A brand-new cryptocurrency whale has actually acquired $1.34 billion worth of Ether in the previous 8 days, outmatching record United States area Ether ETF inflows and sustaining speculation over the token’s cost trajectory ahead of essential United States inflation information.

The whale obtained 312,052 Ether (ETH) throughout 10 recently developed cryptocurrency wallets, according to crypto intelligence platform Lookonchain.

The whale has actually gotten $300 million more than the record-breaking inflows to United States area Ether exchange-traded funds (ETFs), which generated $1 billion worth of Ether on Monday, their biggest day-to-day web inflows because launch.

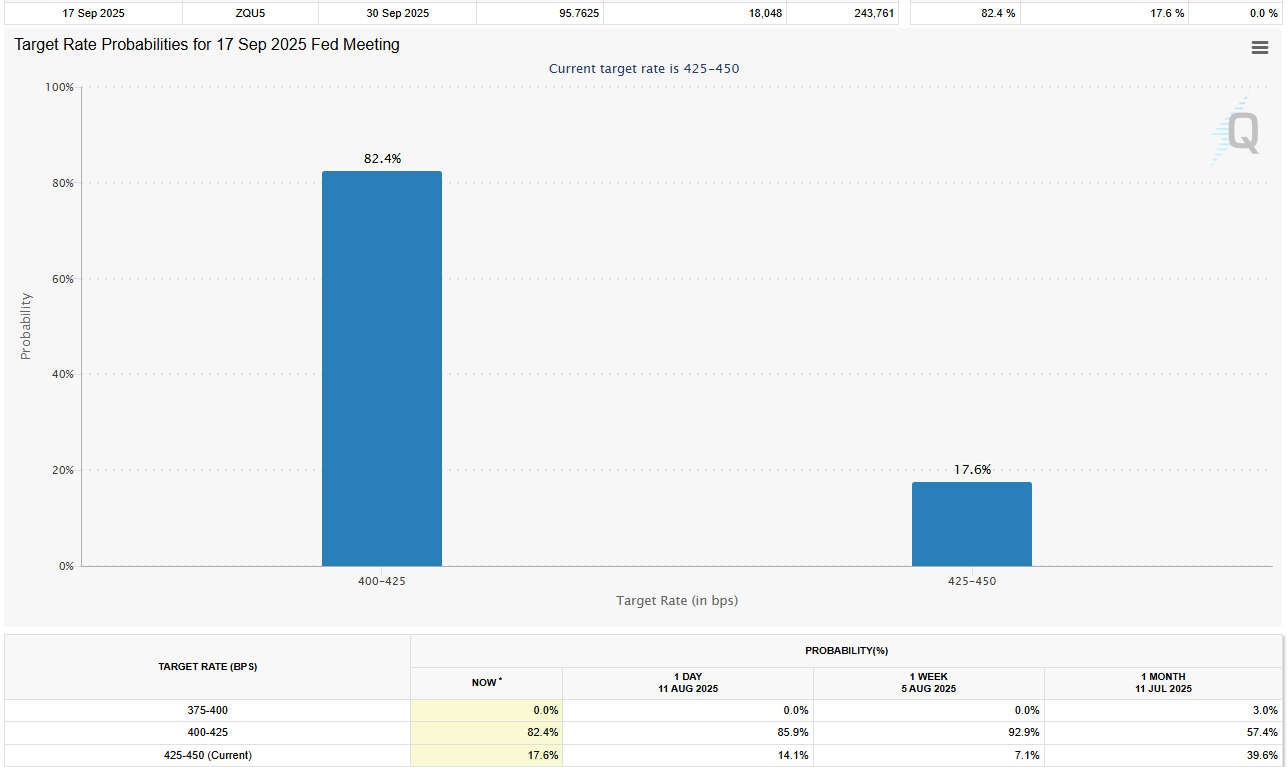

Experts state the billion-dollar build-up might assist press Ether closer to its previous all-time high of $4,890, still more than 12% above existing levels. The rise in need comes as financiers await today’s Customer Rate Index (CPI) and Manufacturer Rate Index (PPI) reports, which might form expectations for the United States Federal Reserve’s Sept. 17 rates of interest choice.

Related: SEC to concentrate on ‘clear’ crypto policies after Ripple case: Atkins

89% of financiers anticipate a September rates of interest cut

The CPI and PPI reports are “essential” for forming financial policy expectations, as higher-than-expected inflation information might “compromise” financier cravings and “stall” the existing crypto rally, according to Javier Rodriguez-Alarcón, primary financial investment officer at crypto trading and possession management platform XBTO. “The rally fits within ETH’s common behaviour and might stop briefly or combine without fresh drivers.

” It’s near-neutral Z-score (– 0.06) reveals that, regardless of the size of the relocation, it stays well within ETH’s typical volatility variety,” he stated, including that the ongoing business treasury purchasing might make it possible for Ether to check its previous all-time high.

Related: Bitcoin’s business boom raises ‘Fort Knox’ nationalization issues

Markets are pricing in an 82% opportunity that the Fed will keep rates of interest stable throughout the next Federal Free market Committee conference on Sept. 17, according to the current quotes of the CME Group’s FedWatch tool.

Still, Ether is seeing aggressive profit-taking from short-term Ether holders, signifying that this accomplice might anticipate a pullback.

Publication: How Ethereum treasury business might trigger ‘DeFi Summertime 2.0’