The memecoin craze on Pump.fun is striking a wall, with the platform’s “graduation rate” sinking listed below 1% for a 4th straight week.

” Graduation rate” is the memecoin launchpad’s term for tokens that make it through the incubation stage and end up being totally tradable on a Solana decentralized exchange (DEX). To finish, a token need to fulfill particular liquidity and trading requirements.

Over the previous 4 weeks, beginning Feb. 17, Pump.fun’s graduation rate has actually stayed listed below 1% for the very first time, Dune Analytics information programs.

Pump.fun’s tanking token success rate. Source: Dune Analytics

Pump.fun’s graduation rate has actually never ever been especially high. The platform’s best-performing week remained in November 2024 when 1.67% of memecoins proceeded to the free market.

Nevertheless, the large volume of tokens released on the platform at the time made this portion more considerable than it is now. Throughout the week beginning Nov. 11, 323,000 tokens were produced on Pump.fun, indicating the 1.67% graduation rate equated to approximately 5,400 tokens going into Solana’s DeFi economy in a single week.

Related: Pump.fun’s memecoin freak program might lead to criminal charges: Professional

With token production volume decreasing on both Pump.fun and Solana, weekly token graduations have actually dropped to a four-week average of around 1,500 tokens at the time of composing, according to Dune.

Memecoins are passing away, and they’re not reacting to favorable market signals

Pump.fun’s dropping graduation rate shows subsiding financier cravings for memecoins, which have actually established a credibility as degenerate lotto tickets or fast money grabs for their developers.

A number of political figures have actually released their own memecoins too, consisting of United States President Donald Trump. His token is down 84% from its all-time high set on Jan. 19, according to CoinGecko.

Related: Argentine attorney demands Interpol red notification for LIBRA developer: Report

Memecoins’ battles continue in spite of enhancing liquidity, according to Matrixport. In February, Matrixport experts kept in mind that an enhancing United States dollar had actually pressed Bitcoin costs by tightening up dollar-denominated liquidity.

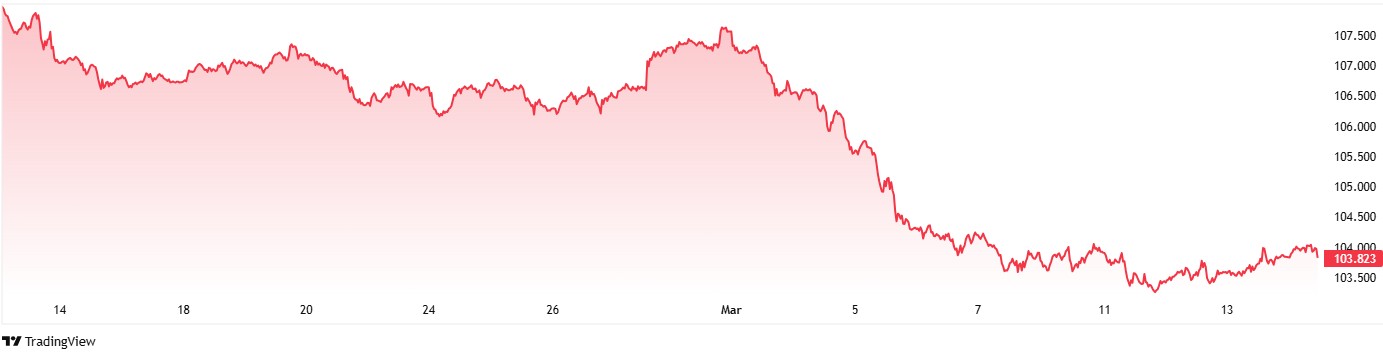

Ever Since, the United States dollar has actually deteriorated. Over the previous month, the United States Dollar Index (DXY), which determines the dollar versus a basket of significant currencies, peaked at 107.61 on Feb. 28 before dropping to 103.95 on March 14.

DXY efficiency in the previous month reveals the United States dollar weakening. Source: TradingView

” The United States dollar has actually just recently deteriorated, causing a rebound in liquidity indications and some minimal enhancements in inflation information. In spite of these favorable shifts, memecoins– formerly among the greatest stories throughout this booming market– continue to have a hard time considerably, without any obvious healing,” Matrixport stated in its report.

Bitcoin captured in memecoin aftershocks

The having a hard time memecoin market has actually added to a $1 trillion wipeout in crypto market capitalization, according to Matrixport.

” This redistribution of wealth might lead financiers to stay careful about releasing additional capital, triggering rebounds– even those set off by better-than-expected inflation information– to be restricted,” the report kept in mind.

Matrixport experts alert that this might result in additional Bitcoin decreases, with a possible retracement to as low as $73,000– a level they think would supply “strong assistance.”

Publication: Ludicrous ‘Chinese Mint’ crypto fraud, Japan dives into stablecoins: Asia Express