The developer of the Libra (LIBRA) token has actually released another memecoin with a few of the very same worrying onchain patterns that indicated substantial expert trading activity ahead of the coin’s 99% collapse.

Hayden Davis, the co-creator of the Authorities Melania Meme (MELANIA) and the Libra token, has actually released a brand-new Solana-based memecoin, with an over 80% expert supply.

Davis released the Wolf (WOLF) memecoin on March 8, banking on reports of Jordan Belfort, called the Wolf of Wall Street, introducing his own token.

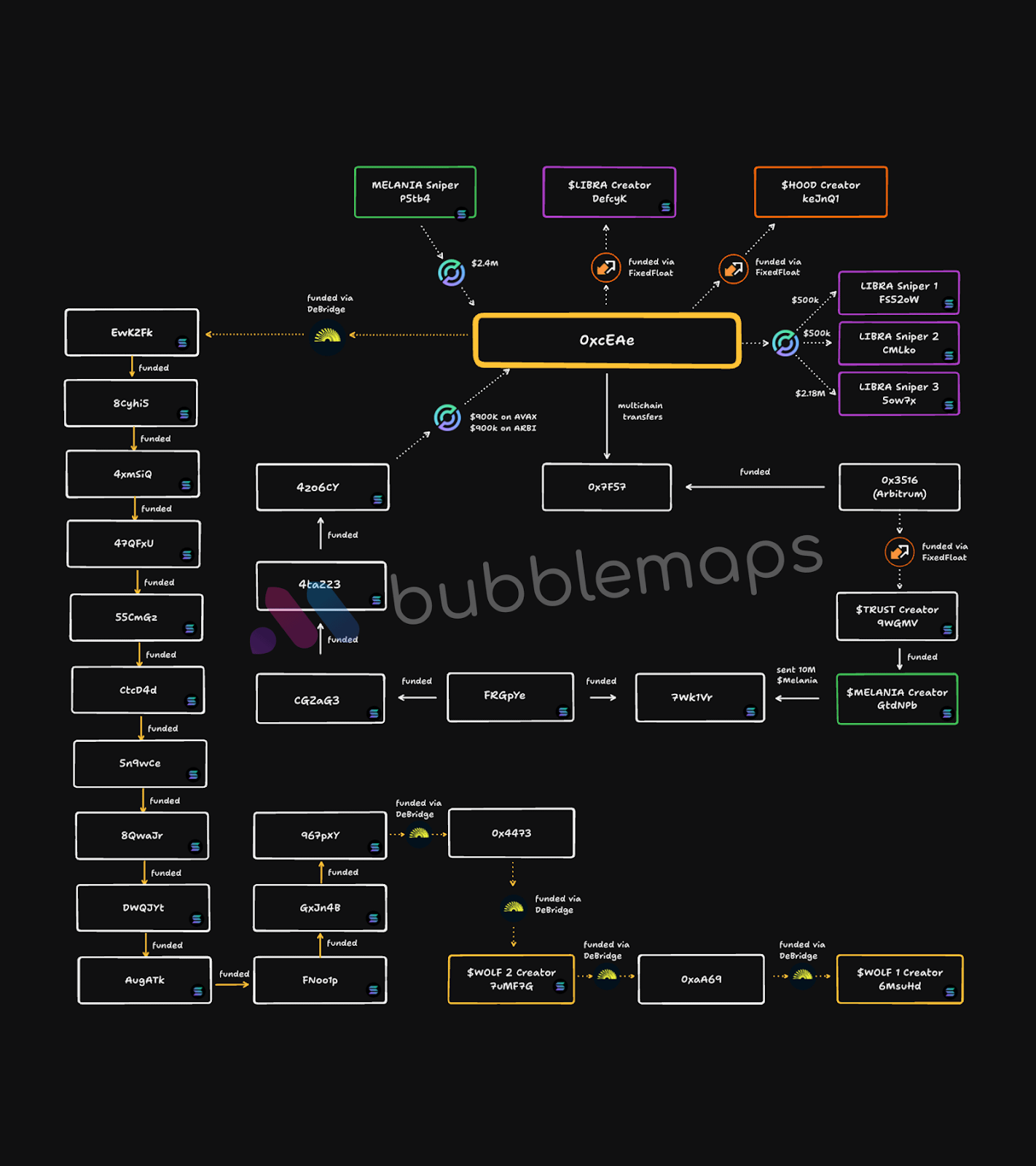

The token reached a peak $42 million market cap, nevertheless, 82% of the WOLF token’s supply was bundled under the very same entity, according to a March 15 X post by Bubblemaps, which composed:

” The bubble map exposed something unusual– $WOLF had the very same pattern as $HOOD, a token released by Hayden Davis. Was he behind this one too?”

Source: Bubblemaps

The blockchain analytics platform exposed transfers throughout 17 various addresses stemming back to deal with ‘OxcEAe’ owned by Davis.

” He moneyed these wallets months before $LIBRA and $WOLF released, moving cash through 17 addresses and 2 chains,” Bubblemaps included.

Source: Bubblemaps

The Wolf memecoin lost over 99% of its worth within 2 days, from the peak $42.9 million market capitalization on March 8 at 4:00 a.m. UTC, to simply $570,000 at press time, Dexscreener information programs.

WOLF/SOL, market cap, 1-hour chart. Source: Dexscreener

Davies’ newest token launch comes weeks after the Libra token’s collapse where 8 expert wallets squandered $107 million in liquidity, resulting in a $4 billion market cap wipeout within hours.

The Libra token developed into a political problem, with Argentinian President Javier Milei running the risk of impeachment after his recommendation of the Libra coin.

Argentine legal representative Gregorio Dalbon has actually requested an Interpol Red Notification to be provided for Davis mentioning a “procedural threat” if Davis stayed totally free as he might have access to large quantities of cash that would enable him to either leave the United States or go into hiding.

Related: Milei-endorsed Libra token was ‘open trick’ in memecoin circles– Jupiter

Memecoins are becoming “retail worth extraction tools”

Memecoins are turning versus crypto’s essential principles of decentralization, ending up being progressively utilized to make use of retail financiers in the middle of the growing variety of carpet pulls, according to Anastasija Plotnikova, co-founder and CEO of blockchain regulative company Fideum.

” Memecoins have actually developed from community-driven social experiments into a disorderly landscape controlled by worth extraction from retail financiers,” Plotnikova informed Cointelegraph, including:

” Expert rings, pump-and-dump plans, and sniper groups have actually changed the natural, collectible nature of initial memecoins, producing an unhealthy playing field.”

Related: TRUMP, DOGE, BONK ETF approvals ‘most likely’ under brand-new SEC management

Financiers will likewise require to compare memecoins that can be viewed as real “antiques” and “straight-out deceitful activities” like carpet pulls which are “not just dishonest however likewise plainly prohibited, with case law to support enforcement.”

” In my view, these activities must fall strongly within the jurisdiction of police,” she included.

United States regulators are ending up being progressively knowledgeable about the growing memecoin frauds.

A New york city legislator presented a costs that would develop criminal charges particularly focused on avoiding cryptocurrency scams and safeguarding financiers from carpet pulls, Cointelegraph reported on March 6.

Under the proposition, brand-new criminal charges would be produced for offenses including “virtual token scams,” clearly targeting misleading practices connected with cryptocurrencies.

Publication: Caitlyn Jenner memecoin ‘mastermind’s’ celeb catalog dripped