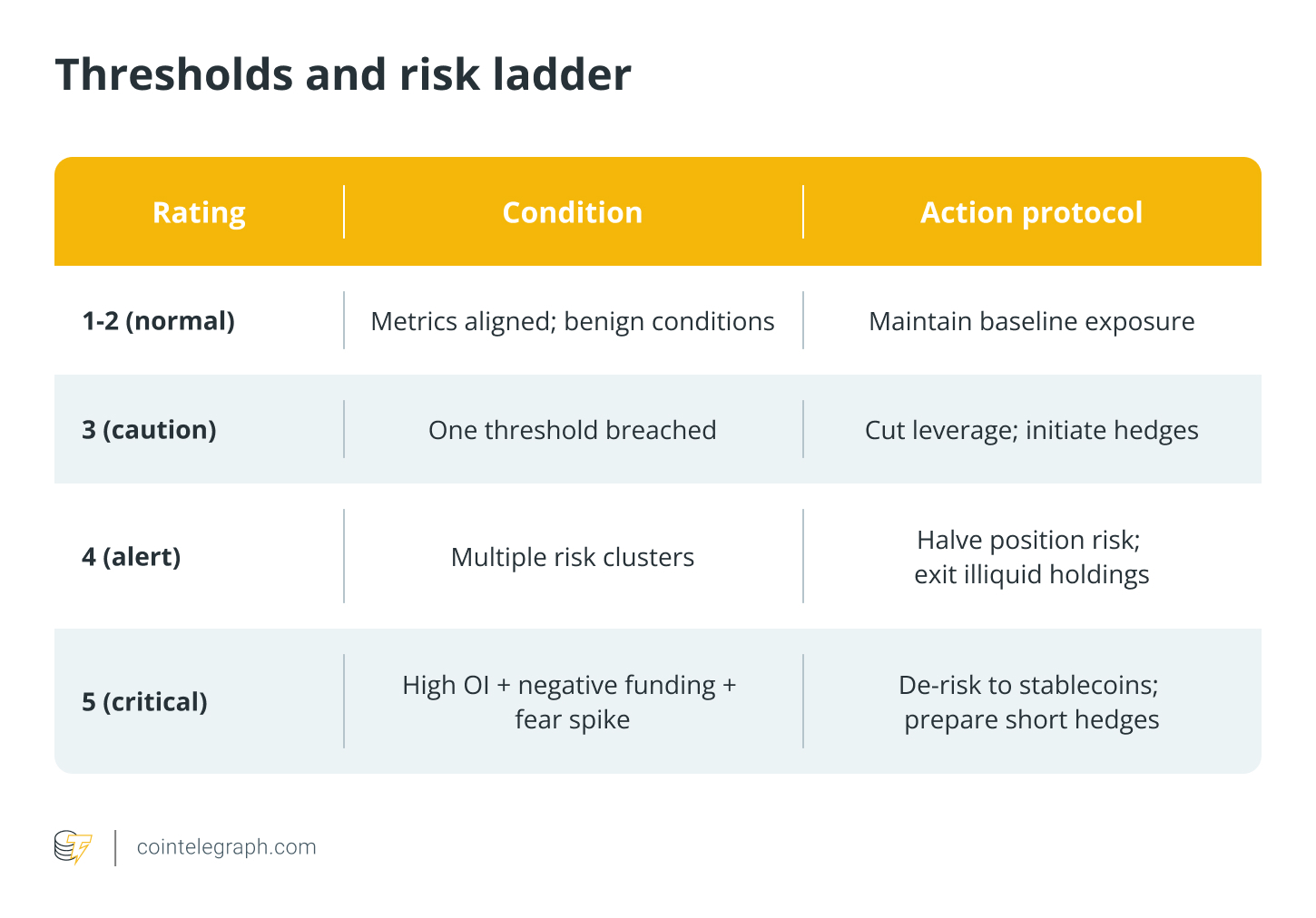

Action 4: Specify limits and the danger ladder

Metrology changes insights into discipline. Limits link observed information to clear actions.

Example sets off:

-

Utilize warning: Financing stays unfavorable on 2 or more significant exchanges for more than 12 hours.

-

Liquidity warning: Stablecoin reserves drop listed below -1.5 σ of the 30-day mean (relentless outflow).

-

Belief warning: Regulative headings increase 150% above the 90-day average while DVOL spikes.

Danger ladder:

Following this ladder guarantees actions are rule-based, not psychological.

Step 5: Stress-test trade concepts

Before getting in any trade, usage ChatGPT as a hesitant danger supervisor to filter out weak setups.

Trader’s input:

” Long BTC if 4h candle light closes above $68,000 POC, targeting $72,000.”

Prompt:

” Function as a hesitant danger supervisor. Recognize 3 important non-price verifications needed for this trade to be legitimate and one invalidation trigger.”

Anticipated action:

-

Whale inflow ≥ $50M within 4 hours of breakout.

-

MACD pie chart broadens favorably; RSI ≥ 60.

-

No financing flip unfavorable within 1 hour post-breakout. Invalidation: Failure on any metric = exit right away.

This action changes ChatGPT into a pre-trade stability check.

Action 6: Technical structure analysis with ChatGPT

ChatGPT can use technical structures objectively when supplied with structured chart information or clear visual inputs.

Input:

ETH/USD variety: $3,200-$ 3,500

Prompt:

” Function as a market microstructure expert. Evaluate POC/LVN strength, translate momentum indications and overview bullish and bearish roadmaps.”

Example insight:

-

LVN at $3,400 most likely rejection zone due to decreased volume assistance.

-

Diminishing pie chart indicates compromising momentum; possibility of retest at $3,320 before pattern verification.

This unbiased lens filters predisposition from technical analysis.

Action 7: Post-trade assessment

Usage ChatGPT to examine habits and discipline, not revenue and loss.

Example:

Brief BTC at $67,000 → moved stop loss early → -0.5 R loss.

Prompt:

” Function as a compliance officer. Recognize guideline infractions and psychological chauffeurs and recommend one restorative guideline.”

Output may flag worry of revenue disintegration and recommend:

” Stops can just transfer to breakeven after 1R revenue limit.”

With time, this constructs a behavioral enhancement log, an often-overlooked however important edge.

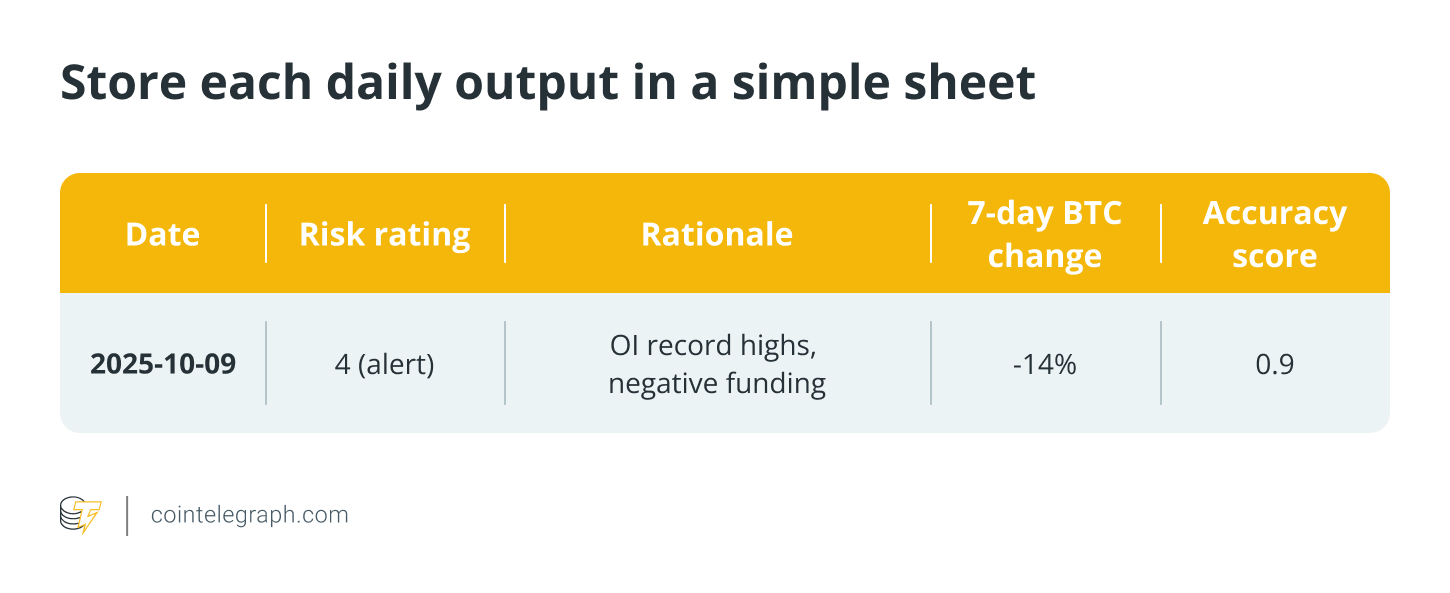

Action 8: Incorporate logging and feedback loops

Shop each day-to-day output in a basic sheet:

Weekly recognition exposes which signals and limits carried out; change your scoring weights appropriately.

Cross-check every claim with main information sources (e.g., Glassnode for reserves, The Block for inflows).

Action 9: Daily execution procedure

A constant day-to-day cycle constructs rhythm and psychological detachment.

-

Early morning instruction (T +0): Collect stabilized information, run the synthesis timely and set the danger ceiling.

-

Pre-trade (T +1): Run conditional verification before carrying out.

-

Post-trade (T +2): Conduct a procedure evaluation to examine habits.

This three-stage loop strengthens procedure consistency over forecast.

Action 10: Devote to readiness, not prediction

ChatGPT stands out at determining tension signals, not timing them. Treat its cautions as probabilistic indications of fragility.

Recognition discipline:

-

Constantly validate quantitative claims utilizing direct control panels (e.g., Glassnode, The Block Research Study).

-

Prevent over-reliance on ChatGPT’s “live” info without independent verification.

Readiness is the genuine one-upmanship, attained by leaving or hedging when structural tension constructs– frequently before volatility appears.

This workflow turns ChatGPT from a conversational AI into a mentally removed analytical co-pilot. It imposes structure, hones awareness and broadens analytical capability without changing human judgment.

The goal is not insight however discipline in the middle of intricacy. In markets driven by take advantage of, liquidity and feeling, that discipline is what separates expert analysis from reactionary trading.

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.