South Korean retail financier capital is sustaining Ether’s rate momentum and the increase of business Ether treasury companies, according to market experts, as the world’s second-largest cryptocurrency trades simply 7% listed below its all-time high.

The “only thing” keeping the Ether (ETH) rate and Ether treasury business at their existing levels has to do with $6 billion worth of Korean retail capital, according to Samson Mow, CEO of Bitcoin innovation business Jan3.

” ETH influencers have actually been flying to South Korea simply to market to retail. These financiers have absolutely no concept about the ETHBTC chart and believe they’re purchasing the next Technique play,” stated Mow in a Monday X post, cautioning that this “will not end well.”

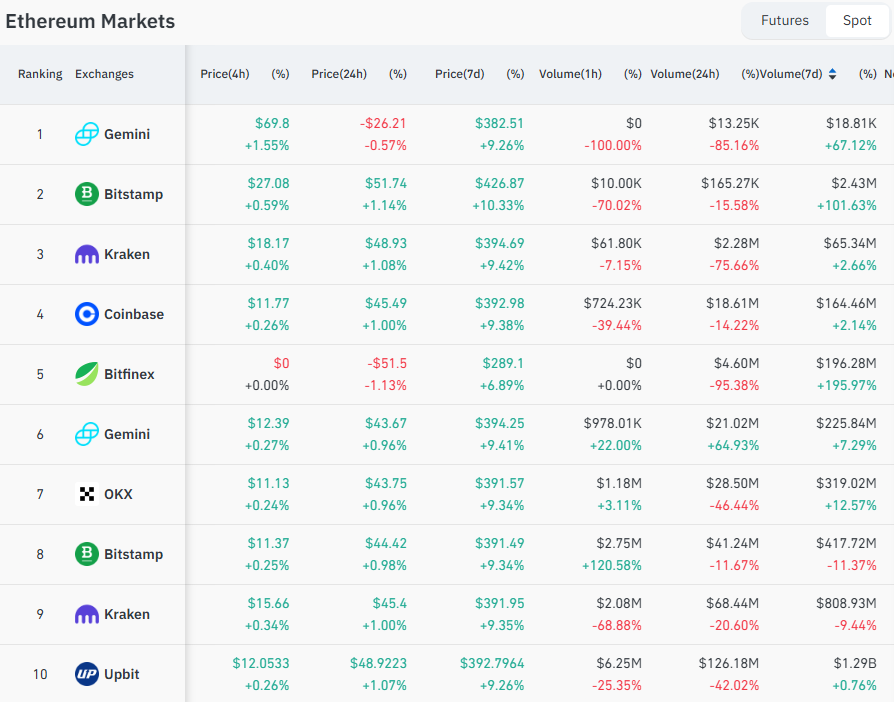

Upbit and Bithumb are the 2 primary central exchanges (CEXs) utilized by South Korean retail traders.

Taking a look at futures information, Upbit ranked as the 10th biggest CEX in regards to Ether futures trading, with $1.29 billion worth of trading volume over the previous week, according to CoinGlass information.

Crypto futures trading normally surpasses the volume of area trading and therefore has a greater effect on the hidden possession’s rate.

Related: Japan’s brand-new PM might be an advantage for threat properties, crypto markets

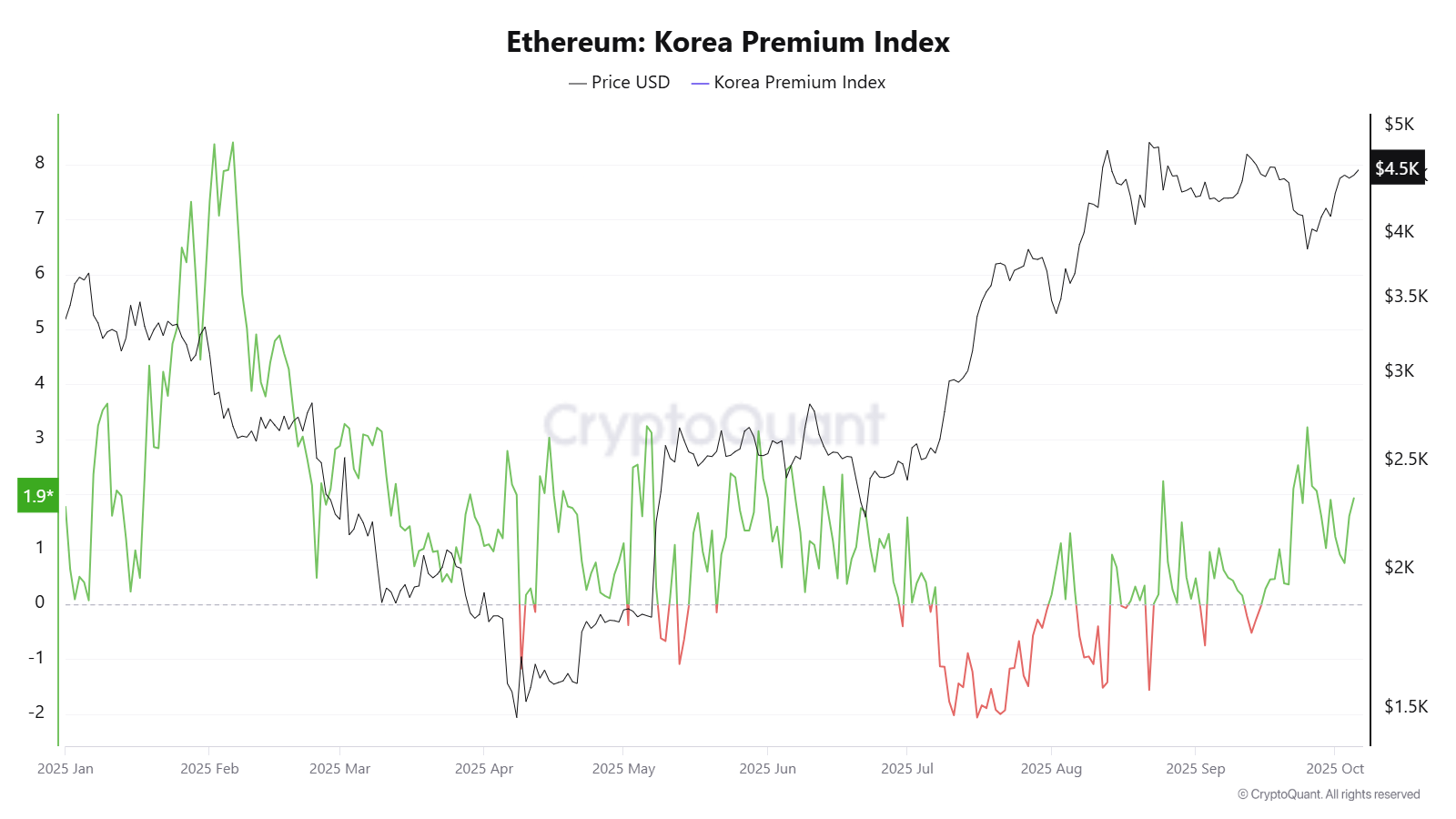

Ether’s “Kimchi premium” signals growing Korean retail financier engagement

Ether’s “Kimchi premium,” when the rate of a cryptocurrency is greater on South Korean exchanges than on other exchanges, likewise signifies growing need from Korean retail financiers.

Ether’s Kimchi premium increased to 1.93 on Sunday, up from -2.06 on July 16, when Ether traded listed below $2,959, according to blockchain information platform CryptoQuant.

This sign determines the rate space for Ether in between South Korean exchanges and others.

Korean retail financiers are substantial individuals in the crypto market, as shown by Ether’s kimchi premium, according to Marcin Kazmierczak, co-founder of blockchain oracle company RedStone.

Nevertheless, Kazmierczak stated this represents just a portion of Ether’s general momentum.

” Defining them as the main assistance for Ethereum considerably downplays the network’s varied international capital base, that includes significant United States institutional financial investment through ETFs, business treasuries, and the large DeFi community that counts on ETH.”

Kazmierczak included that Ethereum’s strength depends on its “borderless nature,” integrating Korean retail and international institutional involvement.

Related: Aging boomers and international wealth seen improving crypto till 2100

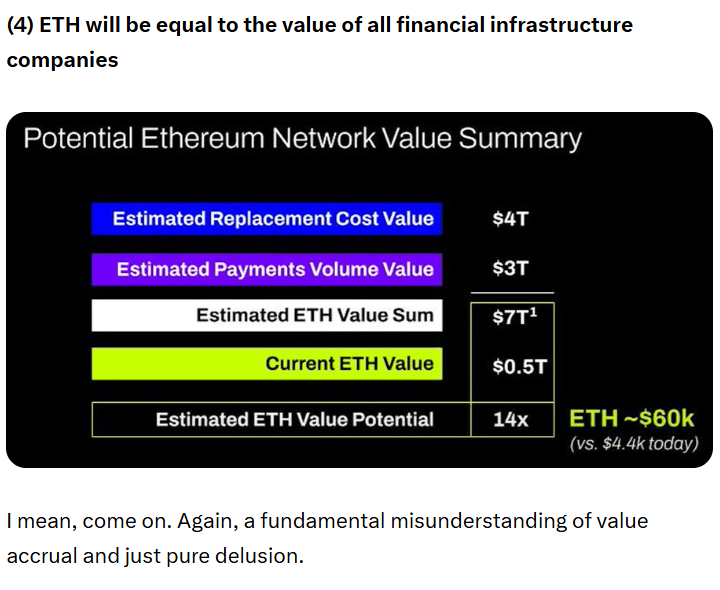

Mow’s insights come as numerous other market watchers have actually questioned the sustainability of Ether treasury companies.

In September, System Capital creator Andrew Kang slammed BitMine creator Tom Lee’s Ether thesis, arguing that it overemphasized Ether’s worth accrual from stablecoins and real-world possession (RWA) tokenization.

” Ethereum’s evaluation comes mostly from monetary illiteracy. Which, to be reasonable, can develop a decently big market cap,” stated Kang in a Sept. 24 X post, including that “the evaluation that can be originated from monetary illiteracy is not limitless.”

While “more comprehensive macro liquidity” has actually preserved Ether’s rate momentum, it requires “significant organizational modification” to wait from “indefinite underperformance,” Kang stated.

Publication: Low users, sex predators eliminate Korean metaverses, 3AC takes legal action against Terra