A co-founder of Bitcoin facilities business, Babylon Labs, declares to have actually constructed a system that enables native Bitcoin to be utilized as trustless security to obtain on the Ethereum blockchain.

In a Wednesday X post, Babylon Labs co-founder and Stanford University teacher David Tse declared Babylon constructed a proof-of-concept permitting native Bitcoin (BTC) “to be utilized trustlessly as security to obtain on Ethereum for the very first time.”

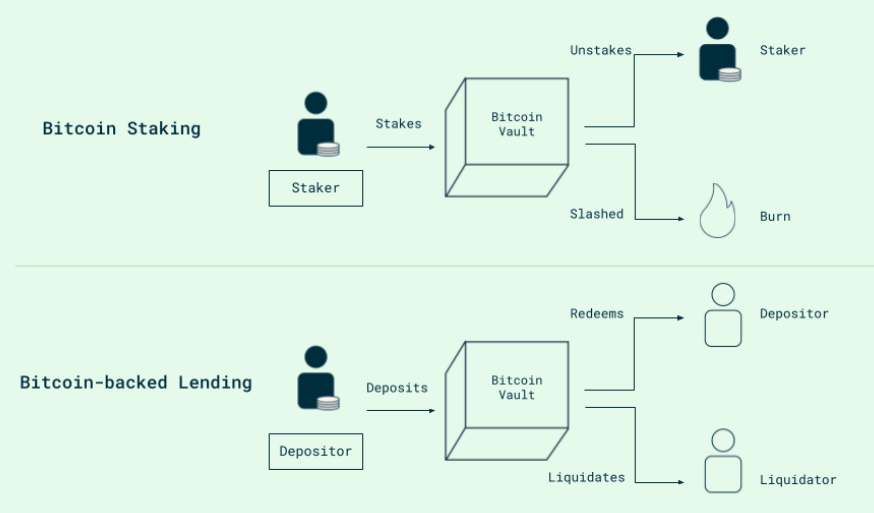

The remarks follow Babylon’s release of a white paper in early August, describing what it calls a Bitcoin trustless vault system. The system leverages the Bitcoin wise agreement confirmation system BitVM3 to lock BTC in per-user vaults, where withdrawals (redemption or liquidation) are gated by cryptographic evidence of external wise agreement state validated on Bitcoin.

This permits users to lock Bitcoin and bridge it to Ethereum without counting on a federated custodian or bridge. On the Ethereum side, a wise agreement validates the BTC vault through a Bitcoin light customer before representing security.

A speculative variation of the resulting token is currently readily available on the onchain loaning procedure Morpho. Still, it remains in the screening stage, with an overall liquidity in the market of $14 in USDC (USDC). Tse explained VaultBTC as “an intermediate non-fungible property that interfaces the vault with Morpho and permits depositor and liquidators to trustlessly withdraw BTC.”

Babylon Labs and Tse had actually not reacted to Cointelegraph’s ask for remark by publication.

Related: Kraken launches Bitcoin staking with Babylon combination

How trustless is it?

While the formerly discussed part of the system is trustless, some parts stay non-trustless. Per the white paper, Babylon’s Bitcoin vault liquidations use whitelisted liquidators to keep track of the rate and vault state, leading to a liquidation system that is not permissioned and presents trust presumptions.

Even with co-signing indicated to suppress censorship, the design still presumes sufficient liquidators (and in some cases big lending institutions) act properly. Even if they can not take Bitcoin thanks to the system’s style, this presents a trust presumption into the system.

Liquidations depend upon a rate oracle, so they acquire the oracle’s precision, timeliness, and censorship-resistance dangers. If the oracle is incorrect or postponed, the system makes the incorrect call. Oracle suppliers with existing relationships with Babylon Labs, Band Procedure and Pyth Network had actually not reacted to Cointelegraph’s ask for remark by publication.

Related: The future of DeFi isn’t on Ethereum– it’s on Bitcoin

What truly alters?

The white paper supplies a basic example: “Bob holds 1 BTC and wants to obtain $50,000 in a stablecoin from Larry through a financing procedure on Ethereum.” This would require that if Bitcoin’s rate falls under $50,000, Larry can liquidate the security, and if Bob pays back the loan on time, he recuperates the BTC.

Babylon Labs describes that present systems need various trust presumptions. Bob can turn over the Bitcoin to Larry for safekeeping, relying on that he will return it.

Otherwise, Bob can keep the Bitcoin and assure to enable Larry to liquidate it if the rate falls– however Larry would rely on Bob to keep his word. Last but not least, Bob might bridge Bitcoin to Ethereum as Wrapped Bitcoin (WBTC) and utilize it in a wise agreement as security. Still, he would need to rely on the covering system itself.

WBTC needs trust due to the fact that the Bitcoin support it is held by a central custodian who should be relied on not to lose, freeze, or abuse the funds. Users depend upon this custodian’s sincerity and solvency instead of cryptographic warranties. This is the main concern resolved by Babylon’s trustless application.

” Trustless vaults remove all such trust presumptions. Bob and Larry collectively pre-sign a set of Bitcoin deals specifying conditional costs rights,” the white paper states.

Publication: ‘ Debasement trade’ will pump Bitcoin, Ethereum DATs will win: Hodler’s Digest, Oct. 5– 11