Crypto adoption in European nations like the UK and Germany is dragging Russia, according to the current report from United States blockchain analytics firm Chainalysis.

Russia became the leading crypto market in Chainalysis’ most current European Crypto Adoption report, getting $376.3 billion in crypto in between July 2024 and June 2025.

Released Thursday, the report integrates analyses of areas formerly analyzed individually, covering Central, Northern, and Western Europe, along with Eastern Europe as a whole.

” For this year’s analysis, we have actually rearranged our local categories to much better show both existing crypto activity and geopolitical truths,” Chainalysis stated.

Russia’s volumes up nearly 50% because in 2015

Russia’s gotten crypto volumes have actually increased 48% from in 2015’s $256.5 billion, expanding its lead over significant economies such as the UK, which taped $273.2 billion in the previous year, about 30% less.

Chainalysis associated Russia’s rise in crypto adoption to 2 main aspects: a spike in big institutional transfers and the growing usage of decentralized financing (DeFi).

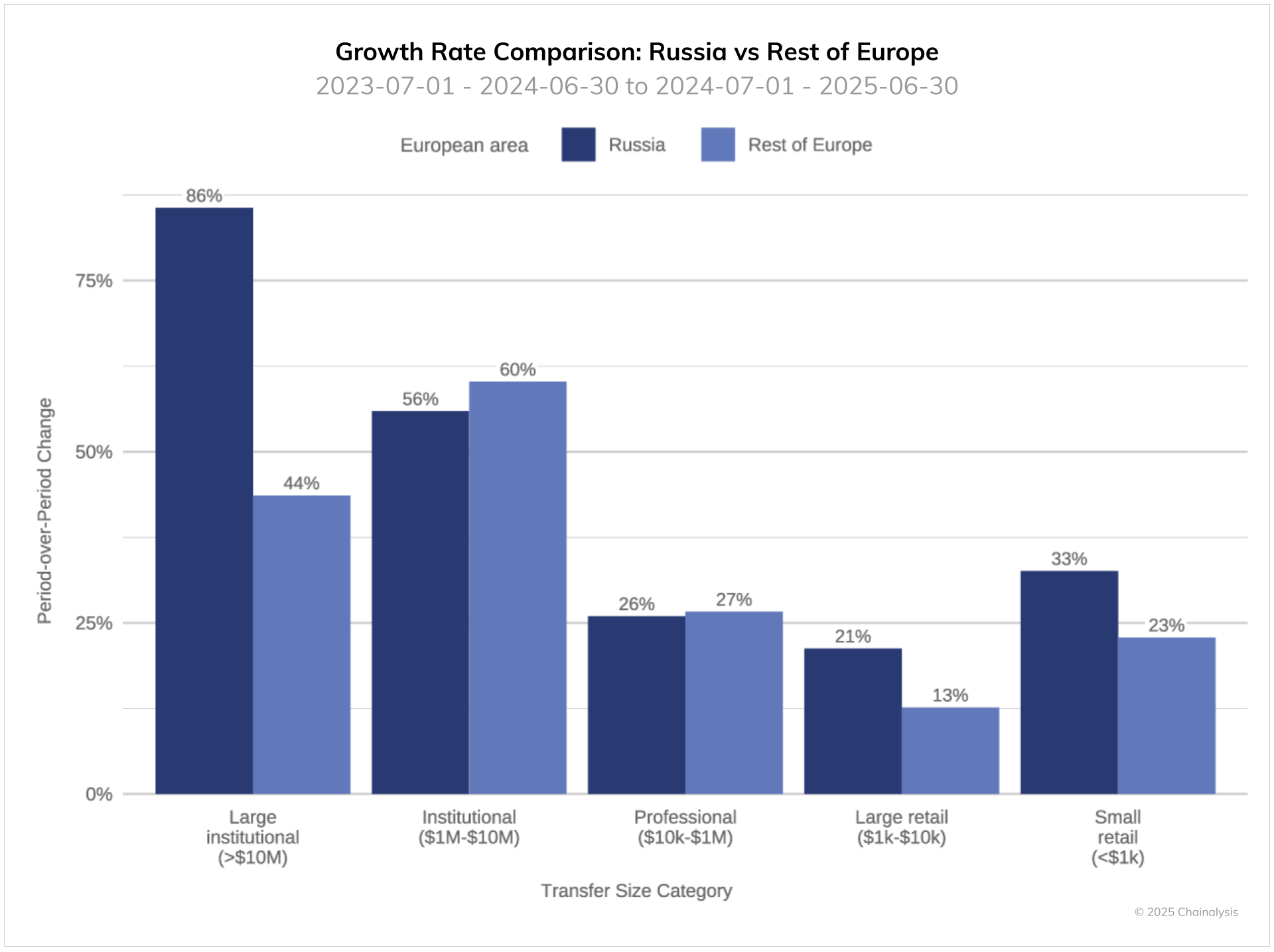

” The scale of institutional activity is especially significant,” Chainalysis stated, describing big transfers– those going beyond $10 million– rising 86% year-over-year (YoY). The rise rate is almost double the 44% development observed in the rest of Europe, it included.

DeFi and retail amongst factors

Beyond institutional activity, Russia likewise leads in both big and little retail sectors, with YoY development surpassing the rest of Europe by about 10%.

” DeFi adoption patterns expose a a lot more significant shift,” Chainalysis stated, describing Russia’s DeFi activity rising 8 times its previous levels in early 2025.

Russia’s fast DeFi growth and the boost in large-value transfers show growing adoption of crypto for monetary services, Chainalysis concluded.

It likewise discussed that A7A5– an approved ruble-pegged stablecoin released in Kyrgyzstan– is a significant example of this pattern as it assists in cross-border payments for both institutional and company users.

Introduced in early 2025, A7A5 has actually become the world’s biggest non-US dollar stablecoin by market capitalization, regardless of dealing with numerous sanctions.

The stablecoin has actually been slammed by the European Union for being utilized as a tool for sanction evasion by Russia. The United States federal government has actually likewise connected A7A5 to Grinex, the follower of Garantex, which was presumably associated with cash laundering and ransomware attacks with $100 million in deals associated with illegal activities.

Related: United States increases to second in crypto adoption as APAC sees most development: Chainalysis

The ruble-pegged stablecoin reached $500 million in market cap in late September, surpassing significant non– United States dollar competitors such as Europe’s euro-pegged EURC, released by Circle.

Chainalysis’s findings on Russia’s crypto market development over the previous year come in the middle of installing sanctions and a magnifying regulative focus in the area. Especially, Russia was left out from the Financial Stability Board’s peer evaluation on cross-border guideline, likewise released Thursday.

Publication: Binance shocks Korea, Morgan Stanley’s security tokens in Japan: Asia Express