Jupiter stated it has actually protected a $35 million tactical financial investment from ParaFi Capital, marking the very first time the Solana-based onchain trading and liquidity aggregation procedure has actually taken outdoors capital after years of bootstrapped, successful development.

The deal included token purchases at market value without any discount rate and a prolonged lockup duration and was settled completely in Jupiter’s JupUSD stablecoin, the business stated. Financial terms beyond the $35 million financial investment were not divulged.

The financial investment comes as Jupiter has actually processed more than $1 trillion in trading volume over the previous year and broadened beyond swap routing into perpetuals, loaning and stablecoins, according to the business.

The offer likewise consisted of warrants enabling ParaFi Capital to get extra tokens at greater rates, a structure the business stated was meant to show long-lasting positioning.

The financial investment follows a current growth of Jupiter’s item offerings. In October, Jupiter presented a beta variation of its onchain forecast market established with Kalshi, followed in January by the launch of JupUSD, a Solana-native, dollar-pegged stablecoin integrated in collaboration with Ethena Labs.

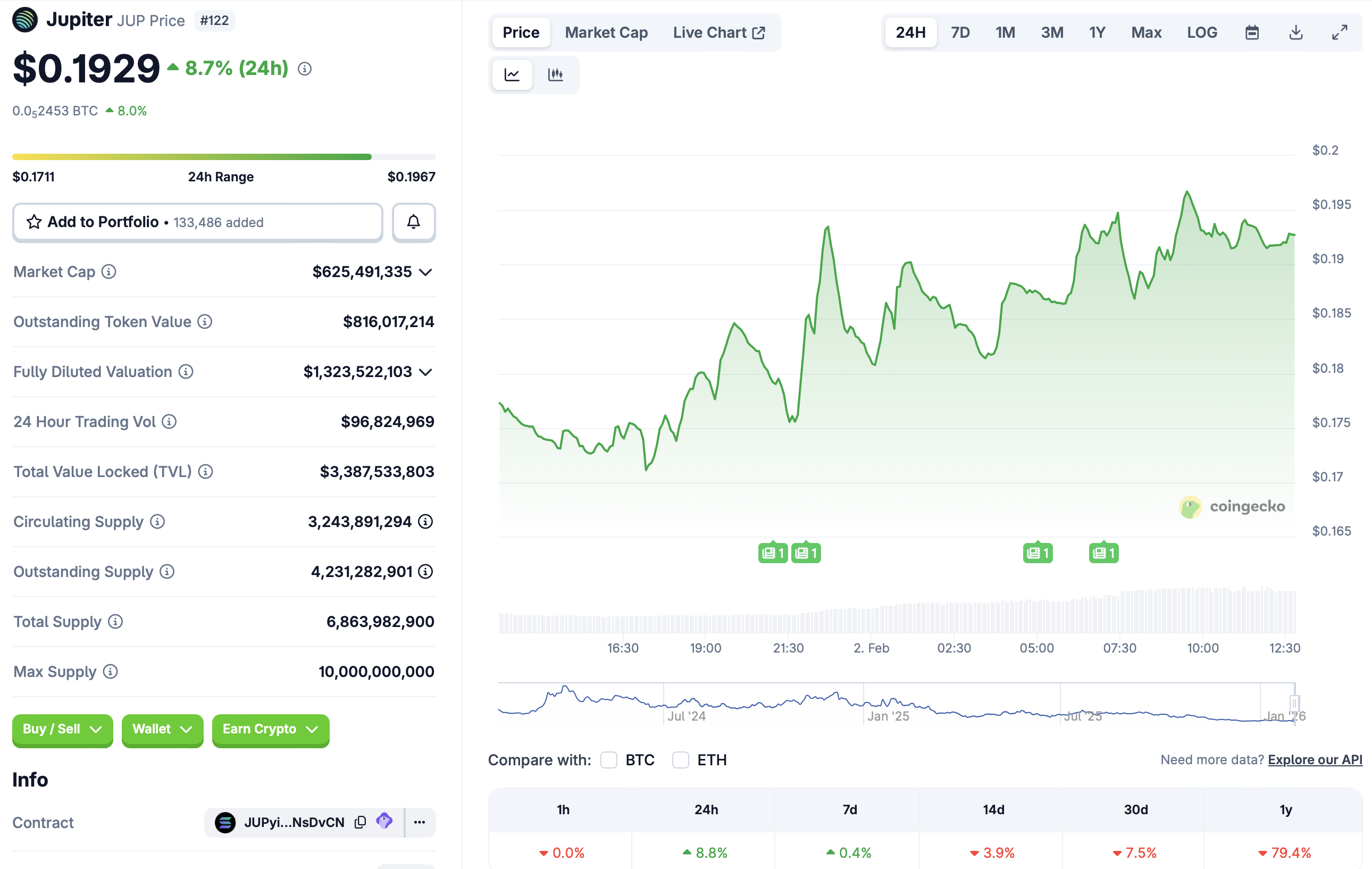

Jupiter’s native token (JUP) was up around 9% over the previous 24 hr, according to CoinGecko information.

Related: VC Roundup: Crypto moneying rebounds as organizations test onchain financing

Decentralized procedures draw in VC attention

In 2025 and early 2026, endeavor companies have actually continued to release capital into decentralized procedures through token-based offers.

In October, a16z Crypto invested $50 million in Jito, a Solana-based liquid staking procedure, through a token-based offer that gave the company a concealed allotment of Jito’s native tokens at a discount rate.

In January, Babylon, a decentralized procedure concentrated on Bitcoin-native staking and loaning, raised $15 million from a16z Crypto through the sale of its infant token, with the company stating the financing would support advancement of the procedure’s onchain facilities.

Beyond decentralized financing, endeavor financiers have actually likewise supported other classifications of decentralized procedures in current months.

In September, decentralized science platform Bio Procedure raised $6.9 million from financiers consisting of Maelstrom Fund and Animoca Brands to support the advancement of its AI-native, blockchain-based structure for biomedical research study.

In 2015, Mankind Procedure, a decentralized identity platform, raised $20 million from Pantera Capital and Dive Crypto at a reported $1.1 billion assessment to establish its Evidence of Mankind onchain identity system based upon biometric information.

Publication: A ‘tsunami’ of wealth is headed for crypto: Nansen’s Alex Svanevik