GD Culture Group (GDC), a Nasdaq-listed holding business concentrated on livestreaming, e-commerce and synthetic intelligence-powered digital human innovation, prepares to raise approximately $300 million for a cryptocurrency treasury reserve.

In a May 12 declaration, GDC and its subsidiary, AI Catalysis, revealed participating in a typical stock purchase arrangement with a British Virgin Islands minimal liability business to offer up to $300 countless its typical stock.

The earnings from the stock sale will be utilized to money the company’s crypto treasury, which will consist of purchases of Bitcoin (BTC) and the Authorities Trump (TRUMP) token.

” Under this effort, and based on specific constraints, GDC means to designate a substantial part of the earnings from any share sales under the center to the acquisition, long-lasting holding, and combination of crypto properties into its core treasury operations,” the business stated in the statement.

GDC explained the method as a transfer to line up with the more comprehensive “decentralization improvement.”

Established in 2016, GDC is a micro-cap business with a present $34 million market capitalization, according to Nasdaq information.

Related: Multi-wallet use up 16%, however AI might resolve crypto fragmentation space

GDC’s chairman and CEO, Xiaojian Wang, stated the effort constructs on the business’s strengths in digital innovations and positions it for a blockchain-powered commercial shift.

” GDC’s adoption of crypto properties as treasury reserve holdings is a purposeful method that shows both present market patterns and our distinct strengths in digital innovations and the livestreaming e-commerce environment,” Wang stated.

The stock offering was revealed over a month after the company got a noncompliance caution from Nasdaq associated to its shareholders’ equity. The notification suggested that the company reported shareholders’ equity of just $2,643, well listed below the minimum requirement of $2.5 million.

The company was offered till May 4 to send a strategy to abide by the listing requirements. If accepted by Nasdaq, the compliance strategy will permit approximately 180 days from the notice duration to abide by the requirements.

The Nevada-based business signs up with a little however growing group of public companies that are assigning part of their balance sheets to crypto properties.

Related: Crypto speculation controls $600B cross-border payments: BIS report

Trump token supper prepared for leading holders

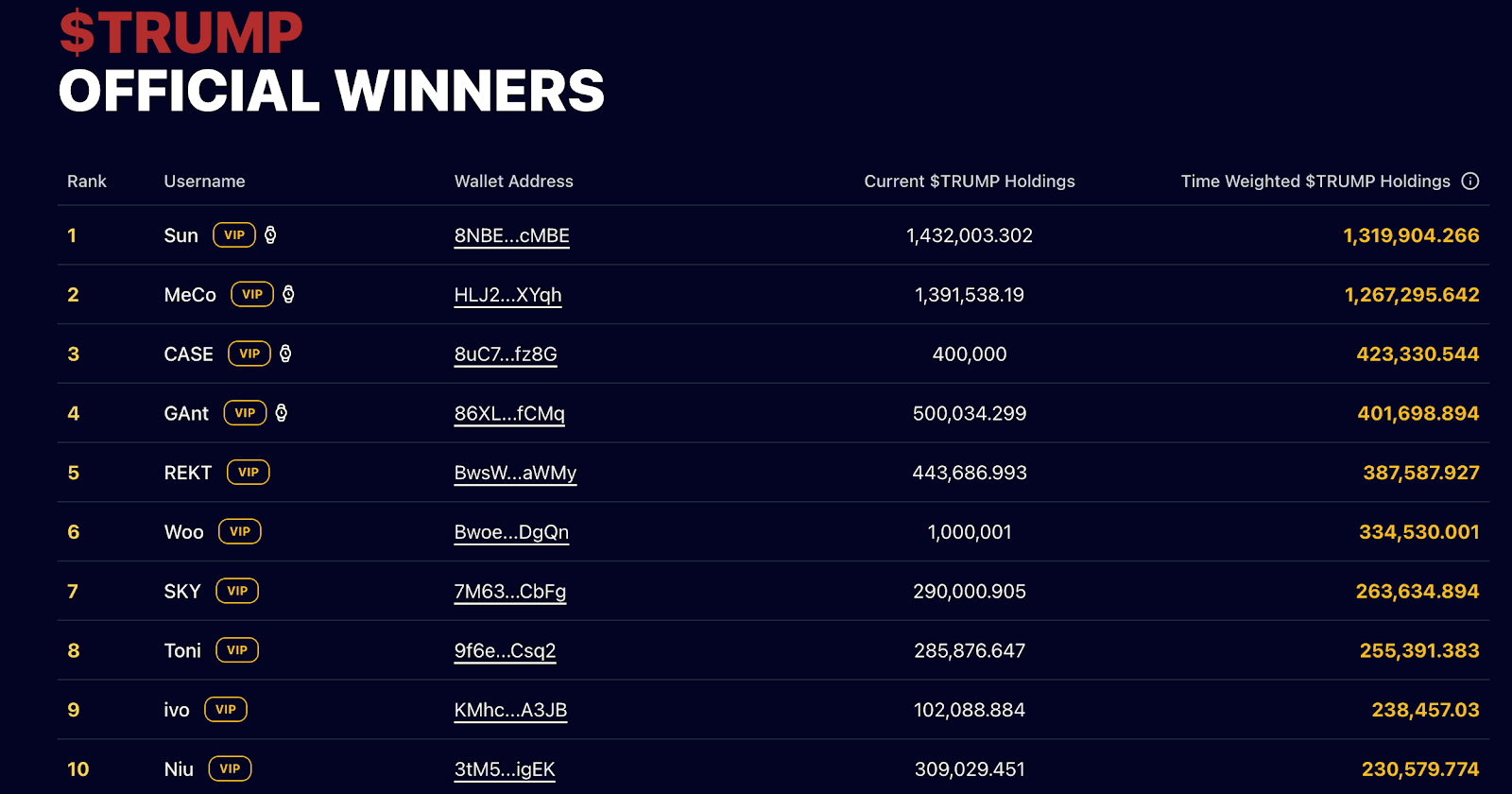

GDC’s statement accompanies an upcoming prominent occasion connected to the Trump token job. The 25 biggest holders of TRUMP tokens are set to participate in a personal supper at the White Home on Might 22.

Nevertheless, the TRUMP memecoin job stated in a Might 12 X post that it has actually stopped thinking about extra purchases for the supper which the guests had actually been alerted to obtain background checks.

According to information offered on the job’s leaderboard, the leading 220 wallets held more than 13.7 million tokens since Might 12, worth about $174 million at the time of publication.

Some United States legislators have actually slammed the supper. Republican Senator Cynthia Lummis supposedly stated that the concept of the United States president offering special gain access to for individuals happy to pay “provides [her] time out.”

Crypto guideline specialists likewise fear that the Trump household’s crypto undertakings might set off more regulative examination by the United States Securities and Exchange Commission, as politically associated memecoins present a brand-new obstacle for crypto legislation.

Publication: Uni trainees crypto ‘grooming’ scandal, 67K scammed by phony females: Asia Express