The hacker behind the $5.8 million current Loopscale make use of remains in speak with return the taken funds in exchange for a bounty, the Solana-based procedure stated.

The exploiter pilfered roughly 5.7 million USDC (USDC) and 1,200 Solana (SOL) tokens from 2 of Loopscale’s yield vaults on April 26, triggering the decentralized financing procedure to briefly pause its financing markets.

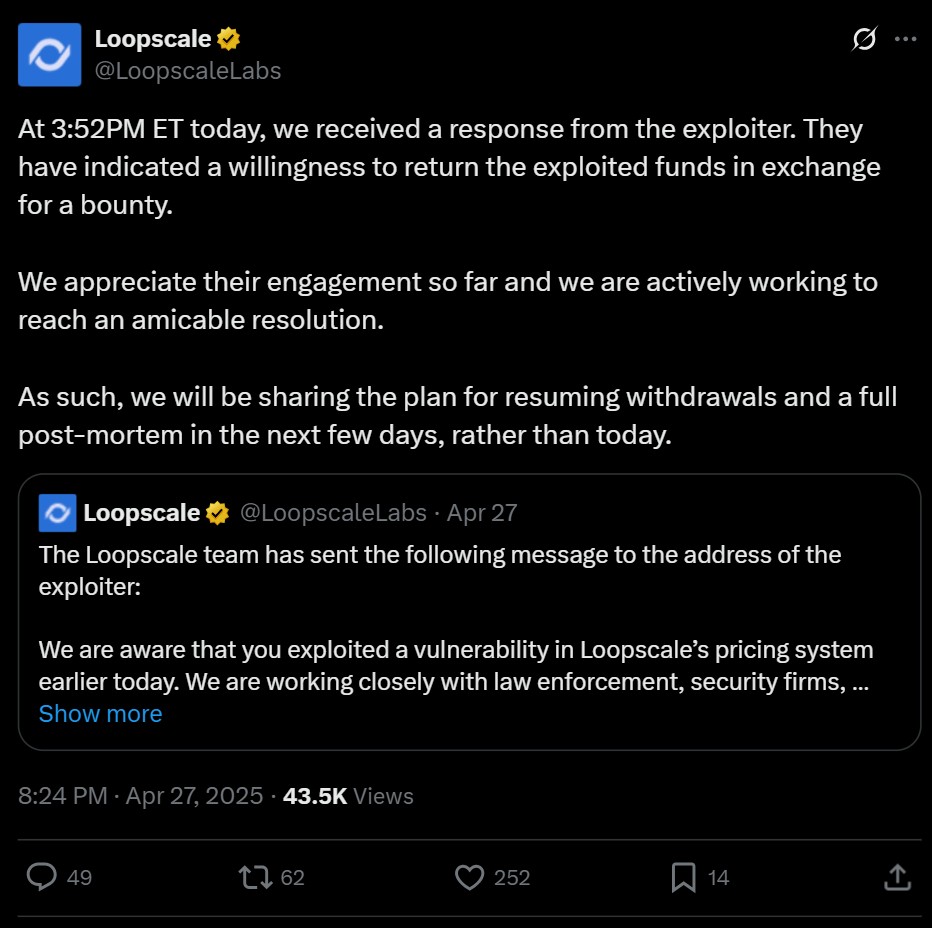

The following day, the hacker sent out a message on the Etherscan blockchain scanner “indicat[ing] a desire to return the made use of funds in exchange for a bounty,” Loopscale stated in an April 27 X post.

” We are acceptable to working together with you to reach a white hat contract. Nevertheless, we wish to work out the bounty portion; our expectation is 20%,” the hacker stated. ” To show our dedication to a cooperative technique, we will right away return the 5,000 wSOL funds following the transmission of this message,” they included.

Settlements are continuous for the staying funds, according to the general public messaging exchange on Etherscan.

Related: Solana’s Loopscale stops briefly financing after $5.8 M hack

The make use of

Web3 procedures regularly provide bounties to hackers in exchange for returning lost funds. Nevertheless, just a little part of the more than $1.6 billion in crypto taken throughout the very first quarter of 2025 has actually been effectively recuperated.

The Loopscale make use of just affected the procedure’s USDC and SOL vaults, with losses representing around 12% of its overall worth locked (TVL), Loopscale co-founder Mary Gooneratne stated in an April 26 X post.

In the after-effects of the attack, Loopscale briefly stopped financing however has given that “re-enabled loan payments, top-ups, and loop closing,” it stated in an X post.

” All other app functions (consisting of Vault withdrawals) are still briefly limited while we examine and guarantee mitigation of this make use of,” Loopscale stated.

Released on April 10, Loopscale is a DeFi financing procedure that intends to enhance capital performance by straight matching loan providers and debtors.

In addition, Loopscale helps with customized financing markets, such as “structured credit, receivables funding, and undercollateralized financing,” it stated in an April statement shown Cointelegraph.

Publication: Bitcoin $100K hopes on ice, SBF’s mystical jail relocation: Hodler’s Digest, April 20– 26