Secret takeaways:

-

Luke Judges specifies that technical strength alone can not ensure long-lasting competitiveness, recommending that XRP might gain from Solana’s pragmatism and execution speed.

-

Judges thinks Solana’s market traction originates from useful engineering and a quick go-to-market technique instead of procedure style alone.

-

David Schwartz takes the opposite position, arguing that XRPL’s dependability and stability are better than pursuing high-throughput chains.

-

Judges highlights that designer onboarding, tooling and validator rewards are crucial for sustaining development and minimizing centralization threats.

Luke Judges, international partner success lead and director of Ripple, shared observations about the progressing XRP Journal environment and its competitive landscape, highlighting a clear parallel to the functional successes of competing layer-1 network Solana. Making use of his previous experience in the Solana network handling a significant validator, Judges recommended that technical supremacy alone is inadequate to protect a network’s long-lasting importance.

This short article checks out Ripple executives’ insights on functional lessons, concentrating on technical developments within the XRP Journal (XRPL) and the tactical requirements for layer-1 competitiveness.

Functional lessons from Solana’s playbook

Judges’ point of view is special and rooted in his experience running 2 start-ups and running a Solana validator that handled more than $30 million in staked tokens through a complete market cycle. He shared this information on Nov. 30, 2025, on X, keeping in mind that he saw the network’s significant cost peak along with its subsequent collapse and healing.

This hands-on direct exposure led Judges to conclude that the success of layer-1 networks in a competitive cycle is frequently driven by aspects unique from core innovation. He particularly credited Solana with having “pragmatism and speed,” which he deems important for protecting designer mindshare and driving adoption.

The core concept is that execution speed and a useful method to engineering and market entry can exceed theoretical management in the race for environment development.

Nevertheless, Judges recommends that other chains might keep in mind of how Solana runs its network, arguing there is “no point burying your head in the sand pretending you’re the only chain in the area.” For the XRPL, these observations highlight possible blind areas, recommending that technical turning points should be coupled with a proactive go-to-market (GTM) technique to equate into a real one-upmanship.

Technical advancements in the XRP Journal

The call for tactical velocity comes as the XRPL is actively pursuing substantial technical growth, consisting of the launch of XRP Journal Smart Agreements on AlphaNet. Historically enhanced for quick, affordable cross-border payments through its federated agreement system, the XRPL is now concentrating on increasing its programmability and energy in the decentralized financing (DeFi) area.

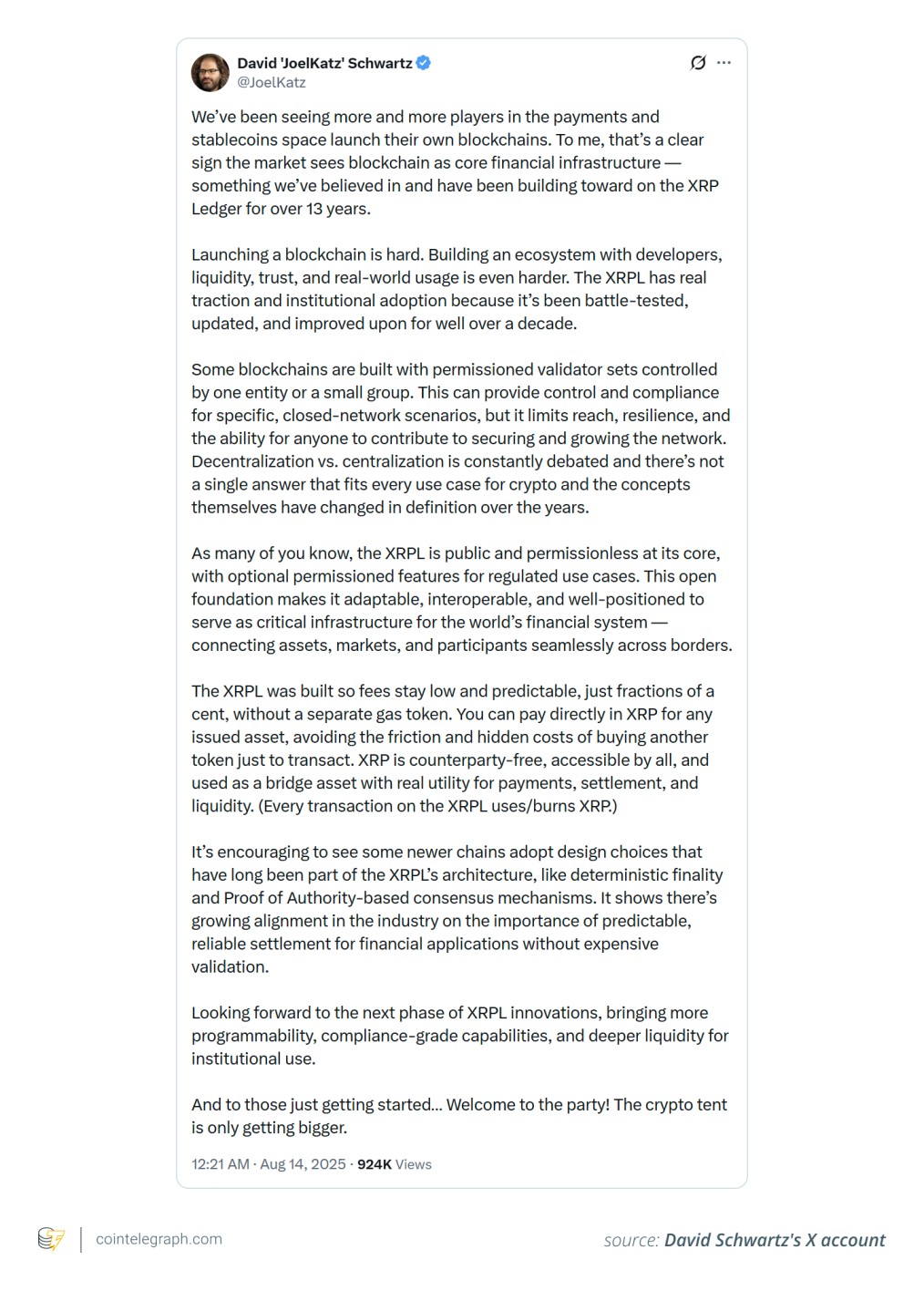

In direct contrast to Judges’ view, David Schwartz, primary innovation officer of Ripple and the initial designer of the XRP Journal, stressed that XRP’s style approach is fixated dependability, effectiveness and institutional-grade efficiency. He argued that this positions the network as naturally remarkable to high-throughput chains like Solana without requiring to upgrade its core technique.

Schwartz reviews blockchains such as Solana for focusing on raw speed at the cost of stability, indicating its history of network blackouts as proof that this method disagrees for real-world monetary applications.

For Schwartz, the XRPL’s agreement system provides constant deal finality and near-zero charges, providing remarkable uptime and predictability. He argues that this is a crucial one-upmanship that must be focused on over matching the environment structure that Judges applauds for its “pragmatism and speed.”

Designer and environment factors to consider

A crucial element of Judges’ evaluation issues designer experience and environment assistance. Supplying efficient designer tools, clear paperwork and structured onboarding procedures can motivate contractors to release applications and engage with the network.

Judges’ commentary highlights core difficulties in preserving a durable layer-1 network, especially the requirement for robust and sustainable validator economics. While acknowledging Solana’s success in bring in contractors, he likewise kept in mind that the network is dealing with the obstacle of how “validator count is dropping quick today,” which raises long-lasting issues about decentralization and the sustainability of its reward design.

For the XRPL, this works as a preemptive care versus producing reward structures that might cause comparable concentration threats, specifically as the network checks out native staking principles.

The dispute over validator economics highlights the 2 networks’ various style viewpoints. The XRPL’s agreement is valued for its battle-tested stability, quick deal finality and institutional-grade dependability. Its obstacle is to establish brand-new staking systems that increase energy without jeopardizing its core worth proposal of foreseeable dependability, which stands in contrast to the instability seen in some high-throughput chains.

Did you understand? In his X post, Judges keeps in mind that the Ethereum Structure is ending up being “a lot more focused in their GTM,” describing its shift towards layer-2 services, or rollups. This relocation straight dealt with user problems about high charges and sluggish speeds on the primary chain, concerns that Solana was efficiently utilizing to bring in users.

Market context and tactical execution

Judges’ general message need to not be translated as an existential risk to the XRPL however rather as a positive required for tactical adjustment. It shows a top-level acknowledgment that the competitive landscape benefits execution over theoretical technological supremacy.

In useful terms, Judges specifies that the XRPL’s tactical focus need to fixate 3 locations:

-

Improving the designer experience by making it much faster and easier for developers to construct on the XRPL, obtaining Solana’s concentrate on useful, quick-to-use tools.

-

Honing the marketplace technique to rapidly turn brand-new technical functions such as clever agreements into clear, special and enticing advantages for partners and users.

-

Leveraging dependability for business adoption, which is the XRPL’s primary strength, while embracing the functional speed and versatility seen in competing networks.

Judges’ takeaway can be translated as a tip that catching the next stage of blockchain adoption needs tactical adjustment to guarantee the XRPL’s execution matches its technical development and recognized management in cross-border monetary applications.

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding. While we aim to offer precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this short article. This short article might include positive declarations that undergo threats and unpredictabilities. Cointelegraph will not be accountable for any loss or damage emerging from your dependence on this details.