Continuous decentralized exchanges (DEXs) are acquiring traction as traders turn to blockchain-based platforms that guarantee lower expenses and less intermediaries than standard central places.

Perp DEXs are blockchain-based places for trading continuous futures agreements, permitting traders to bank on the hidden possession’s cost with utilize and without an expiration date.

Crypto research study company Delphi Digital stated in its outlook for 2026 that perp DEXs are poised to continue taking market share from standard financing items. It argued that decentralized facilities is structurally more effective than tradition systems, which it referred to as fragmented and costly to run.

” Now Hyperliquid is developing native financing. Perp DEXs might end up being brokerage, exchange, custodian, bank, and clearinghouse at one time,” composed Delphi Digital in a Tuesday X post, including that rivals such as Aster, Lighter and Paradex are “racing to capture up.”

Related: $ 675M Lighter airdrop ranks amongst crypto’s 10 biggest: Bubblemaps

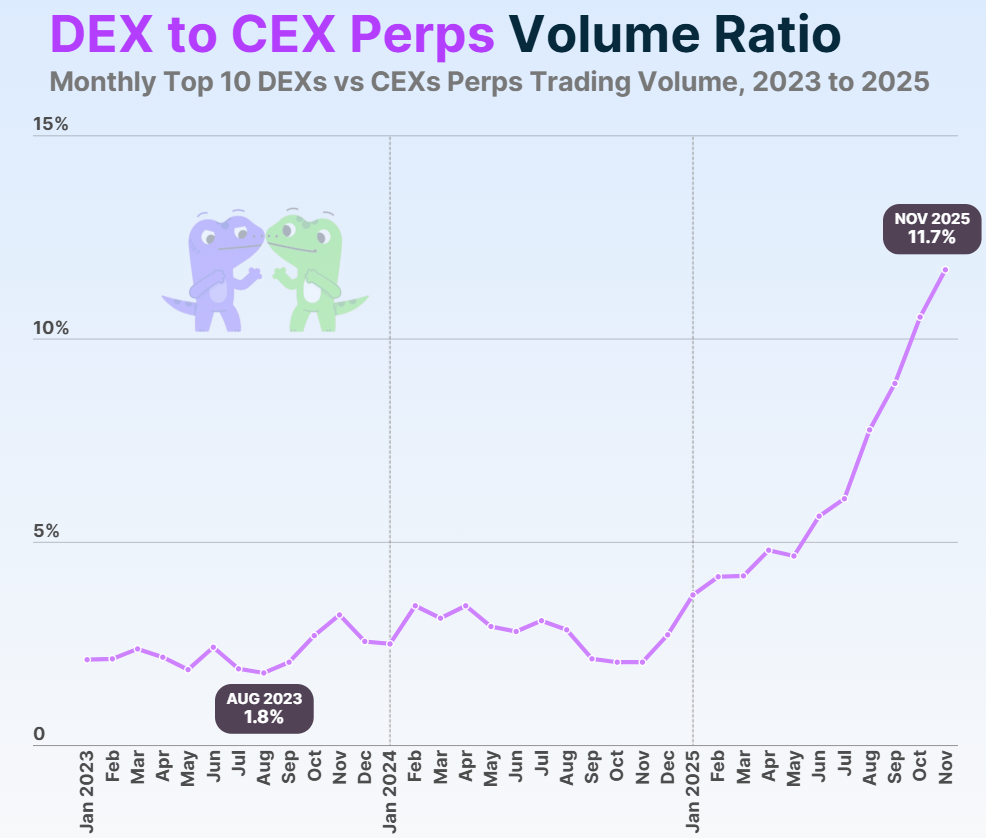

Perp DEXs have actually currently taken a substantial share of profits from central exchanges, as their market share increased from 2.1% in January 2023 to a brand-new all-time high of 11.7% in November 2025, according to a report by information aggregator CoinGecko.

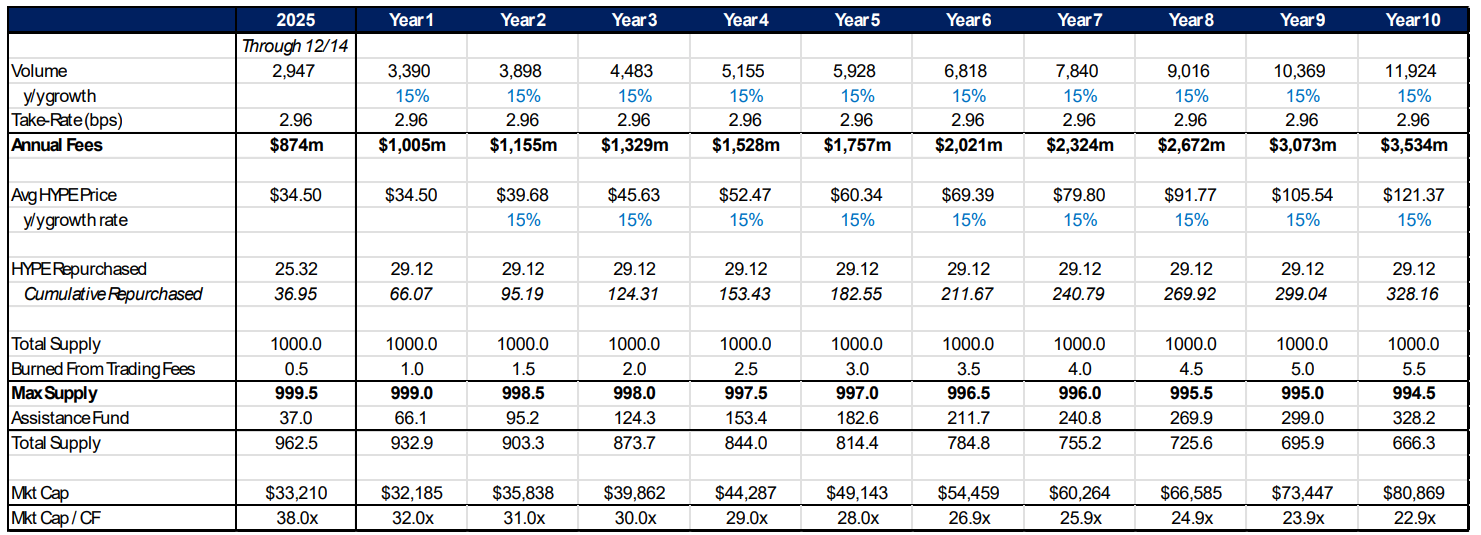

The growing adoption of decentralized trading platforms might reinforce the leading DEX token, Hyperliquid (BUZZ), to over $200 in the next ten years, according to a December research study note from Cantor Fitzgerald.

The business’s forecast presumed that the token’s cost will grow at a 15% substance yearly development rate while the Support Fund will buy about 291 million buzz tokens, minimizing the overall supply to 666 million tokens.

Related: Basic Chartered stated to prepare crypto brokerage, cuts ETH projection

Perp DEX volume triples in 2025 in the middle of growing onchain derivatives need

The cumulative trading volume of perp DEXs tripled throughout 2025, reaching $12.09 trillion, up from $4.1 trillion at the start of the year, Cointelegraph reported on Dec. 31.

About $7.9 trillion, or 65% of the overall perp DEX volume, was produced in 2025, according to DefiLlama information, revealing the considerable adoption of these trading platforms throughout the previous year.

Nevertheless, this figure fades in contrast to the notional worth of exceptional over the counter derivatives, which reached $846 trillion in June 2025, according to information from the Bank for International Settlements.

Publication: Can Robinhood or Kraken’s tokenized stocks ever be really decentralized?