The tokenization of real-world possessions (RWAs) rose in the very first half of 2025 as increased regulative clearness sustained more comprehensive adoption of blockchain-based monetary items.

Real-world possession tokenization describes monetary and other concrete possessions minted on the immutable blockchain journal, increasing financier availability and trading chances for these possessions.

The RWA market rose more than 260% throughout the very first half of 2025, exceeding $23 billion in overall evaluation. It was $8.6 billion at the start of the year, according to a Binance Research study report shown Cointelegraph.

Tokenized personal credit led the RWA market boom, representing about 58% of the marketplace share, followed by tokenized United States Treasury financial obligation, which represented 34%.

” As regulative structures end up being clearer, the sector is poised for ongoing development and increased involvement from significant market gamers,” the report stated.

Related: Blockchain and AI might sustain $3.5 T DePIN market boom by 2028: WEF

RWAs have no devoted regulative structure and are thought about securities by the United States Securities and Exchange Commission (SEC). Nevertheless, the sector still takes advantage of regulative advancements in the more comprehensive crypto area.

On Might 29, the SEC provided brand-new assistance on cryptocurrency staking, an advancement that was viewed as an action towards “more reasonable policy,” marking a substantial win for the market, Alison Mangiero, head of staking policy at the Crypto Council for Development, informed Cointelegraph.

The market is waiting for a complete Senate vote on the Guiding and Developing National Development for United States Stablecoins (GENIUS) Act, which intends to set clear guidelines for stablecoin collateralization.

Other experts indicated Bitcoin’s (BTC) momentary cost debt consolidations as the primary motorist for the RWA market’s development, as a more secure financial investment alternative with a foreseeable yield.

Related: $ 2.1 B crypto taken in 2025 as hackers shift focus from code to users: CertiK

Business FOMO fuels Bitcoin balance sheets

A renewed business “FOMO,” brief for worry of losing out, is motivating progressively more business to embrace Bitcoin on their balance sheets.

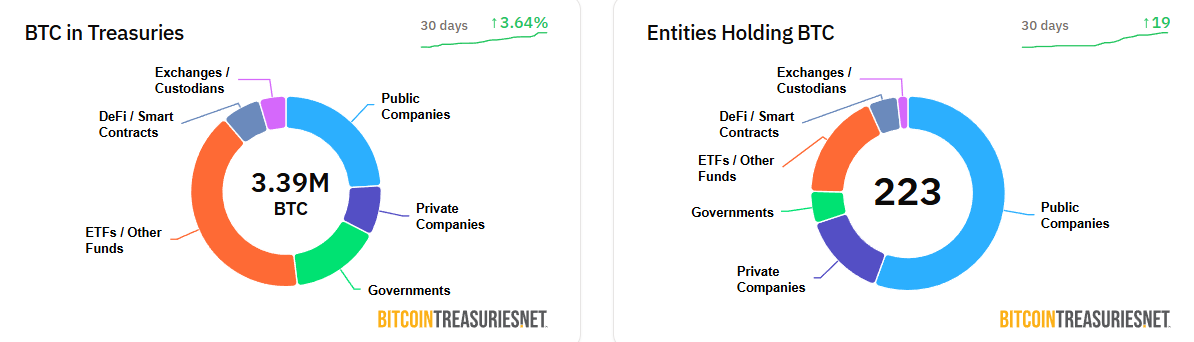

A minimum of 124 public business are now holding Bitcoin as part of their business treasury, according to information from BitcoinTreasuries.NET.

While the summer season might bring a downturn in total crypto market activity, more comprehensive macro conditions and regulative advancements will mainly determine the speed of business Bitcoin adoption, a Binance Research study representative informed Cointelegraph, including:

” Business BTC adoption is driven by long-lasting balance sheet method, treasury diversity and capital-raising activity.”

Long-lasting financial investment point of views will likely continue driving Bitcoin’s business adoption, instead of “short-term liquidity or seasonal market characteristics,” the scientists included.

Publication: How crypto laws are altering throughout the world in 2025