Maximal-extractable worth (MEV) on the Ethereum network is ending up being significantly central, with arbitrageurs tightening their grip on deal buying.

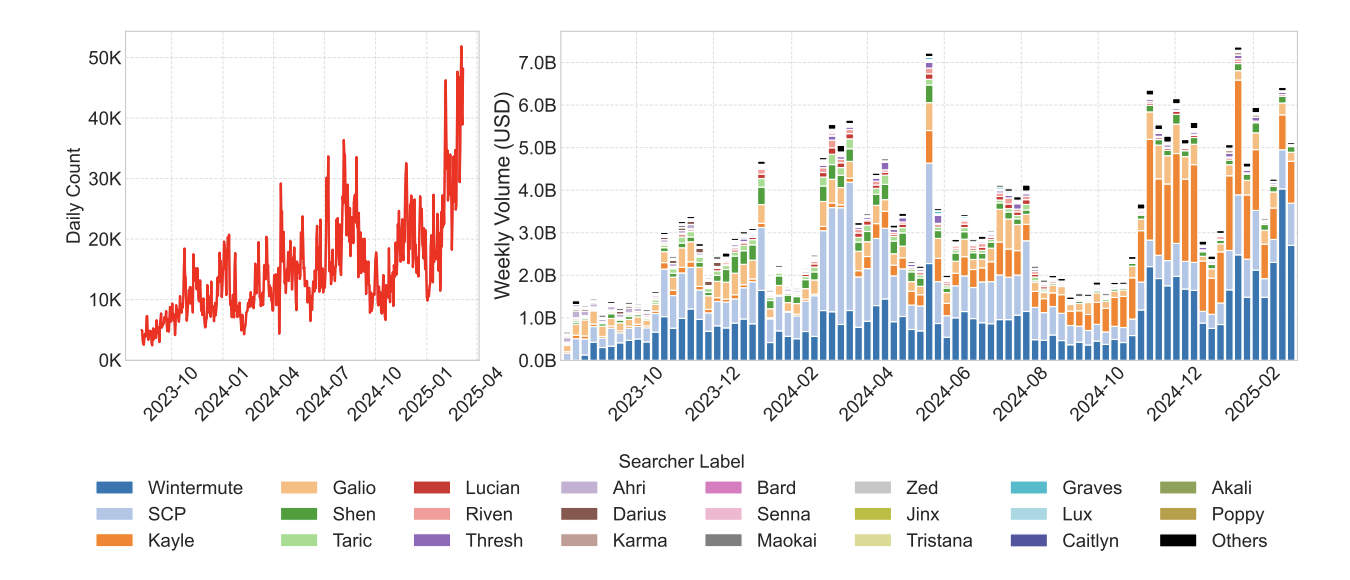

According to a current term paper, these arbitrageurs, called “searchers” in the paper, are significantly internal or have unique agreements with optimum extractable worth home builders, who are accountable for block building and construction on the Ethereum network.

MEV describes the earnings that blockchain validators or other individuals can make by reordering deals within a block before it’s completed. On Ethereum, MEV typically includes methods like arbitrage, front-running, or sandwich attacks, where traders make use of rate distinctions to optimize gains.

The paper, entitled “Determining CEX-DEX Extracted Worth and Searcher Success: The Darkest of the MEV Dark Forest,” took a look at how arbitrageurs make the most of rate disparities in between central (CEX) and decentralized (DEX) crypto exchanges, front-running smaller sized users.

” At the time of composing, 3 home builders, beaverbuild, Titan, and rsync, control the Ethereum contractor market, 2 of which vertically incorporate their own CEX-DEX searchers,” the authors of the paper composed. They continued:

” Such vertical combination raises crucial issues for Ethereum’s decentralization and security: it cultivates economies of scale that reinforce dominant gamers, allows monopoly prices that triggers proposer loss, and increases vulnerability to censorship and dedication attacks.”

The scientists concluded that the centralization of CEX-DEX arbitrage through unique arrangements with block home builders intensifies “centralization pressures” within the Ethereum community, and need to be thought about when preparing the future instructions and development of the layer-1 network.

Related: Bros who deceived MEV bots with their own medication need to deal with trial, states judge

MEV: a seasonal obstacle for the Ethereum network

Under Ethereum’s Proposer-Builder Separation (PBS), block proposers can contract out the block building and construction to entities called home builders. This plan was done to promote censorship resistance.

Nevertheless, critics of PBS, consisting of the authors of the term paper, state that it centralizes the network and develops unjust market conditions for smaller sized individuals.

In March, pseudonymous Ethereum scientist Malik672 proposed that Ethereum block structure need to end up being equalized, enabling countless individuals to add to obstruct structure and improve network decentralization.

” With 80% of blocks presently proposed by simply 2 entities. This compromises decentralization and fairness,” the scientists composed.

Ethereum co-founder Vitalik Buterin formerly recommended mitigating MEV by constructing alternative facilities, consisting of crypto exchanges.

Buterin likewise stated that MEV might be reduced by starving MEV arbitrageurs from the onchain information they count on to make money from complicated trades and deal reordering.

Publication: Proposed modification might conserve Ethereum from L2 ‘roadmap to hell’